For what seems like an eternity, Cardano (ADA) has been wandering through a narrow corridor, like a poet lost in the labyrinth of his own thoughts. But lo and behold, the day has come when ADA has finally found its way out of the descending triangle, a pattern so common it might as well be the alphabet of technical analysis. The breakthrough above the $0.64 to $0.65 barrier is more than just a number; it’s a sign, a whisper of change in the air, with the market volume quietly growing and the price action hinting at deeper accumulations. 📈

Cardano’s Leap: From Descent to Ascent

On the weekly chart, ADA has made a bold move, breaking free from the long-term descending triangle. This pattern, a classic harbinger of the end of a downtrend, has seen ADA respect the upper trendline while steadily forming higher lows. The breakout candle, piercing the $0.64 to $0.65 ceiling, is a testament to the accumulated buying pressure. The rising volume on the weekly charts further suggests a shift in the market’s mood, from cautious to confident. 🌟

The next significant milestone lies at $1.00, a level where ADA last faced heavy selling pressure. Should ADA clear this hurdle, the path ahead would be relatively unobstructed until the $1.50 to $1.60 range, with the chart suggesting a potential journey to $3.00 in the distant future. For now, the key will be whether ADA can maintain its newfound strength above the former resistance, turning it into a solid support. 💪

Whales Align: A Bullish Signal for ADA

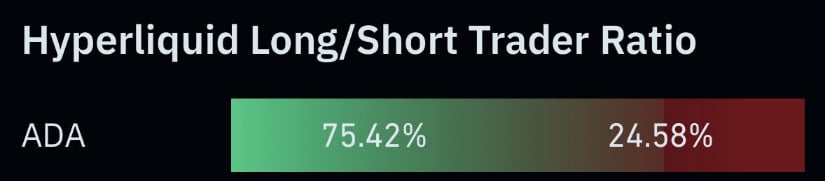

Data from TapTools reveals that 75.42% of major players on Hyperliquid are bullish on ADA, with only 24.58% holding short positions. This overwhelming tilt towards long exposure is a powerful indicator of confidence among the whales, perfectly aligned with the recent breakout. 🐳

Technically speaking, this alignment could serve as a catalyst if ADA continues to hold above the $0.64 to $0.65 breakout zone. The sustained presence of whales often fortifies key support levels, reducing the risk of significant pullbacks. If ADA retains this level of large-holder support, the prospects of reaching the $1.00 resistance and beyond become increasingly plausible. 🚀

Approaching the Next Hurdles: $0.85 and $0.93

Order book data from CW8900 indicates that ADA’s next major supply zones are clustered around $0.85 and $0.93. These levels, marked in red on the chart, represent areas where sellers have historically been active, posing potential obstacles to the current uptrend. The recent rally from below $0.80 has brought ADA close to the first resistance, and trading volume is starting to pick up as the price nears this critical region. 📊

Breaking through $0.85 with strong volume could pave the way for a smoother ascent to the $0.93 mark, where another round of selling is expected. If both levels are overcome, ADA could gain the momentum needed to challenge the $1.00 psychological barrier. 🎯

Breaking the Falling Wedge: A Path to $1.35

The 3D chart from Crypto Front illustrates a clean breakout from a falling wedge pattern, a formation often associated with bullish reversals. After several failed attempts to breach the wedge’s upper trendline, the latest move has decisively closed above it. The yellow circle marks the confirmation point, backed by increased buying volume. This setup suggests that ADA is on track to test the $1.00 level in the medium term, with $1.35 as the next major technical target if the momentum persists. 🌠

Crypto analyst Ssebi’s insights add a layer of momentum to the bullish narrative, noting that ADA has historically delivered explosive 200%-300% moves under favorable market conditions. Technically, the current position above $0.80 places ADA in a position for a rapid extension towards $3.00 if buying pressure intensifies. This aligns with previous breakout patterns, where holding key reclaimed levels often precedes strong upward movements. While the timing remains uncertain, the combination of technical structure, whale positioning, and market sentiment supports the possibility of a significant move in the right macro environment. 🌈

Final Thoughts: Could the ETF Be the Spark?

With the technicals aligning and whale positioning heavily skewed towards bulls, ADA already has the chart strength to challenge higher levels. The pending SEC decision on Grayscale’s ADA ETF could provide the necessary spark, particularly if recent staking clarifications continue to alleviate regulatory concerns. A clean break through $0.85 and $0.93 would bring the $1.00 target within reach, making the ETF timeline a crucial date to watch. 📅

Read More

- Best Controller Settings for ARC Raiders

- Donkey Kong Country Returns HD version 1.1.0 update now available, adds Dixie Kong and Switch 2 enhancements

- PS5’s Biggest Game Has Not Released Yet, PlayStation Boss Teases

- Ashes of Creation Rogue Guide for Beginners

- Sega Insider Drops Tease of Next Sonic Game

- When to Expect One Piece Chapter 1172 Spoilers & Manga Leaks

- Fantasista Asuka launches February 12

- Hytale: Upgrade All Workbenches to Max Level, Materials Guide

- If You Like Stranger Things, You’ll Love This Three-Season Sci-Fi Thriller That Launched Five Years Ago Today

- New Netflix Movie Based on Hugely Popular Book Becomes An Instant Hit With Over 33M Hours Viewed

2025-08-10 00:39