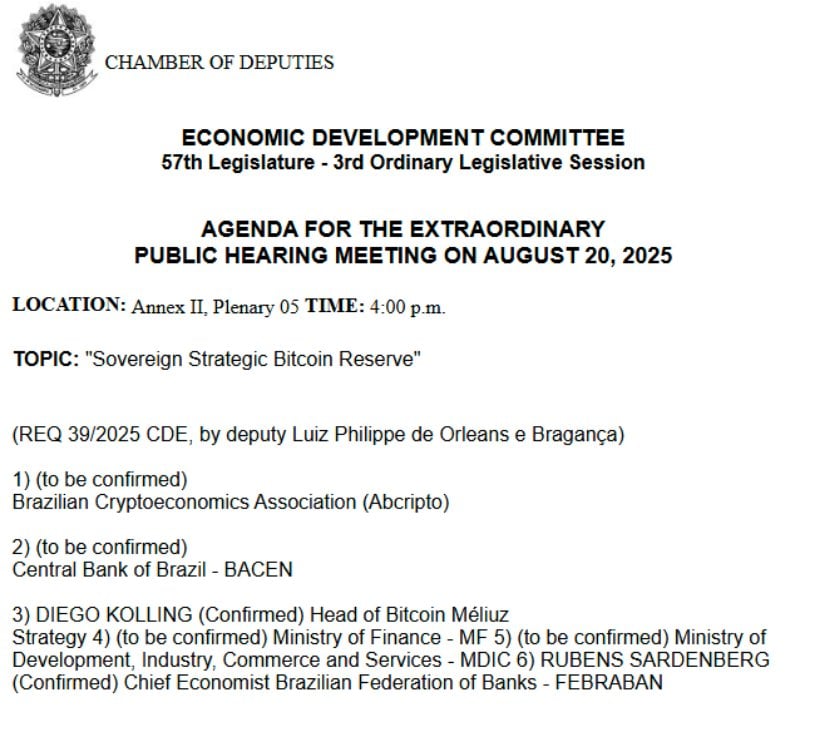

Well now, it looks like Brazil’s got the itch to dip its toes into the wild waters of digital gold. Come August 20, 2025, they’re fixin’ to sit down and chew the fat over – you guessed it – a national Bitcoin reserve. If they go through with it, they’re talking about tossing up to 5% of their stash of $300 billion in international reserves into this shiny new thing. That’s a cool $15 billion, folks! Imagine that-one of the biggest government crypto splashes in history. Who knew patriotism and digital currency could mix like whiskey and soda? 🍹

Enter Federal Deputy Eros Biondini-he’s the fellow wave-makers put forth Bill 4501/2024, and he figures Brazil needs a little ‘digital gold’ to keep Uncle Sam’s dollar and all that pesky global risk at bay, while giving their economy a whiff of the future. The plan’s called RESBit, a fancy name for creating a treasure chest filled with Bitcoin managed by Brazil’s Central Bank and Finance Ministry. And they’re not gonna rush headlong into it-they’ll buy Bitcoin gradually, like a cautious farmer planting seeds in the spring.

Security’s a big concern-they’re locking that Bitcoin in cold wallets-offline and safe from hackers’ grubby fingers. And if any government official tries to turn the reserve into their own piggy bank, they’ll be shown the door and face criminal charges faster than a clap of thunder. The government’s got 180 days to get this show on the road if the bill passes. Pedro Giocondo Guerra, a man with a fancy title and a twinkle in his eye, calls Bitcoin “the digital gold” and sees it as a bright prospect for Brazil’s future wealth-probably dreaming of beaches and a big hat, I suppose.

Not everyone’s clapping, mind you. Nilton David, the central bank’s man of the monetary policy, is sounding the alarm-says adding crypto to the reserves might be as wise as betting on a blind horse. The hearing’s got both sides lined up, ready to lay out their arguments like at a Texas ropin’ contest.

South America’s Crypto Storm

Meanwhile, across the map, South America’s turning into a sort of digital gold rush. The region’s crypto activity grew over 42% in the past year-second only to somewhere else I can’t recall-like a wildfire in dry grass. Folks here face high inflation, broken banking systems, and unstable currencies, so they’re flocking to digital money like moths to a lantern. Argentina, for instance, is converting their paychecks into digital dollars faster than you can say “hyperinflation,” dodging the devaluation like a fox in a henhouse.

Brazil’s not lagging behind. They rank ninth in crypto usage worldwide and even launched the first XRP ETF-imagine that! Big players like Ripple are moving in, seeing gold in the Brazilian market’s potential. It’s like watching a new frontier being carved out, and everyone’s got a cowboy hat or two in the game.

Argentina’s Crypto Cowboy

Over yonder in Argentina, folks elected Javier Milei, who’s as close to an anarcho-capitalist as you can get without breaking out into song. He’s all for Bitcoin and tossing the old economy onto the dung heap. He’s promising Argentines they can spend whatever currency they fancy-Bitcoin included-for their daily shoppin’. And wouldn’t you know, inflation fallin’ like a stone, but poverty’s up-like a stubborn mule-at 53%. Many Argentinians are hoarding crypto to keep their savings from melting away faster than ice cream on a summer’s day. 🇦🇷

Milei’s not proposing a Bitcoin reserve just yet-he’s more of a free-market cowboy, letting folks decide for themselves rather than mandating it. It’s a different kind of rodeo from El Salvador’s wild, all-or-nothing approach.

El Salvador’s Crypto Caper

El Salvador jumped into the crypto pond in 2021, decreeing Bitcoin as legal tender-like making it the official pet of the nation. But it turns out, most Salvadorans didn’t bite the bait. By 2024, 92% refused to use Bitcoin for groceries or what-have-you. The government’s Chivo wallet was about as reliable as a three-legged mule-full of bugs and security holes, and trust took a nosedive faster than a kite in a storm.

By January 2025, under pressure from the IMF-those funny folks who lend money but always want things their way-El Salvador backpedaled and ended Bitcoin’s legal status. Still, they keep buying and holding Bitcoin for reserves-about 6,000 coins worth nearly $569 million. Lesson learned? Sometimes forcing a wild animal into a pen doesn’t make it tame, and a little patience goes a long way.

What’s Next on the Digital Trail?

This August 20th shindig ain’t just about Brazil-it’s likely to set the tone for the whole South American continent. If Brazil’s bold gamble pays off, other countries might dust off their hats and follow suit. Argentina, Colombia, Paraguay-they’re all eyeing crypto-friendly rules, like kids eyeing candy stores.

Experts reckon a government-backed Bitcoin stash might just be the spark needed for a global crypto wildfire. Some US politicians even whisper about creating their own reserves-america’s turn at the crypto rodeo. Brazil’s approach might be more like tiptoeing through the tulips-using Bitcoin as a reserve, not mandating it as law, avoiding the pitfalls of El Salvador’s all-in strategy.

The upcoming talk fest will gather crypto whizzes, bankers, and government folks-each trying to rope in the future of digital finance and steer the course of this modern-day gold rush.

The Road That Leads Us Forward

So, this Brazil Bitcoin hoo-ha might just be the start of something big-like the opening scene of a new frontier. While El Salvador blazed a wild trail, Brazil’s playing it cautious, using Bitcoin to bolster their reserves while keeping their old money in the saddle. High inflation, weak currencies, and the need for a better way-these are the reasons South America’s popping up on the crypto map like wildflowers in spring.

If all goes well, this hearing could see Brazil stepping into the small club of countries with official Bitcoin reserves-like a secret handshake among digital pioneers. Fail it, and the world might slow down, waiting for the next big thing to come along. And I’d keep my eye on that horizon, partner-because who knows what tomorrow’s rides might bring.

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Supergirl Trailer Shows 1 Thing DCU Movie Does Better Than Woman of Tomorrow Comic

- Ashes of Creation Rogue Guide for Beginners

- Ghostbusters Star Confirms the Weirdest Cameo in Franchise History Is Actually Canon to the Movies

- Gold Rate Forecast

2025-08-06 23:20