Good morning, dears. Or, as good as it can be, considering the state of things. This is your ever-so-slightly cynical briefing on the overnight crypto escapades, guaranteed to leave you vaguely bewildered and longing for a perfectly mixed Martini. Brought to you, naturally, by Paul Kim. One simply must have a beverage.

The Americans, you see, are in a pickle. Employment figures doing a rather dramatic tango with the Trump administration’s… enthusiastic tariff policies. The Federal Reserve, poor souls, are expected to perform miracles. Interest rates are wobbling like a tipsy dowager. Honestly, the drama! 🙄

A Touch of Stagflation, Perhaps?

Last week’s fuss began with some rather dreary news from the US services sector. Slowing down, apparently. And prices going up while people are losing their jobs? My dears, that’s called stagflation, and it’s dreadfully inconvenient. It rather ties the central bankers’ hands, doesn’t it? One hears whispers that Mr. Trump’s policies are to blame. Shocking, I say! 🎭

The market, naturally, is behaving like a hysterical patient. Rumours of rate cuts wax and wane with every economic sneeze. Two cuts one day, three the next. It’s utterly exhausting, keeping up. A spot of gin might be required. 🍸 And then, the astonishing news that Mr. Miran, a particularly close friend of the ex-President, has been appointed to the Federal Reserve. One suspects a bit of… persuasion is afoot. The stock market positively beamed.

Ethereum‘s Little Ups and Downs

Over the weekend, Vice Chair Bowman decided to be rather bold, suggesting three rate cuts were essential. Ethereum, ever the opportunist, briefly soared above $4,300. But, alas, BlackRock, that bastion of financial seriousness, decided to withdraw a rather substantial sum from its Bitcoin and Ethereum ETFs. Honestly, the inconsistency! 😒

A net outflow of $292.21 million from Bitcoin, and a rather more alarming $375 million from Ethereum. Speculation, naturally, abounds that Bitcoin might tumble. So fickle, these markets.

Tom Lee’s Bold Prediction

Thankfully, the panic subsided somewhat. Ethereum demonstrated a surprising resilience, aided by a spot of strategic buying. Bitmain, apparently, is accumulating vast quantities of the stuff. And Tom Lee, that guru of Wall Street, has declared that buying Ethereum is the “most important trade of the next 10 years.” Rather a strong statement, don’t you think? Geoff Kendrick suggests investing in the companies buying Ethereum might be a rather clever move. Think of it as a proxy! 💡

Mr. Trump even signed some executive orders to protect crypto businesses. Ethereum enjoyed a glorious 25.01% increase, while Bitcoin only managed a paltry 5.44%. Solana, bless its heart, also had a good week. It seems Ethereum is rather enjoying the limelight.

CPI: The Moment of Truth

This week, the pattern is expected to continue. All eyes are, naturally, on the Federal Reserve and the truly agonizing question of rate cuts. And the crucial piece of the puzzle? Tuesday’s US Consumer Price Index (CPI) data. If it’s higher than expected, well, brace yourselves, dears. 😬

| Date | Day | Event |

|---|---|---|

| Aug 13 | Tuesday | US July Consumer Price Index (CPI) release |

| Aug 14 | Wednesday | Chicago Fed President Austan Goolsbee speaks at Springfield Chamber monetary policy luncheon |

| Aug 15 | Thursday | US Producer Price Index (PPI) release |

| Aug 16 | Friday | US July Industrial Production data release |

| Aug 16 | Friday | US July Retail Sales data release |

The Producer Price Index (PPI) and the industrial and retail sales figures are also worth a glance. And, of course, pronouncements from the Federal Reserve. Chicago Fed President Austan Goolsbee will be holding forth on Wednesday. One expects a great deal of carefully worded ambiguity.

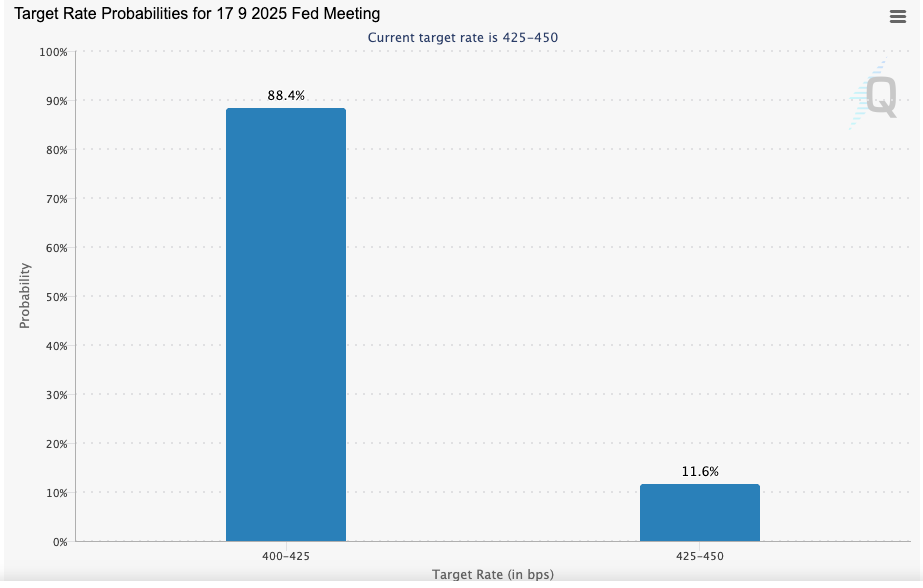

As of Monday morning, the odds of a rate cut in September are 88.4%. However, one never knows what fresh chaos awaits. Good luck, darlings. You’ll need it. 😉

Wishing you profitable investments – and a stiff drink.

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Ashes of Creation Rogue Guide for Beginners

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Michael Turner and Geoff Johns’ Ekos Vol. 2 Reveals First Look Preview as Kickstarter Shatters Funding Goal (Exclusive)

- Paramount To Adapt Popular Anthropomorphic Children’s Book Series

2025-08-11 04:09