Breaking news from the world of crypto: whales are officially more dramatic than my last breakup. Recent on-chain data from Binance has revealed that Bitcoin (BTC) and Ethereum (ETH) are being treated like exes in a custody battle. While BTC whales can’t decide if they’re coming or going, ETH whales are all aboard the “let’s HODL this thing forever” train 🚂. Investor caution? Oh, it’s intensifying faster than my regret after eating that third slice of pizza.

Here’s the tea: big-time BTC holders are currently locked in what I can only describe as a whale version of tug-of-war. Meanwhile, ETH whales are acting like a synchronized swim team, calmly withdrawing funds from exchanges like it’s no big deal. Truly, one coin is living its best life while the other is stuck in an episode of *Game of Thrones*. 🐳⚔️

Bitcoin’s Got Drama, Ethereum’s Got Game

According to Murphy, everyone’s favorite on-chain analyst who probably doesn’t get invited to parties, Binance saw a whopping 7,709 BTC deposited between August 13 and September 3. Translation? More people were dumping their coins than buying them. Classic BTC chaos.

“During this period, the amount of BTC bought and withdrawn was less than the amount transferred in with the intention to sell,” Murphy wrote, presumably while sipping coffee and judging us all.

And then there’s the tale of two whale groups. One set of whales-those doing single transfers between $10-100 million-is shoving BTC into exchanges like they’re trying to Marie Kondo their portfolios. The other group-the über-rich ones moving over $100 million at a time-is pulling out. It’s basically Shark Week meets Shakespearean tragedy. 🦈🎭

“Back in April, both groups were aligned in withdrawing BTC. But since August 13, divergence has emerged,” Murphy added, because apparently even whales need therapy.

Meanwhile, ETH whales have been behaving like they’re planning a surprise birthday party for Vitalik Buterin. Over the same timeframe, Binance experienced a MASSIVE outflow of 1.616 MILLION ETH. Yes, you read that right. These whales aren’t just aligned; they’re practically holding hands and skipping into the sunset together. 🌅✨

This kind of unity reduces selling pressure and screams, “We believe in ETH!” louder than my dog barks at the mailman. Meanwhile, poor old BTC continues to suffer through internal conflicts, making it look like the cryptocurrency equivalent of a soap opera villain. 📺🔥

“When prices fall, demand enters the market… but clearly, large-scale funds favor ETH over BTC,” Murphy said, which feels like a mic drop moment for Ethereum fans everywhere.

So what does all this mean? Well, BTC whales might be indecisive messes caught in a volatile hedge-fest, but ETH whales are out here building fortresses of digital gold. Or, you know, accumulating ETH like it’s discounted designer handbags. 🛍️💎

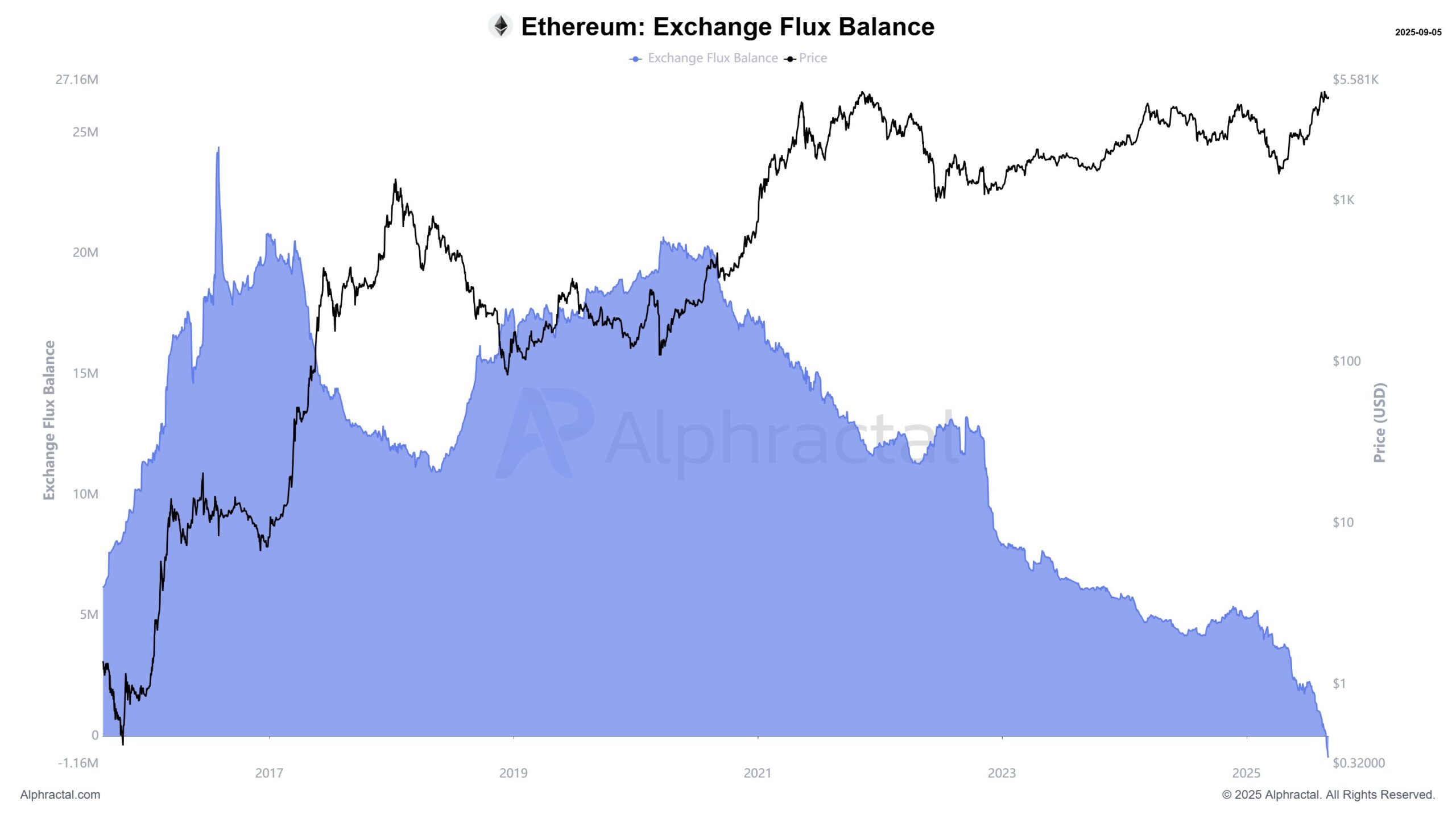

Oh, and let’s not forget the stats backing this up. Analyst Cas Abbé pointed out that Ethereum’s Exchange Flux Balance has gone negative-for the first time EVER. That means more ETH is leaving exchanges than entering, shrinking supply while prices hover above $5,500. Sounds fancy, right?

“The signal is clear: ETH isn’t being positioned to sell, it’s being positioned to hold,” Abbé declared, channeling his inner financial guru.

But wait, there’s more! Blockchain analytics firm Lookonchain reported that whales and institutions snapped up roughly 218,750 ETH (about $942.8 million) in JUST TWO DAYS. That’s faster than I empty a bag of chips during Netflix binge sessions. 🍿💼

For example, Bitmine went full retail mode and grabbed 69,603 ETH (≈$300 million) from BitGo and Galaxy Digital. And five newly created wallets combined forces to buy 102,455 ETH (≈$441.6 million) via FalconX. Talk about teamwork making the ETH dream work! 🤝📈

Analyst Ted Pillows chimed in too, noting that three fresh wallets purchased around $148.9 million worth of ETH. So yeah, whales are consolidating their positions like they’re preparing for crypto winter-but make it fashionable. 🧥💡

In conclusion, deep-pocketed players seem confident about Ethereum, even though the rest of us mortals are still nervously refreshing our portfolios every five minutes. Honestly, if I were Bitcoin, I’d feel personally attacked. But hey, at least it keeps things interesting. 😉

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Best Shazam Comics (Updated: September 2025)

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Resident Evil Requiem cast: Full list of voice actors

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- Wicked Recap: 5 Biggest Things To Remember Before Watching Wicked: For Good

2025-09-05 15:49