In a dramatic turn of events reminiscent of an Agatha Christie novel, our shadowy institution has launched a rather spectacular shopping spree, nudging Ethereum‘s price above the most magical threshold of $4,000 for the first time since late 2021. How quaint! 🎩

The Billion-Dollar Buying Spree Continues

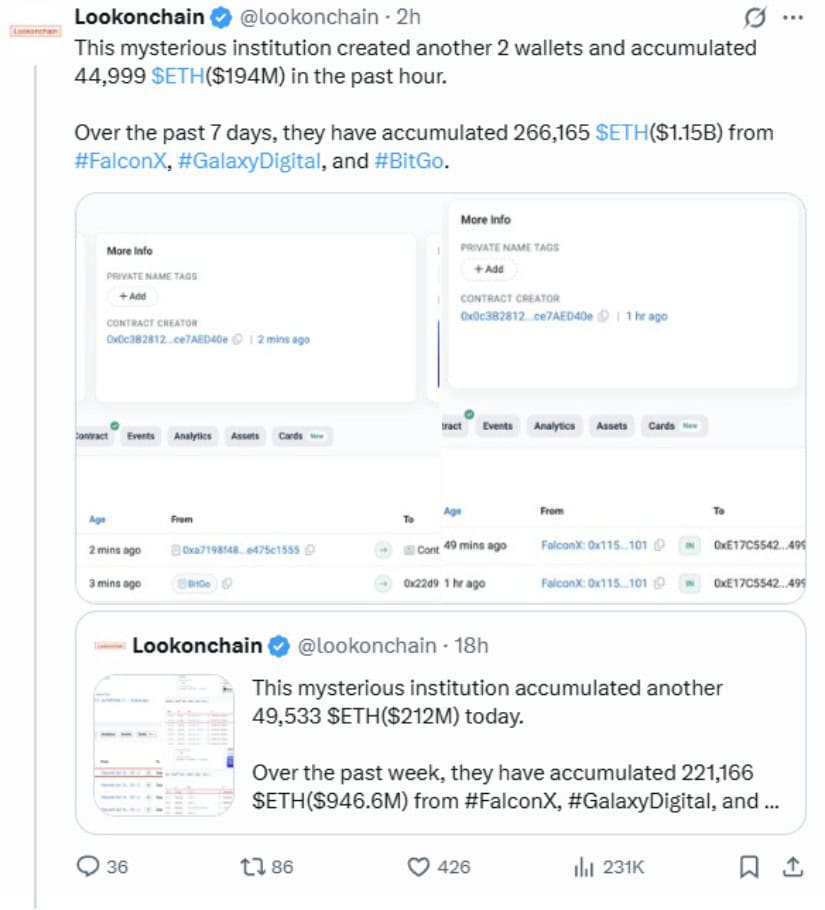

It seems our mystery benefactor has developed a taste for the finer things in life, now hoarding a staggering 266,165 ETH tokens worth approximately $1.15 billion over the past week. The latest updates from the ever-watchful Lookonchain reveal that this elusive buyer has taken to creating wallets like one might collect postcards, just a mere hour ago acquiring another 44,999 ETH worth $194 million. Oh, what fun! 💸

This institution has clearly been on a binge-just 18 hours prior, they had gained yet another 221,166 ETH for a delightfully modest $946.6 million. One cannot help but admire their persistence. They are buying aggressively as Ethereum’s price sweeps up like a dramatic wave on the English coast. 🌊

The wily buyer has chosen to scatter their prized tokens across eight wallets as though playing a game of hide and seek-are they guarding their treasure against nefarious pirates? Wallets vary in value from $128 million to $181 million, because why settle for mediocrity? 🤷♂️

But where is all this Ethereum coming from? Instead of the more plebeian exchanges, this lofty institution prefers the plush lounge of major trading desks and custodians, such as Galaxy Digital and BitGo. This not-so-subtle hint suggests that coffee and croissants in a corporate boardroom are the likely setting for the buyer’s machinations. Clearly, they are more business moguls than blundering amateurs. ☕💼

Corporate Ethereum Rush Gains Steam

And lo! This mysterious figure isn’t gallivanting alone. In fact, an entire horde of corporations has decided to partake in this Ethereum banquet, with over 304,000 ETH changing hands for a staggering $1.3 billion in the last week alone. Isn’t it delightful when the bigwigs play nice? 🎉

BitMine Immersion Technologies is leading this corporate charge, conveniently amassing 833,137 ETH valued at an eye-watering $2.9 billion in just 35 days. Imagine the spreadsheets! 📈

Following closely is SharpLink Gaming, which recently sank a cool $303 million into Ethereum, now holding over 521,000 ETH worth nearly $2 billion. Their approach marks a clear departure from Bitcoin’s reclusive “digital gold” persona, as Ethereum allows for an array of to-dos like smart contracts and yield generation. Practicality with a hint of derring-do! 💪

Market Impact and Price Surge

Thanks to this unyielding institutional enthusiasm, Ethereum’s price ascended a glorious 21% within the week. A real climactic rise, breaking through the $4,100 resistance like a hero in a melodrama, in a feat not seen since December 2021. Bravo! 👏

With this last-minute acquisition of $194 million, one can’t help but wonder if this buyer possesses a crystal ball-what else motivates such fervent purchasing at elevated prices? A gambler’s instinct, perhaps? 🎲

Ethereum’s market cap now towers at an impressive $523 billion, surpassing the illustrious $519 billion valuation of Mastercard. Just imagine that dinner party! 🍽️💳

The number of sizeable Ethereum holders is also swelling-wallets containing over 10,000 ETH have hit 868,886, the highest point in a year according to Glassnode data. The elite are indeed hoarding their riches! 🏰

Technical Outlook Points Higher

Analysts are playing the part of the seers, predicting Ethereum could soar even higher. The recent breakout above $4,100 hints at a cheeky move toward $7,000 or beyond by year’s end. Isn’t that just positively riveting? 📊

Nilesh Verma, the soothsayer of the crypto realm, envisions ETH climbing to $20,000 within six to eight months. Another analyst, Merlijn The Trader, suggests Ethereum might reach further heights. Oh, to be a fly on the wall during such predictions! 🦋

Tom Lee of Fundstrat opines that Ethereum is “arguably the biggest macro trade over the next 10-15 years.” Such bold declarations! His firm holds the reins at BitMine’s board, banking on institutional adoption for long-term growth. You do root for him, don’t you? 🎩

Meanwhile, ETH exchange reserves are dwindling to almost all-time lows of 18.89 million tokens. This tightening of supply amidst soaring demand creates a favorable cocktail for further price fluctuations. 🍸

Risks and Warnings

However, not all that shines is gold, dear reader. Our illustrious Ethereum co-founder, Vitalik Buterin, advises caution, warning against thrusting these purchases into the realm of an “overleveraged game.” Quite the buzzkill, Mr. Buterin! 😬

The enigma of the billion-dollar buyer adds a layer of intrigue. While their size and sourcing indicate institutional backing, the cloud of anonymity enveloping their identity raises a considerable eyebrow. Investors may feel a twinge of unease; after all, who doesn’t love a good whodunit? 🔍

Cryptocurrency markets remain as temperamental as the British weather. Despite the fervent institutional interest, Ethereum’s price may still twist and turn based on the whims of market conditions, regulatory shifts, or sudden changes in investor sentiment. Buckle up! 🎢

What This Means for Ethereum

Currently, nearly 30% of Ethereum’s supply sits ensconced in staking, while a cavalcade of tokens lies wrapped in various protocols. Strategic reserves are now hugging over 3 million ETH, while exchange-traded funds have snatched up approximately 5.3 million ETH. One’s reach needs to match one’s grasp, dear investors! 🤔

This institutional adoption, twinned with technical breakouts and dwindling exchange supplies, paints a tantalizing picture for Ethereum’s future. Yet, caution is advised; the cryptocurrency landscape resembles a lively chess game-consider your moves carefully! ♟️

The identity of the elusive buyer may one day unveil itself, but their impact on Ethereum’s price and institutional adoption is already reshaping this wild cryptocurrency frontier. With over $1.15 billion amassed in just a week and a relentless buying spree, this entity claims its spot in the chronicles of aggressive institutional accumulation. A tale for the ages! 📚

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Pokémon Legends: Z-A’s Mega Dimension Offers Level 100+ Threats, Launches on December 10th for $30

- James Gunn & Zack Snyder’s $102 Million Remake Arrives Soon on Netflix

- Ashes of Creation Rogue Guide for Beginners

- Unleash the Seas: ‘Master and Commander’ Sets Sail on Stunning 4K Steelbook!

2025-08-12 00:42