Imagine, if you will, a realm where digital tokens-once dismissed as mere crypto folly-are now stretching their metaphorical legs across the vast expanse of American debt. Yes, these stablecoins, draped in the guise of stability, are quietly, insidiously, accumulating so much US debt that they are outpacing entire nations, leaving Germany, South Korea, and even the shimmering Emirates in the dust. Who needs sovereign governments when you have dollar-pegged tokens, eh? 😂

The recent enactment of the GENIUS Act-an act so cleverly named it might have been dreamed up during a sleepless night-has turned these digital tokens into mainstream heroes. Banks, payment processors, and Fortune 500 titans now eagerly eye stablecoins, mistaking them perhaps for the Holy Grail or at the very least a quick ticket to the financial Promised Land.

Circle and Tether Secretly Outbid Nations: A Comedy of Caps and Crowns

Picture stablecoins: digital marvels linked to Uncle Sam’s greenback, their reserves backed by the mighty US Treasury bills-those tiny pieces of paper that say, “Trust me, I promise to pay.” This tethering makes them so reliable that one token equals one dollar, a feat that has some Wall Street wizards placing bets and others biting their nails. 💼

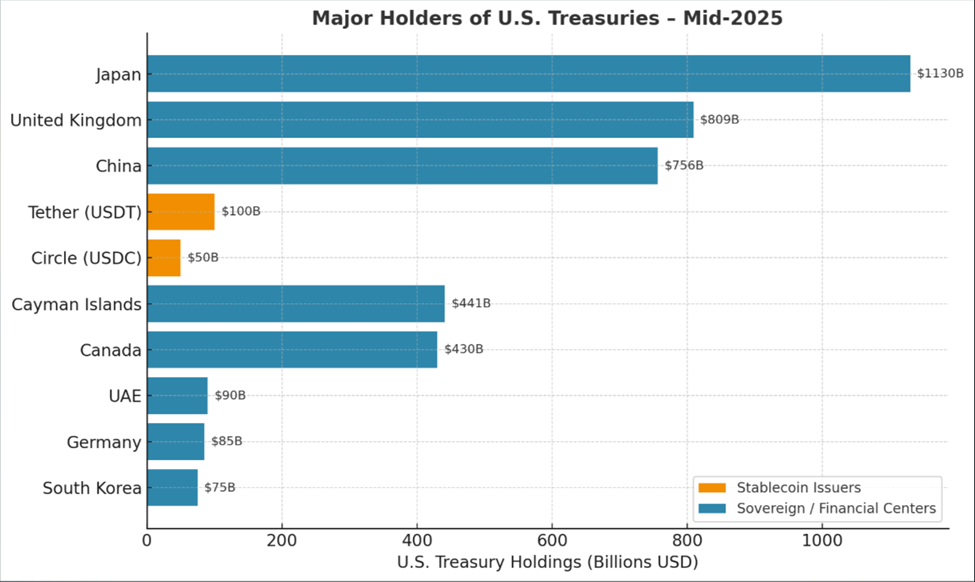

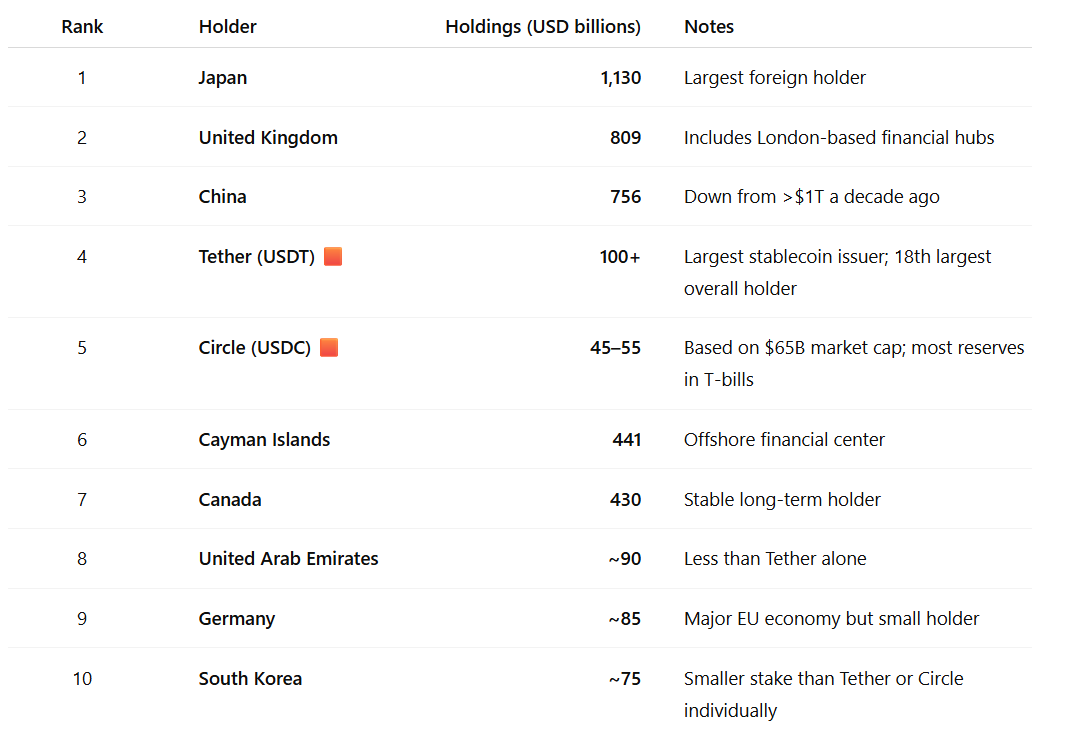

These samurai of stability-Tether and Circle-are now holders of more US debt than entire countries. Tether, the colossal titan of tokens, holds over $100 billion in T-bills, punching above its weight and ranking as the 18th-largest holder of US debt. Yes, dear reader, it’s above even the UAE’s $85 billion! Meanwhile, Circle’s USDC bag ranges from $45 to $55 billion-just shy of South Korea’s big shot $75 billion. If you’re counting, together they outpace Germany, South Korea, and the Emiratis combined-who knew that digital coins would be the new big spenders? 😂🙃

And the sector is growing faster than a cat meme going viral, with projections suggesting it could rocket from a modest $270 billion to a staggering $2 trillion by 2028. The USDC market alone swelled 90% in a year-proof that institutional adoption and IPOs are like rocket fuel for these digital beasts.

But wait, it gets better-or worse, depending on whether you’re a traditionalist! Stablecoin transaction volumes in early 2024 now outrun Visa’s, thanks to their quick, cheap, and apparently irresistible appeal for global crypto trading and money transfers. Visa, eat your heart out. 💳🔥

And here’s the kicker: Stablecoin issuers, the new kids on the debt block, are gobbling up US Treasuries at a pace that even China-and Japan-are starting to notice. China, once the proud holder of over a trillion in US debt, has pared down to $756 billion; Japan, the stalwart, remains the biggest foreign creditor at $1.13 trillion, but even they are eyeing the horizon with suspicion.

“Having stablecoin issuers always hovering in the debt landscape is like having a reliable, albeit weird, neighborhood watch-comforting, but also a little unsettling,” quipped Vanderbilt Law’s Yadav. Or maybe it was just the coffee talking. ☕

Their argument? These digital titans could cement the dollar’s global rule-or spell chaos, depending on whether their rapid turnover destabilizes the bond market or not. Meanwhile, skeptics shout about trillion-dollar money market funds, which dwarf stablecoins, happily siphoning deposits from traditional banks-debates are the new sitcom in town.

Citibank’s forecast warns that if T-bills wobble because of these new giants, the trust in the digital dollar could take a nosedive, causing a ripple effect through the financial seas. 🌊🤡

So, are stablecoins the future? Or a new form of financial chaos? Well, as fortunes are made and lost, and the debt clock keeps ticking, one thing’s clear: Wall Street’s new heavyweight contenders aren’t exactly what you’d call traditional. They’re born from volatility, cynicism, and perhaps a bit of cyber-isolationism. And they seem to be here to stay-at least until someone turns off the digital tap.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Best Controller Settings for ARC Raiders

- 10 Movies That Were Secretly Sequels

- Goat 2 Release Date Estimate, News & Updates

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

2025-08-09 17:42