My dearest readers, it is a truth universally acknowledged, that a single token in possession of a fine inverted head and shoulders pattern must be in want of a rally towards the illustrious sum of $0.925. But let us not be too hasty; such a journey requires the support of key levels and a generous helping of volume. For without these, even the most promising of tokens might find itself in the company of bears, rather than bulls.

An Inverted Head and Shoulders Pattern, Most Delicately Formed

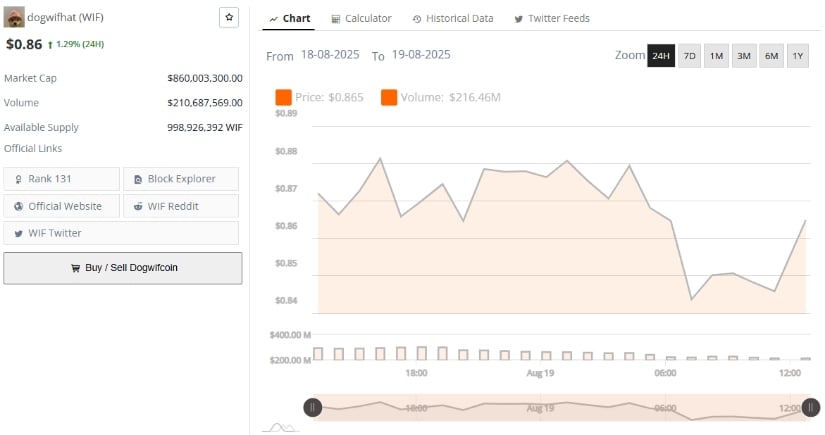

The 30-minute chart of WIF/TetherUS presents a most elegant formation, one that would do credit to any ballroom in Meryton. It begins with the left shoulder, a figure of considerable poise, standing at roughly $0.860. This is followed by a deeper trough, the head, which dips gracefully to about $0.844. The pattern concludes with the right shoulder, a more elevated form, resting near $0.856. Such a configuration often heralds a shift from the melancholy of bearishness to the gaiety of bullish enthusiasm.

The neckline, acting as a barrier to further descent, is positioned at approximately $0.869. Should the token muster the courage to break above this point, a rally is likely to ensue, with the measured price target set at the delightful sum of $0.925, as projected by the chart.

Volume, my dear readers, is the lifeblood of such a venture. Historically, breakouts accompanied by a surge in trading volume are more likely to culminate in a lasting romance between the token and its new heights. An increase in volume as the price approaches and breaches the neckline would indeed be a most auspicious sign.

Recent Price Momentum and Volume Activity, A Dance of Intrigue

The 24-hour price movement reveals a moderate ascent from the somber lows of $0.860 to a recent high of nearly $0.889. This upward trajectory is accompanied by a rise in volume, suggesting that the market is beginning to take a keen interest in the token’s fortunes and actively engaging in its purchase during the rally.

Resistance is noted at $0.890, a level where the price has met with several rejections in recent hours. Meanwhile, $0.860 remains a vital support zone, serving as the foundation for the inverted head-and-shoulders formation.

Traders will be watching these levels with bated breath: holding above support and breaking through resistance could confirm the breakout, while a failure might lead to further consolidation or a decline. The notable volume spikes during price advances lend credence to the bullish outlook, suggesting that buyers are becoming increasingly active. Sustained volume alongside upward price action strengthens the likelihood of a rally toward the $0.925 target.

Momentum Indicators, A Mix of Caution and Hope

On the daily chart, technical momentum indicators provide additional insight. The Relative Strength Index (RSI) stands at 42.90, a position of neutrality, just above the oversold levels. This suggests that WIF is not yet overextended and may have room to move in either direction, depending on the whims of the market.

The MACD, that most discerning of indicators, shows the MACD line below the signal line, reflecting a short-term bearish momentum. However, the recent histogram bars are diminutive, indicating a waning of downward pressure. This scenario hints at the potential for a shift in momentum, should buying pressure intensify and key resistance levels be overcome.

Thus, the RSI and MACD present a picture of cautious optimism. While the market sentiment is mixed, the neutral RSI supports the possibility of an upward move. Confirmation from a MACD crossover and a decisive price action breaking resistance levels would be necessary to solidify the bullish narrative.

And so, dear reader, we shall watch with bated breath and a cup of tea in hand, as the tale of WIF unfolds. May fortune smile upon our hero, and may the bulls triumph over the bears. 🐂🐻

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Ashes of Creation Rogue Guide for Beginners

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- There Are Big Concerns About Plants vs Zombies’ PS5, PS4 Re-Release

- Luther film sequel confirmed by Netflix with Idris Elba joined by returning fan-favourite

- Kate Middleton, Prince William Coordinate During Red Carpet Date Night

2025-08-20 00:47