Ah, September! The month when Ethereum usually dons its bleakest cloak-losing more than 12% as if the market was conspiring with the weather to cause heartbreak. This September kicked off in the usual dismal fashion, with ETF outflows and jittery investors nervously tiptoeing around like they’d just swallowed a bad potion.

But dear reader, 2025’s September has decided to dance to a different waltz. Three peculiar signs have emerged, daring to flip the ancient scrolls of Ethereum’s gloomy fate and perhaps push its price upward-right in its historically weakest hour. How delightfully ironic, like finding a wolf reading Dostoevsky.

Whales Buy Big as Weak Hands Exit (Cue Dramatic Music)

As of this very moment, Ethereum lounges around $4,406-having flirted briefly with $4,261 before shaking it off like an elegant cat who just knocked over a vase.

In the last 24 hours, the price graph looks about as exciting as a Siberian winter: mostly flat and unpromising. Yet, the grand whales-those enormous, mysterious creatures of the deep-have been scooping up ETH like there’s no tomorrow. The supply in their colossal wallets, offshore from pesky exchanges, ballooned from 95.72 million ETH to a staggering 99.41 million ETH. That’s 3.69 million ETH richer, or roughly $16 billion, enough to make even the devil pause and ponder a deal.

Hungry for more crypto wizardry? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter and imbibe the mystic arts of token wisdom.

If such gargantuan accumulations mean anything, it’s that the whales have a hunch-or perhaps a prophecy-in their bellies. While retail traders clutch their pearls and hesitate, these leviathans position themselves, planning a rally that could ruffle some feathers.

Fear not, though-this whale feast coincides with the fleeing of weak hands, those short-term holders who, like frightened mice, scurry off when the waters get choppy.

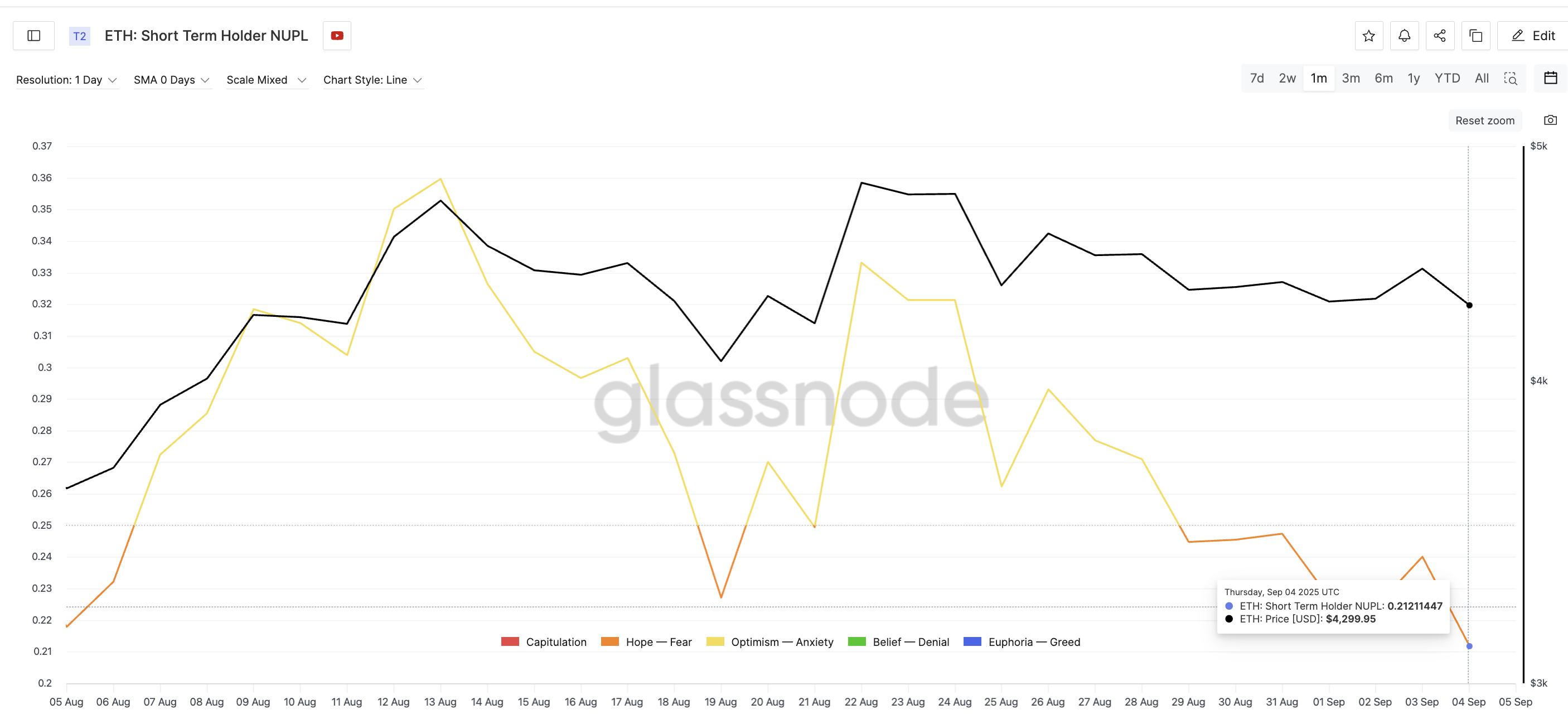

Observe the short-term holder Net Unrealized Profit/Loss (NUPL), a cryptic oracle that drops to 0.21-the second lowest in thirty days-signaling that these jittery short-term holders are cashing out their modest gains. History whispers softly: such moments often herald a rebound as those weak hands vanish into the shadows.

Recall August 19, when NUPL was similarly demure at 0.22, and the price, a humble $4,077, soon danced up almost 20% to $4,829. A charming déjà vu, wouldn’t you say?

When whales buy and weak hands flee, it’s like a grand theatrical production where the chorus prepares for the crescendo. Even a modest 10% climb now could flirt with new peaks-though don’t expect 20%, that’s just greedy talk.

Ethereum Price Levels and RSI Divergence Validate Bullishness (Or So They Say)

Now, for the pièce de résistance-the third sign of this cryptic optimism hides itself within the price charts, that ancient scroll beloved by many a trader. Here, Ethereum’s daily price story reveals a hidden bullish divergence. Picture this: ETH cautiously raises a higher low, while the RSI-a moody, mercurial spirit gauging buying and selling fervor-sinks to a lower low.

This charming paradox signals a trend hungering for continuation-like a hopeless romantic refusing to surrender. Sellers are gasping for breath, while Ethereum stands firm, proud as a cat on a windowsill. Combine this with our whale gathering, and the tale gets even juicier.

Watch closely for Ethereum’s key resistance at $4,672-but only once it heroically breaks through $4,496. Then it may bravely march toward $4,958 and perhaps boldly beyond, into the wild frontiers of price discovery.

But beware! Should ETH stumble below $4,210, the bullish fairytale might end abruptly-like a play interrupted by a forgetful actor.

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Katy Perry and Justin Trudeau Hold Hands in First Joint Appearance

- XRP: Will It Crash or Just… Mildly Disappoint? 🤷

2025-09-05 21:19