Ah, Bitcoin-the gift that keeps on giving (and occasionally breaking your heart). Despite a little short-term drama, the cryptocurrency has been pulling off an impressive tightrope act, balancing technical signals, whale activity, and that post-halving hope that never quite fades. If you’ve been watching the ticker with bated breath, the market is serving up more twists than a Russian novel. Investors are bracing for yet another potential rally, but first, let’s dig into the fine print.

Market Overview: Bitcoin Technical Analysis

As of August 24, 2025, Bitcoin is hanging out around the $115,000 mark, taking a breather after a brief flirtation with the $117,300 heights. Analysts are eyeing this as a classic “consolidation” period, a bit like waiting for your laundry to dry-no clear direction, but something’s probably happening under the surface.

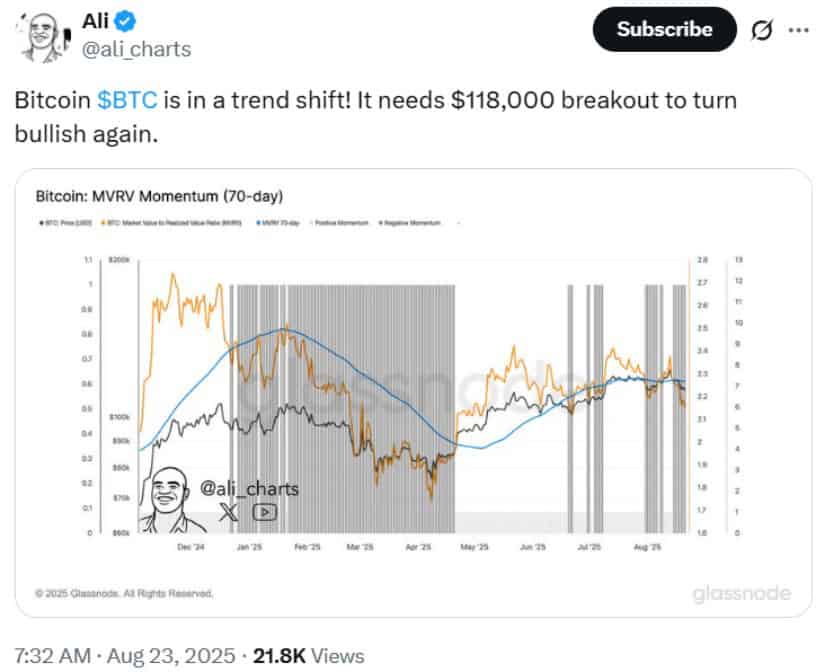

Key technicals are giving mixed signals-what a surprise! The Relative Strength Index (RSI) is keeping it neutral, while the MACD is pulling a full-on “don’t look at me” with bearish divergence. Meanwhile, a sneaky little bearish trendline has formed, drawing resistance lines between $117,000 and $118,000. But don’t lose hope just yet! If Bitcoin can break through this, the sky might be the limit (well, $122,000 to be specific). Who’s excited for some high liquidity action?

And don’t forget about the CME gaps, which have a habit of acting like magnets for Bitcoin’s price recovery. Charles Ledoux, crypto analyst extraordinaire, even said they often “pull” Bitcoin right back to these levels, like an ex texting you after a year of silence. Classic move.

Trend Drivers: Halving, Whales, and Market Sentiment

Here comes the good stuff. Glassnode’s MVRV Z-Score is flashing a little “undervalued” warning, dipping below neutral-cue the drama! Historically, this has hinted at the start of something big. Think of it as the crypto equivalent of finding a forgotten treasure chest under the floorboards.

But that’s not all-Bitcoin has been absorbing the market like a sponge, with over 60,000 BTC flowing into exchanges in a single day (I’m sure someone at the exchanges was popping open a bottle of champagne). Meanwhile, net outflows showed 29,000 BTC going the other way, with long-term holders continuing their quiet accumulation like hoarders at a Black Friday sale.

And let’s not forget the upcoming halving in 2025. Fewer coins in circulation could be exactly what Bitcoin needs to break free from its technical shackles. Ah, the beauty of supply and demand.

Expert Insights: Inflation Hedge and Institutional Interest

Oh, Jerome Powell-his recent comments at the Jackson Hole Symposium were just the right touch of chaos for the market. But guess what? Historical data points to a possible Q4 rally. BTC shot up past $116,000 after his “dovish” tone-how’s that for a plot twist?

On Twitter (or whatever they’re calling it now), analysts are pointing out that Bitcoin has a track record of going all out after these speeches, racking up 100-200% returns. It’s like the markets’ way of saying, “Hey, thanks for that, Jerome!” Institutions are all over the $112,000-$118,000 zone, looking for their chance to dive in before the real breakout begins.

BTC Next Move and Long-Term Outlook

Now, here’s the cliffhanger: Bitcoin is at a crossroads. If it can maintain consolidation above $118,000, we might see a beautiful ascent to $131,000. However, if it falters, don’t be surprised if we take a little trip back to $114,000-$113,500. Ah, the suspense!

In the end, the confluence of technicals, on-chain metrics, and market history suggests we might be looking at a bullish reversal. Keep an eye on those whale moves, and remember-volatility is the name of the game. Bitcoin could be on the verge of cementing its place as the flagship digital asset, or maybe it’ll just take a nap for a bit longer. Only time will tell. 🤷♂️

Read More

- Best Controller Settings for ARC Raiders

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Best Werewolf Movies (October 2025)

- How to Build a Waterfall in Enshrouded

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- Meet the cast of Mighty Nein: Every Critical Role character explained

- These Are the 10 Best Stephen King Movies of All Time

2025-08-24 19:23