Ah, Solana, our old friend, is playing the long game with a flair for the dramatic. After weeks of tightrope-walking between consolidation zones, SOL now teeters on the brink of a breakout, like a diva rehearsing for her grand entrance. The market whispers suggest sellers are exhausted, while buyers-oh, the buyers-are tiptoeing in with the subtlety of a jazz pianist. If this charade continues, $200 might just be the velvet rope to the next party.

The Solana Spectacle: Accumulation, Bulls, and the Art of the Slow Burn

Solana’s chart is a masterclass in accumulation, darling. Two consolidation zones have formed a base so solid, one could build a chandelier on it. The descent from its channel has been a masterstroke of market theatre-sellers packing up their bags, buyers reclaiming the spotlight. With price action tightening like a corset, SOL might just waltz toward $200, provided it doesn’t trip over its own ego. 🐳

Technically speaking, this is a Wyckoff accumulation model in action-range-bound trading like a cat in a room full of rocking chairs. The higher lows and rising volume near support are the market’s way of saying, “Darling, I’m ready for my close-up.” If bulls can keep this charade going, $240-$260 is the next act in this bullish opera. 🎭

Capital Flows: Solana’s Newfound Glamour Role

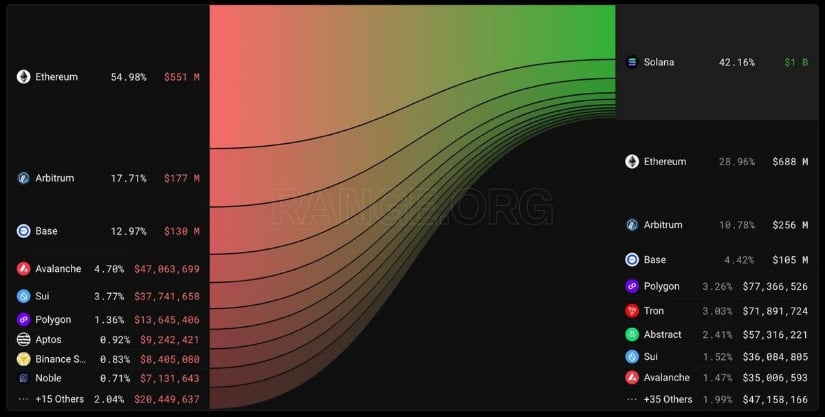

Capital flows? Oh, they’re not just flowing-they’re strutting into Solana like a debutante at a ball. Over $1 billion has bridged into this ecosystem in 30 days, outpacing Ethereum and its pretentious cousins. On-chain activity? A 42% share of bridging volume, darling. If this keeps up, Solana won’t just be a memecoin hub-it’ll be the toast of the crypto elite. 🥂

Ethereum, meanwhile, is trailing like a forgotten suitor. If Solana keeps this momentum, the technicals and capital inflows will duet a symphony toward $350. A match made in market heaven, or so the analysts claim. 🎶

Solana’s Ascending Triangle: A Geometrically Elegant Prison Break

Analyst Anup Dhungana, our resident mathematician in a pinstripe suit, has spotted an ascending triangle on the weekly chart. It’s the market’s way of saying, “I’m trapped, but I’m very well-dressed.” Resistance at $250-$260 is the velvet curtain, while the ascending trendline is the floor of a ballroom. A close above $260 would be the grand finale, with $320-$350 as the encore. 🎉

This tightening volatility is like a suspenseful intermission. The audience knows something’s coming, but the curtain hasn’t lifted yet. Breakout, darling, is inevitable. 🌟

Short-Term Solana: The Falling Wedge and Its Delicate Dance

On the 4H chart, Solana is performing a falling wedge, a ballet of caution and hope. Price is pressing against $176 like a timid guest at a masquerade ball. If it rebounds, the wedge’s upper trendline at $188-$190 becomes the next chandelier to crash through. A breakout here would be the cue for bulls to take a bow. 🩰

Higher-volume reactions at support? The market is playing 20 Questions with momentum. Sellers are losing their grip, while buyers are rehearsing their grand entrance. 🎭

Whale Activity: The Uninvited Guest at the Party

But lo! A whale has unstaked 98,291 SOL, transferring it to Binance like a guest leaving a party early. $17.83M in the spotlight, darling. Historically, such moves are as reliable as a umbrella in a hurricane-either profit-taking or hedging. It’s a polite reminder that even bullish structures can be derailed by a rogue whale. 🐳

This isn’t a red flag, just a cautionary note. If sellers flex their muscles, $176-$169 becomes the emergency exit. But let’s not spoil the party with panic, shall we? 🎈

Final Thoughts: The Solana Soirée

Solana’s technicals and on-chain data are a lavish cocktail of accumulation, inflows, and bullish geometry. The ascending triangle and falling wedge are the market’s way of saying, “Darling, I’m ready for my close-up.” A breakout above $260 could see SOL waltz toward $350, but the whale’s exit is a polite reminder that markets are rarely a straight line. 🎭

Support at $176-$169? A test of resolve. If it holds, dips may be the market’s way of saying, “Come closer, dear.” But if it breaks… well, even the most glamorous parties have their share of drama. 🎬

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Best Shazam Comics (Updated: September 2025)

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Resident Evil Requiem cast: Full list of voice actors

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- Wicked Recap: 5 Biggest Things To Remember Before Watching Wicked: For Good

2025-08-21 10:30