In a dazzling pirouette of corporate ambition, Coinbase Global Inc. has, with all the fanfare of a circus ringmaster, completed its acquisition of Deribit FZE, the reigning monarch of crypto options exchanges. This audacious maneuver is poised to catapult Coinbase into the stratosphere of international derivatives markets, where the air is thin and the stakes are high. With spot, futures, perpetuals, and now options all snugly nestled under one roof, Coinbase is transforming into the Swiss Army knife of crypto trading platforms-minus the corkscrew, of course.

“We’ve closed the deal-excited to welcome @LStrijers and the whole Deribit team to Coinbase. Their talent will be a key part of us building the everything exchange, and being able to offer industry-leading derivatives products around the world.”

– Brian Armstrong (@brian_armstrong) August 14, 2025

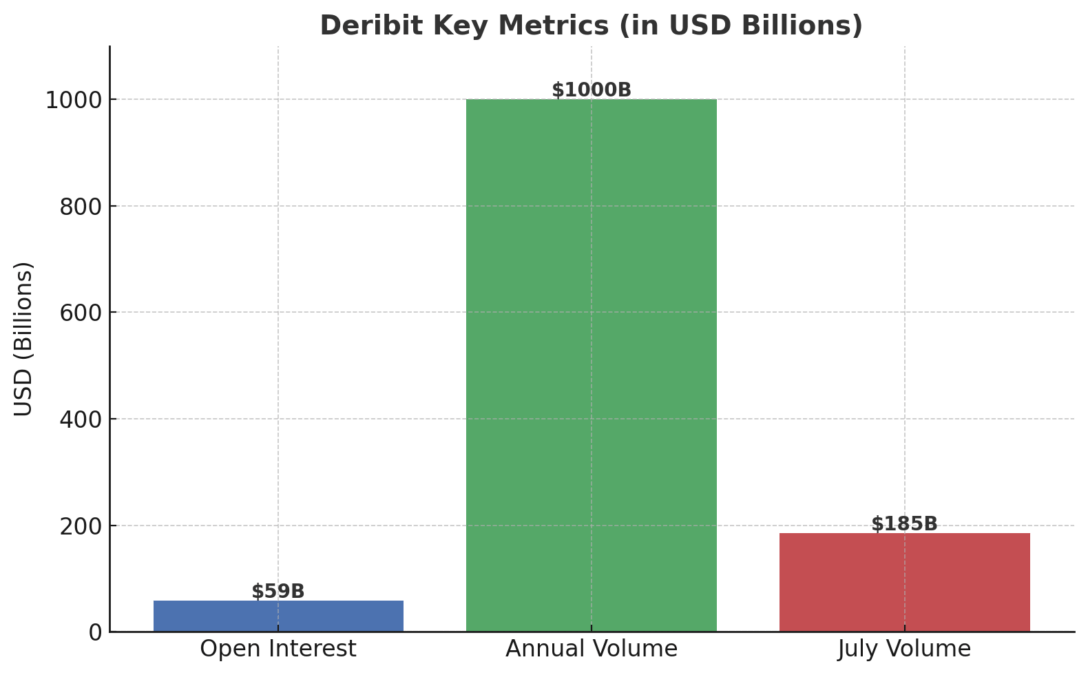

Deribit, that sprightly little exchange, has danced its way to the top of the crypto options market share, flaunting its quickness and capital efficiency like a peacock in full plumage. July 2025 was a particularly splendid month, with trading volume soaring past a staggering $185 billion and open interest strutting around the $60 billion mark. Who knew numbers could be so sexy?

With a staggering $1 trillion worth of transactions processed in the last year, Deribit has proven itself to be a veritable titan in the market. For Coinbase, this acquisition arrives at a time when institutional demand is hotter than a jalapeño in July. The advanced infrastructure of Deribit promises to sprinkle some much-needed liquidity into the mix, expand participation, and solidify Coinbase’s position in a business landscape that resembles a gladiatorial arena.

Financially speaking, this deal is expected to be as sweet as a ripe peach for Coinbase’s day one adjusted EBITDA. Deribit, for instance, raked in over $30 million in transaction revenue in July alone-talk about a cash cow! Coinbase anticipates around $10 million in incremental costs for Q3, thanks to technology, development, and administrative work, all while conveniently ignoring the pesky acquisition-related amortization.

This purchase is Coinbase’s strategic play to ride the wave of growing global demand for crypto derivatives. By marrying the virtues of Deribit with Coinbase’s expansive platform, the company is set to offer a trading experience that is not just sophisticated, but also faster and easier for both institutional and advanced retail traders. Because who doesn’t want to trade crypto derivatives with the finesse of a ballet dancer?

As the crypto derivatives marketplace continues to expand like a balloon at a birthday party, the Coinbase acquisition of Deribit stands as a significant milestone-a grand merger of two influential industry titans, poised to shape the future of trading evolution. Let the games begin! 🎉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Gold Rate Forecast

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Controller Settings for ARC Raiders

- Best Werewolf Movies (October 2025)

- Goat 2 Release Date Estimate, News & Updates

2025-08-14 22:32