Ah, Bitcoin, that mercurial creature, once again poised on the precipice of destiny, pirouetting delicately around the charmingly arbitrary $110,000 mark. The bulls, possessed of all the zeal of a Victorian suitor denied his lady, valiantly defend this enchanted threshold, while ogling the $113,000 resistance with all the hopeful longing of a playwright awaiting applause. Should it break free, Bitcoin might just sashay upward, waltzing into richer pastures and rekindling the eternal flame of bullish rapture. But beware! The market, as fragile as a soufflé in a tornado, is weighed down by volatility and a morose cocktail of dread and hope.

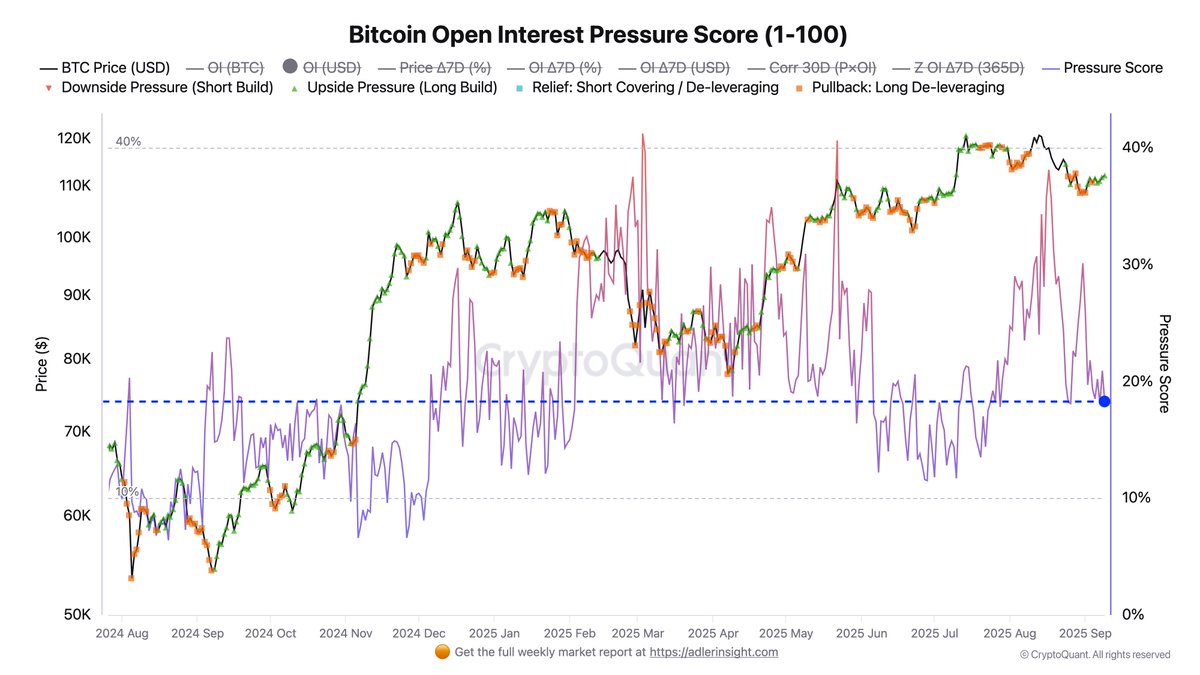

Enter the esteemed Axel Adler, oracle of derivatives, who deigns to shed light upon this cryptic theatre. He reveals that the Bitcoin Futures Pressure Score hovers modestly at 18%, a number so disappointingly neutral that one might suspect it was plucked from the whims of a bored gambler. Neither the shorts growl with hunger nor the longs puff with pride; they simply linger, unsure of whether to leap or languish. It is, in short, the suspense of a debutante’s first ball, full of promises yet to be made and alliances yet unformed.

This delicate equilibrium suggests a market tiptoeing on the edge of revelation, awaiting the inevitable catalyst like a dramatis personae awaiting their cue. Until the curtain rises, the skirmish between $110K and $113K shall be the stage upon which Bitcoin’s fate is dramatized.

Bitcoin Futures: The Switzerland of Crypto?

According to Mr. Adler’s keen observations, the futures market is currently a study in civil restraint rather than rebellious fervor. At this tepid 18%, the Pressure Score speaks not of love nor war, but that dreary room in between where traders shuffle their feet and sip tea nervously. There are no grand declarations, no lavish wagers – merely a poker game without the risk, played by those who apparently find excitement in indecision.

Should this enigmatic metric ever ascend into the fabled 30-40% realm, one might expect the shorts to multiply as if summoned by an impatient playwright craving scandal. Such spikes have historically heralded the much-feared price dumps, the tragic denouement in our crypto drama. Yet, for now, Bitcoin remains poised safely on the ledge, though not without the ever-watchful eye of sentiment, which can change faster than a dandy’s mood upon hearing a bad pun.

The plot thickens with the US labor market losing its breath, inspiring whispers about the Federal Reserve’s next act. Any surprise in economic verses or Fed soliloquies could unleash a tempest upon the crypto stage, sending our digital protagonist into a frenzy of choppiness. Meanwhile, bulls and bears prepare their best dance moves, eyeing the $110K-$113K interval as their bout of destiny.

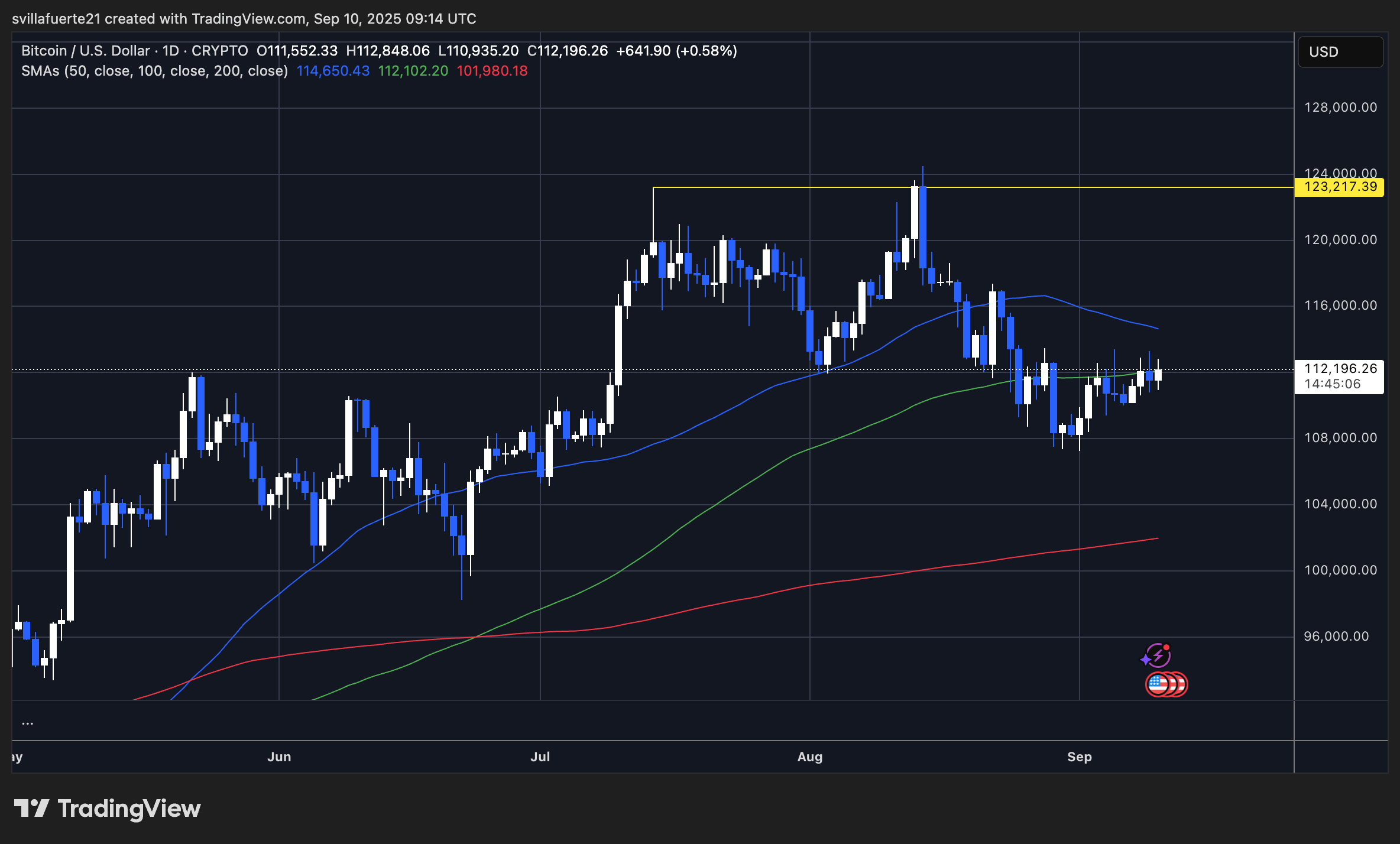

Dashing Through the Numbers: The Technical Ballet

Presently, Bitcoin flirts with $112,196-a modest recovery from the drama near $110,000-performing a delicate consolidation that would make any prima ballerina proud. It pirouettes above the 100-day simple moving average (SMA) at $112,102, while the 50-day SMA prudently stands guard at $114,650, an obstinate critter refusing to yield. Should Bitcoin break this spell, it might dare to waltz toward $116,000 and even challenge the seasoned diva known as $123,217, the summer peak.

Below, the stoic 200-day SMA at $101,980 offers a comforting cushion to those fearing a fall from grace. So long as Bitcoin lingers above, the broader bullish narrative holds firm, even in the face of recent tempestuous moods. But the perils of indecision loom large; a repeated failure to conquer the 50-day SMA could invite a somber reprise near $108,000-$110,000.

In this grand spectacle, the bulls must seize the $114,650 bastion to set sights on the glamorous $120K, while the bears sharpen their claws to defend and drag prices downward. The coming days promise a thrilling chapter in Bitcoin’s ongoing saga-will it ascend, or will it be forced to bow out gracefully? Stay tuned, dear reader, for the encore is nigh.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Controller Settings for ARC Raiders

- Goat 2 Release Date Estimate, News & Updates

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- 10 Movies That Were Secretly Sequels

2025-09-10 14:52