Ah, Bitcoin-the digital diva of finance-has once again taken center stage in her never-ending opera of chaos and charisma. After flirting dangerously with the $120,000 mark like a debutante at her first ball, BTC now finds itself clinging to the $115,000 level as if it were the last martini glass at an Oscar Wilde soirée. The bears are circling, darling, and volatility is serving looks fiercer than Lady Bracknell on a bad day.

Despite its recent flirtation with all-time highs (yes, she peaked-pun intended), Bitcoin’s inability to maintain resistance zones has sparked whispers of a potential correction. Is this a healthy reset or the beginning of a Shakespearean tragedy? Only time-and perhaps some overly caffeinated traders-will tell.

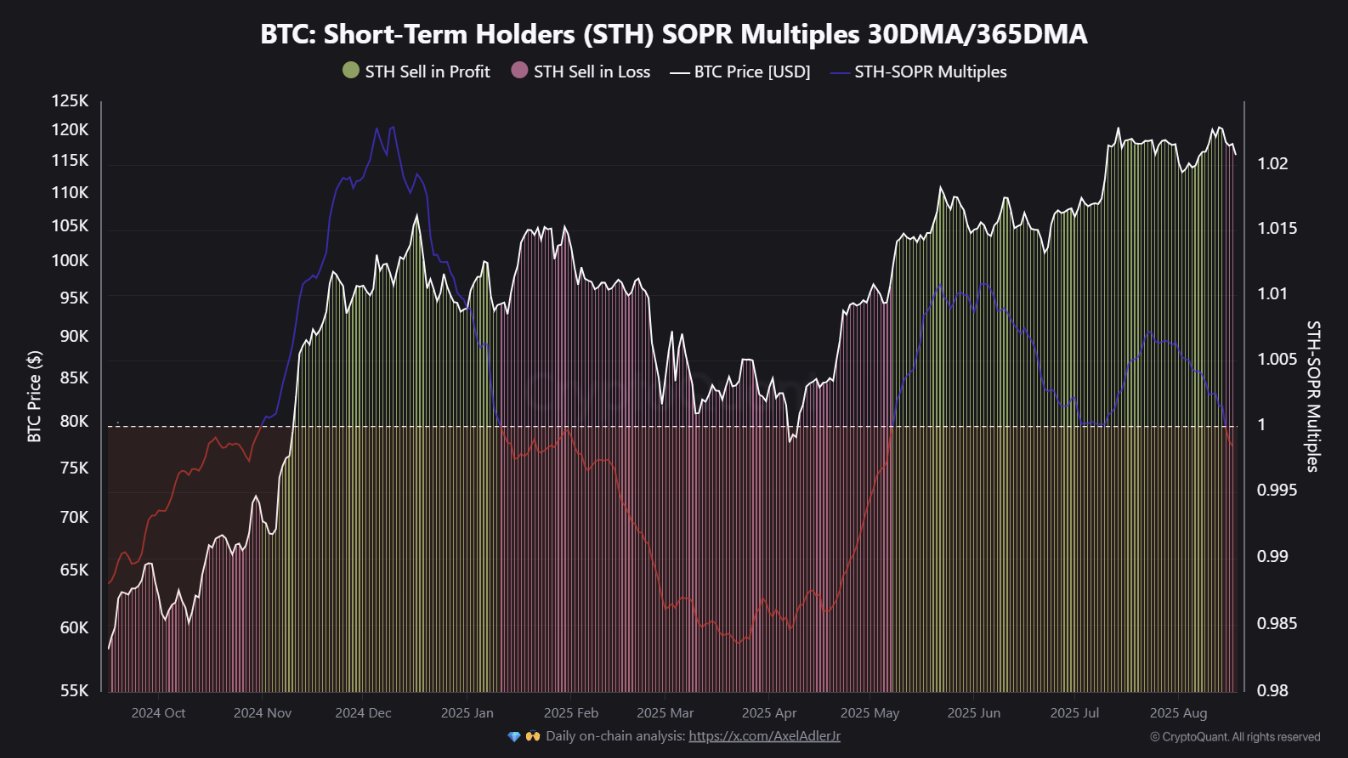

Enter CryptoQuant analyst Kerem, who drops a bombshell worthy of Dorian Gray’s scandalous diary: for the first time since January, Bitcoin’s short-term holders (STHs) have returned to selling at a loss. Oh, the humanity! Or rather, the lack thereof. This cohort, known for their fleeting loyalty to crypto fortunes, previously sold at a loss during January’s dramatic correction-a period so bleak even Lord Byron might have written poetry about it. Yet, history reminds us that such moments often cleanse the market of weak hands, paving the way for future rallies. One might say it’s survival of the fittest-or at least those with deeper pockets.

A Tale of Two Scenarios

If this wave of loss-selling subsides swiftly, Bitcoin could mirror past resets, emerging stronger and more dazzling than ever before-like a phoenix rising from ashes made of JPEGs and blockchain dreams. However, should losses deepen, we may witness a breakdown of the bullish structure, sending BTC tumbling toward lower supports faster than one can say “NFT.”

The chart reveals BTC teetering precariously near its 50-day moving average ($115,900), which now stands as the Maginot Line against further decline. A breach here could invite calamity, potentially dragging prices toward the 100-day MA ($110,957) or even the ominous 200-day MA near $100,410. On the upside, the $123,217 resistance looms large, stubbornly refusing to budge despite BTC’s best efforts. It’s almost as if the market itself were mocking our dear coin’s ambitions.

Momentum indicators suggest waning bullish strength, but fear not, optimists! The broader trend remains intact, with higher lows hinting at resilience. Perhaps Bitcoin is merely rehearsing for its next grand performance-a comeback so spectacular it would make Hedonism Bot blush. 🎭✨

In conclusion, dear reader, whether you’re a bull, bear, or simply someone seeking entertainment in these turbulent times, remember this: life imitates art, and Bitcoin imitates both-with just a touch of absurdity thrown in for good measure. Cheers to the drama unfolding before our very eyes! 🍸📈

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Gold Rate Forecast

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 10 Movies That Were Secretly Sequels

- Best Werewolf Movies (October 2025)

- Best Controller Settings for ARC Raiders

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Goat 2 Release Date Estimate, News & Updates

2025-08-20 01:19