Michael Saylor-yes, that relentless sage of the digital pharaohs-just shrugged off the bloodbath and bought more Bitcoin. Because, why not?

Strategy Just Made It Rain Coins: Because Who Doesn’t Love a Bitcoin Flood?

According to Saylor’s latest gospel on the X platform, the company scooped up 3,018 BTC, spending a cool $356.9 million-roughly a hundred grand every time he blinks. The price? An average of $115,829 per coin, because apparently he enjoys paying retail for digital gold. 💸

SEC filings ticked the boxes between August 18th and 24th, during a period when Bitcoin decided to take a nap-dropping in price like a toddler from a high chair. Nothing like a bear market to make investors question their life choices, except Saylor, who apparently saw this as a sale. “Buy low,” right? Or maybe just “buy and keep smiling.”

This week’s purchase blows last week’s tiny 430 BTC out of the water-big investor energy, folks. Last week, it was a modest 155 BTC. The total stash? A staggering 632,457 BTC, valued at roughly $71.1 billion-more zeroes than you’ll find in most bank vaults. And that’s about 53% above the cheap seats Saylor paid ($46.5 billion). Nice profit, if you’re into that sort of thing. 📈

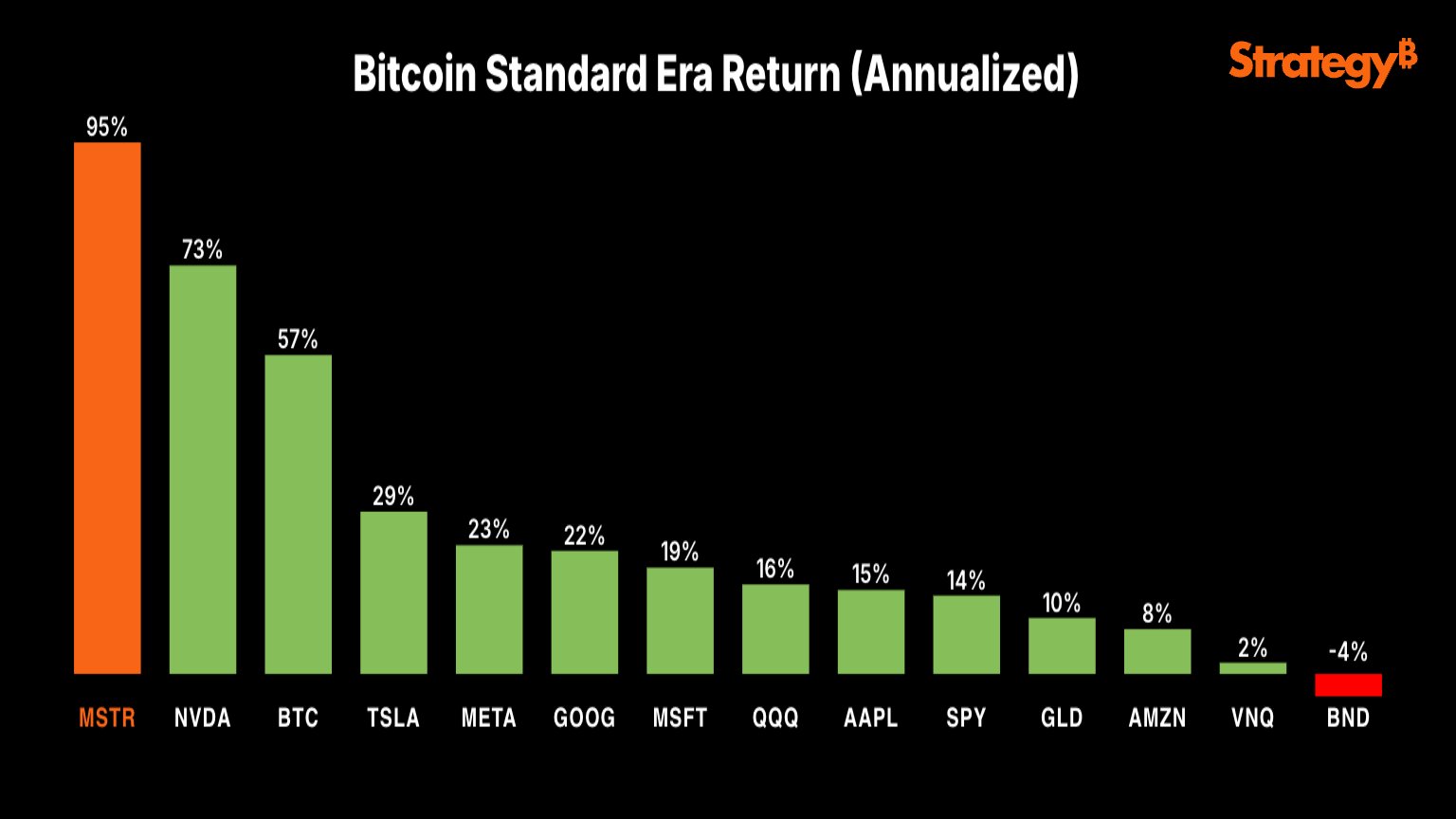

One might say Saylor’s not just playing with monopoly money-his stock performance is also flexing huge muscles. As he proudly declares, “We’ve outperformed everything from stocks to magnum bottles of champagne.” Cheers to that, Michael. 🥂

“Five years ago, our company declared the Bitcoin Standard, and since then, we’ve beaten every asset out there-even the superhero stocks of the Magnificent 7,” Saylor boasts. Trendsetters, beware! His move started a parade of corporate crypto hoarding. It’s like a flash mob, but with more zeros and less choreography.

Enter Japan’s Metaplanet-led by Simon Gerovich, because who needs sleep?-which recently bought 103 BTC for $11.7 million, pushing their reserve to 18,991 BTC, or around two billion yen of digital gold. They’re certainly not shy about jumping into the crypto wild west, are they? 🤠

But it doesn’t stop at Bitcoin-the crypto rollercoaster now swings into altcoins territory. SharpLink has stacked up 740,760 ETH. And rumors swirl of giants like Galaxy Digital, Jump Crypto, and Multicoin Capital plunging into a $1 billion Solana shopping spree-because why buy one coin when you can buy an entire SOL-lection?

Meanwhile, in the land of ominous indices, CryptoQuant’s Bull Score Index is sounding the alarm, signaling that the market might be gearing down into a bearish siesta, as Julio Moreno notes with all the flair of a weather forecaster-except the weather is crypto chaos. 🌧️

As the chart boldly suggests, Bitcoin’s overheated optimism is waning, plunging the Bull Score to a ‘Getting Bearish’ 40. Well, isn’t that just the cherry on the blockchain? 🍒

BTC Price: The Sinking Feeling Continues

While Saylor’s digital empire soars, Bitcoin’s price continues its moody descent, dipping to around $110,900. It’s like watching a soap opera where the hero’s wallet shrinks just as fast as the drama thickens. 📉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Silent Hill 2 Leaks for Xbox Ahead of Official Reveal

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 10 Movies That Were Secretly Sequels

- How to Build a Waterfall in Enshrouded

- USD JPY PREDICTION

- These Are the 10 Best Stephen King Movies of All Time

2025-08-26 07:14