Well, butter my biscuit and call me a skeptic, but it seems the Bitcoin (BTC) circus is back in town, and the clowns-er, miners-are up to their old tricks. As the golden calf of crypto teeters just shy of the $120,000 mark, these digital dredgers have been hauling their loot to Binance like it’s going out of style. Analysts, those modern-day soothsayers, reckon this could spell doom for the price of our beloved BTC. 🤑

Is Bitcoin’s Price About to Take a Header?

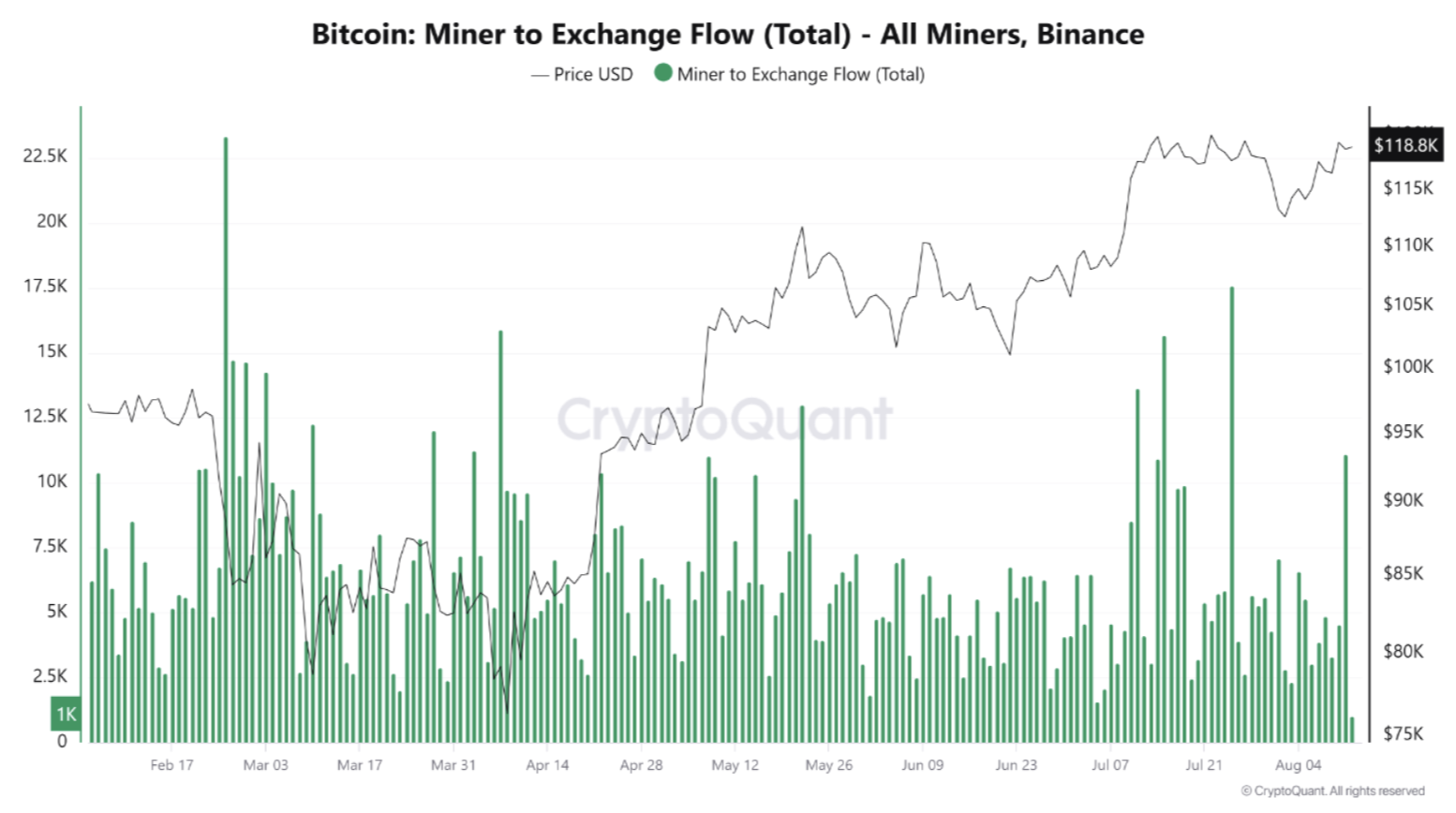

According to a CryptoQuant yarn spun by one Arab Chain, there’s been a hullabaloo of BTC transfers from miners to Binance in late July. Picture this: double tops on the charts, clearer than a liar’s conscience. 📈

These shenanigans were followed by days of above-average shuttling to the exchange. Early August brought another frenzy, with transfers ballooning from a few thousand BTC to a whopping 10,000 BTC at their peak. It’s like a gold rush, but with more zeros and fewer pickaxes. ⛏️

Now, what’s a miner to do when the price is hovering near its all-time high? Why, cash in, of course! These folks are distributing BTC like it’s candy at a parade, and Arab Chain reckons it’s less about “business as usual” and more about “stockpiling or hedging behavior.” Fancy words for “covering their backsides,” if you ask me. 🤔

Take it from Twain: when miners start acting like squirrels in autumn, it’s time to keep an eye on your wallet. Sustained high inflows during a rally? Sounds like they’re grabbing liquidity faster than a politician grabs a photo op. Covering operational costs, managing post-halving treasury needs-whatever the excuse, it’s clear they’re not holding their breath for a moon shot. 🌕

But here’s the kicker: large inflows often mean short-term resistance. The market’s gotta have the guts to swallow all that supply, or we’re looking at a price drop sharper than a con man’s wit. And with peaks more frequent than a preacher’s promises, it’s not a one-time fluke-it’s a full-blown miner mania. This makes Bitcoin’s price about as stable as a three-legged stool. 🪑

Arab Chain says if daily flows stay above 5,000 to 7,000 BTC, we’re in for a supply squeeze. But if it drops like a lead balloon, maybe the panic was all for naught. 🤷♂️

Or Is BTC Just Catching Its Breath Before the Next Leap?

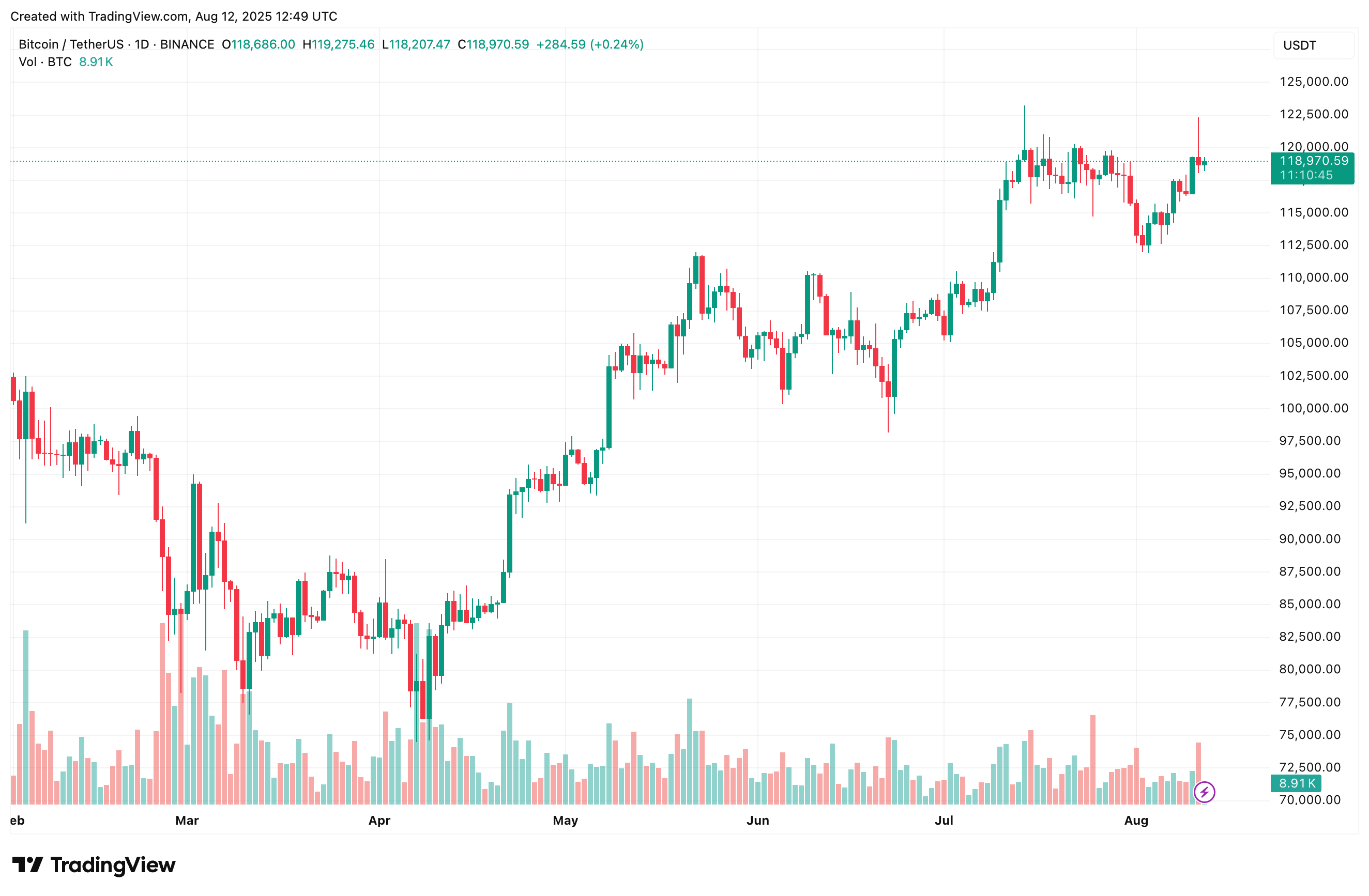

Now, don’t go selling your soul just yet. Despite the price consolidating below $120,000, on-chain data shows no signs of the market overheating. Retail investors are jumping in like it’s a barn dance, and the average order size in Bitcoin futures is shrinking faster than a cheap suit in the rain. 🕺

But-and there’s always a “but”-a heap of short-term holders are sitting pretty in profit, which could spell trouble. At the time of this scribbling, BTC is trading at $118,970, down a smidge (0.6%) in the last 24 hours. 📉

So, dear reader, will Bitcoin soar to new heights or take a nosedive into the abyss? Only time will tell. But one thing’s certain: in the wild west of crypto, the only sure bet is uncertainty. 🤠

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Ashes of Creation Rogue Guide for Beginners

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- DC K.O.: Superman vs Captain Atom #1 Uses a Fight as Character Study (Review)

- “I’m Really Glad”: Demon Slayer Actor Reacts to Zenitsu’s Growing Popularity

2025-08-13 02:22