Ah, Willy Woo – the man who thinks Bitcoin‘s price is just a bit too high for comfort. Well, he’s bailed out of his Bitcoin position, and naturally, he’s got a warning for all of us plebeians. According to Woo, Bitcoin is flashing some rather disconcerting 2013-esque bearish divergence signals. I’m sure you’re all *thrilled* to hear that. 🥂

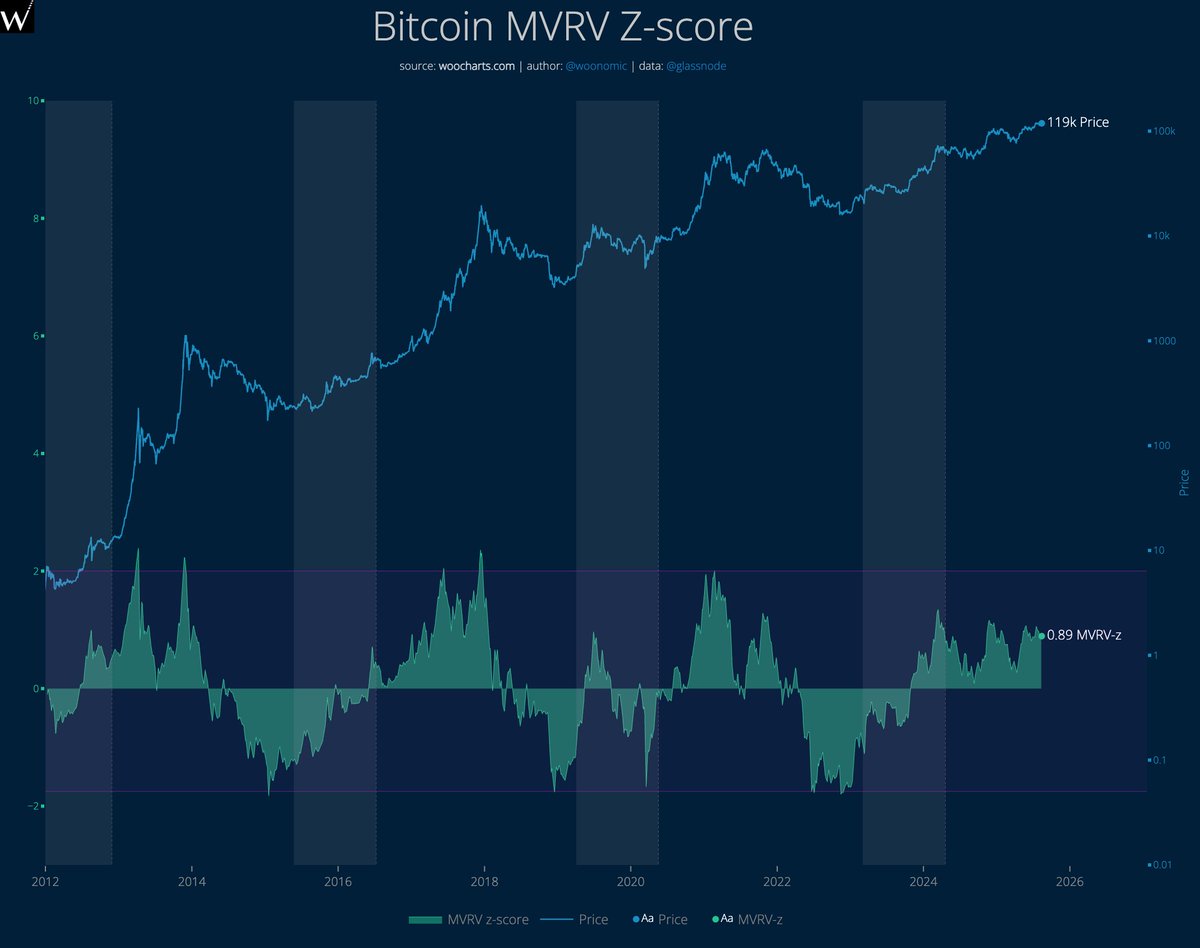

In his infinite wisdom, Woo shared this revelation with his 1.2 million followers on X (formerly Twitter), revealing that Bitcoin’s market value to realized value (MVRV) Z-score is now signaling that we might be in for a downtrend. Don’t worry, this is just the kind of news that keeps everyone on the edge of their seats, right?

The MVRV Z-score, in case you were wondering (because who wouldn’t?), compares Bitcoin’s market cap to the last time each coin was moved, determining whether it’s undervalued, overvalued, or just… fair value. So basically, it’s the finance version of those overly critical restaurant critics we all avoid. 🍴

“MVRV tracks how BTC is valued vs the capital that’s been invested. We like to ask ‘what’s different this cycle?’ Let me ask you. What did you see change in each past cycle, what’s different this cycle?… “

“We’re seeing more bearish divergences for sure. Unseen since 2013’s double top.”

Now, for those who don’t quite understand the fine art of a bearish divergence, let me break it down for you. It happens when Bitcoin’s price makes higher highs, but the MVRV Z-score makes lower highs. It’s like a chart version of a midlife crisis. 💔

In a bold move that only someone with a significant Twitter following could pull off, Woo also responded to an X user who was curious why he sold his precious BTC. Naturally, he had an answer ready.

Says Woo,

“It was a rotation to higher up the risk curve to support the picks and shovels behind BTC. I’ll talk more about it in some podcasts that got recorded, mostly it’s personal to my situation and not about exiting Bitcoin.”

Because, of course, it’s all personal. But who’s counting? 😏

And as if that wasn’t enough to chew on, Woo drops this gem: Bitcoin’s market is being largely driven by high-net-worth individuals (HNWIs) right now, a stark departure from previous cycles where retail traders were the key players. So essentially, we’re now in the “whale phase” of Bitcoin’s life. 🐋

“[Retail traders] are there. Just 10x deemphasized. What moves price now are the large pools of capital inside the $900 trillion buckets of wealth assets. We are in a whale phase of HNWIs. Future flows will be retail money, but managed by gatekeepers: sovereigns and pension funds.”

So, if you were hoping for a sudden surge of retail traders like the good ol’ days, well, forget it. The whales are now in charge, and they’re swimming circles around us. 🦈

At the time of writing, Bitcoin is trading at a cool $119,664, down ever so slightly in the last 24 hours. No panic, though – just another day in the wild world of crypto!

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Goat 2 Release Date Estimate, News & Updates

- USD JPY PREDICTION

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 10 Movies That Were Secretly Sequels

- These Are the 10 Best Stephen King Movies of All Time

- Best Werewolf Movies (October 2025)

2025-08-12 21:42