Hold onto your hats, crypto traders! It’s time to peek at the 3 US economic signals that could totally mess with Bitcoin‘s (BTC) price this week. It’s like playing a high-stakes game of economic roulette-grab your popcorn. 🍿

With Ethereum (ETH) hogging the limelight lately, these US economic signals might just throw a curveball. Just like Jerome Powell’s Jackson Hole speech last Friday-what a show that was. 🙄

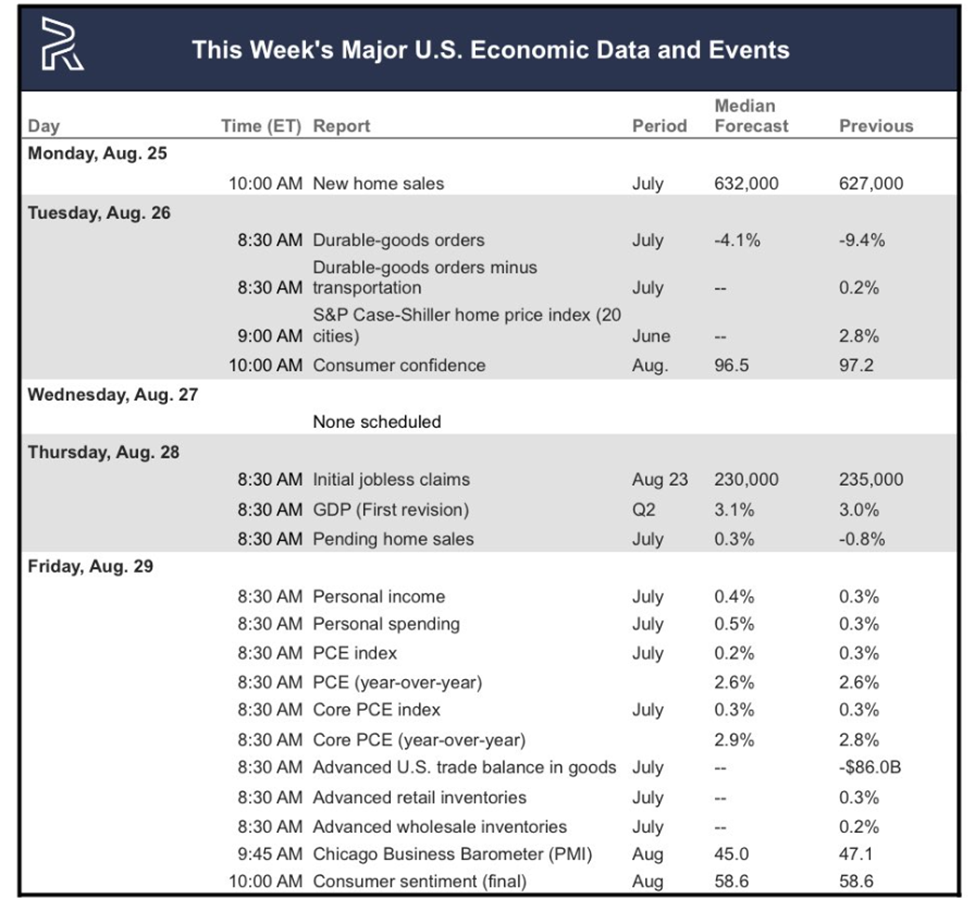

US Economic Events this Week

Okay, let’s dive into what could potentially shake up your portfolio, and no, it’s not just your latest crypto panic sale.

Consumer Confidence and Consumer Sentiment

Brace yourselves-Monday and Friday are about to deliver the kind of data that shows whether the US consumer is feeling optimistic or ready to just take a nap in their recession cave. Experts predict August’s US Consumer Confidence will dip to 96.5, down from July’s still-pathetic 97.2. Not exactly a confidence booster, huh?

And don’t forget about the Consumer Sentiment report due on Friday. It’s expected to stay at 58.6. You know, that lovely “we’re in crisis” zone. Great vibes, right? 💀

Analysts are acting like we’re in some economic apocalypse with the 58.6 score being one of the lowest this century. Fun times.

US consumer sentiment is at CRISIS levels:

The University of Michigan Consumer Sentiment fell to 58.6 points in August, one of the lowest readings this century.

This is in line with the Great Financial Crisis levels and the 1980s recession levels.

– Global Markets Investor (@GlobalMktObserv) August 17, 2025

Lower confidence means weaker consumer spending, which can crush risk assets-like Bitcoin. But hey, if sentiment holds steady, it signals the world is cautiously tiptoeing around. Either way, it’s a tough crowd.

Now, if the numbers get worse? Oh boy, expect people to bet on the Fed loosening up, which *might* give Bitcoin a little boost. But let’s face it, the market is as unpredictable as your favorite reality TV show. 🙄

Initial Jobless Claims

Ah yes, another gem of the week: jobless claims. Because who doesn’t love watching unemployment numbers rise like your crypto portfolio after a bad market dip? 🙄

Last week, 235,000 people filed for unemployment. This week? The number is expected to dip to 230,000. Optimistic, right? 🤑

BREAKING: US jobless claims jumped by 11,000 last week to 235,000, the biggest rise in three months. Continuing claims hit 1.972 million, the highest since Nov 2021.

– MacroMicro (@MacroMicroMe) August 21, 2025

But here’s the kicker-people are taking their sweet time finding new jobs. Continuing jobless claims are steadily rising, like your hopes for a Bitcoin rally that never happens. But we’re not bitter. 😒

If jobless claims dip, it’ll show the labor market is holding up-probably not what the crypto crowd wants to hear. Stronger job data means less chance of rate cuts, which could put the brakes on Bitcoin’s short-term price surge. But if the numbers rise again, brace for a crypto market meltdown (or maybe some relief if you’re into that kind of thing).

PCE

And finally, here’s the PCE (Personal Consumption Expenditures), because why not add one more thing to your crypto rollercoaster ride?

PCE data comes out this week. Headline is expected to be 2.6% y/y, while core is expected to be 2.9% (up slightly from prior month).

The trend is also not looking great, as it appears to have bottomed months ago.

– Coffee Capital (@Coffee__Capital) August 25, 2025

Economists predict that PCE will come in at 2.6% YoY, with core PCE slightly higher at 2.9%. If inflation sticks around, expect more hawkish Fed behavior-which means less Bitcoin love in the short term. Sad face. 😩

But here’s the twist-if inflation continues to rise, Bitcoin could start looking more attractive as a hedge. The long-term dream, right?

So, as of now, Bitcoin’s hanging around $112,579, down 2% in the last 24 hours. Ethereum’s doing its thing at $4,711, after having a moment in the spotlight over the weekend. 🥳

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Felicia Day reveals The Guild movie update, as musical version lands in London

- 10 Movies That Were Secretly Sequels

- Best Thanos Comics (September 2025)

2025-08-25 10:07