Oh, here we go again! Strategy Inc. is at it once more, adding more Bitcoin to its already overflowing treasury while the markets are, as usual, doing their little wobbly dance. Gotta love that stability, right? 😂

So, the company picked up 430 BTC for a cool $51.4 million. That’s around $119,666 per coin – but, you know, who’s counting? They’re still sitting pretty as one of the largest corporate Bitcoin hoarders. Really, how many BTC do you *need* to prove a point? Is it 1,000? 10,000? Oh, wait, it’s 629,376. Just a casual amount. 🙄

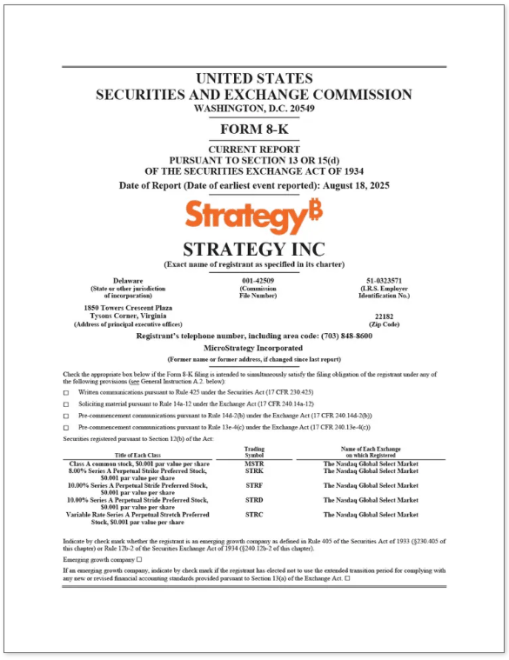

Purchase Details And Holdings

According to some “official” reports (because who else would report it?), the company now holds 629,376 BTC. That’s almost 3% of the entire Bitcoin supply. Can you imagine that? A solid chunk of the market, just hanging out in their vault somewhere. I mean, who needs diversification when you’ve got Bitcoin, right? 📈

Strategy has acquired 430 BTC for ~$51.4 million at ~$119,666 per bitcoin and has achieved BTC Yield of 25.1% YTD 2025. As of 8/17/2025, we hodl 629,376 $BTC acquired for ~$46.15 billion at ~$73,320 per bitcoin. $MSTR $STRC $STRK $STRF $STRD

– Michael Saylor (@saylor) August 18, 2025

That stash? Yeah, it’s worth about $46.15 billion. Nothing too crazy, right? And the latest BTC purchase was funded by the company selling stock. Nothing says “we’re doing fine” like selling your own shares to buy some crypto. The proceeds came from selling STRK, STRF, and STRD stocks. A modest $19.3 million here, $19 million there, and, oh, just a casual $12.1 million over there. Just pocket change. 🤑

And, of course, Michael Saylor couldn’t help but drop a cryptic little nugget on X with “Insufficient Orange.” I’m guessing that means they need more BTC? More orange in the wallet? Because nothing says “I need more” like a random tweet, right? 🍊

Insufficient Orange

– Michael Saylor (@saylor) August 17, 2025

New Equity Guidance And Funding Rules

Now, if you want to get *really* technical (and who doesn’t love a bit of jargon), there’s an update to the company’s equity guidance. When the market NAV multiple (mNAV) is over 4.0x, they’ll issue more shares. But if it’s between 2.5x and 4.0x? More BTC for you! And, if it falls below 2.5x? Well, don’t worry, folks. They’ll *only* prioritize paying off debt and preferred equity dividends. Just some light financial maneuvering. 😏

Oh, and here’s a fun little twist: if mNAV is below 1.0x? Maybe they’ll use credit to buy back MSTR shares. Because why not? What could possibly go wrong when you’re borrowing to buy back stock? 😅

But hey, that’s just the company’s plan. You know, because the market’s unpredictable and all that jazz. We’ll see how it plays out.

Market Moves And Stock Reaction

So, in case you’re wondering, Bitcoin decided to do what Bitcoin does best: go down. It dropped almost 5% last week and dipped below $115,000 for a hot minute. Which, you know, is just your typical day in the crypto world.

Meanwhile, MSTR stock took a bit of a tumble, too, slipping more than 8% over the past five days. I mean, it’s a real rollercoaster over here. One moment you’re at $365, the next, you’re like, “Wait, why are we at $357?” Oh well, such is life in the fast lane. 🎢

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Pokémon Legends: Z-A’s Mega Dimension Offers Level 100+ Threats, Launches on December 10th for $30

- James Gunn & Zack Snyder’s $102 Million Remake Arrives Soon on Netflix

- Ashes of Creation Rogue Guide for Beginners

- Ben Napier & Erin Napier Share Surprising Birthday Rule for Their Kids

2025-08-19 08:15