Markets

What to know:

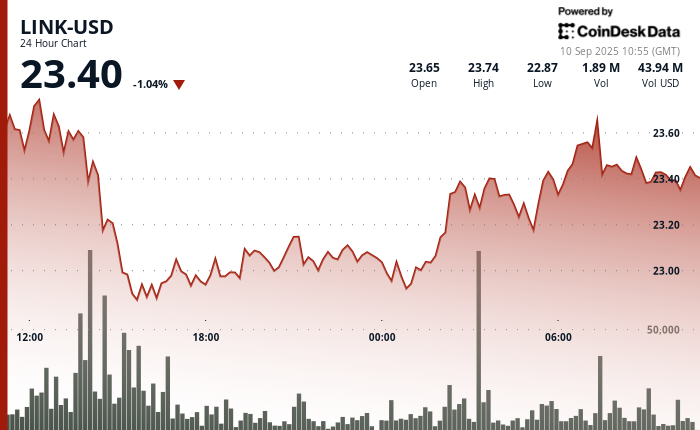

- Chainlink’s native token (LINK) took a whimsical stroll through the market, swinging 7% as if trying to decide whether to join the early week rally or take a nap on Grayscale’s ETF filing news. 😴🚀

- Meanwhile, the Nasdaq-listed Caliber made its first token purchase, sending its stock into a dizzying 2,000% spin before the market’s gravity brought it back down to Earth. 🌀🌍

The native token of Chainlink stalled on Wednesday, much like a poet pausing mid-verse to consider the next word, after a strong start to the week. It gave back some of its gains on the news that asset manager Grayscale was filing to convert its closed-end fund into an exchange-traded fund (ETF). 📜➡️ETF

The token, now slightly down about 1% in the past 24 hours, has been on a rollercoaster ride, experiencing a 7% price swing, according to CoinDesk Research’s technical analysis model. 🎢📊

The price action followed Arizona-based real estate and asset manager Caliber’s (CWD) Tuesday announcement that it had completed its first purchase of LINK tokens, marking the beginning of its digital asset treasury strategy. Its stock, in a moment of market madness, skyrocketed nearly 2,000% on Tuesday before plummeting back down, losing another 20% on Wednesday pre-market. The firm, keeping its cards close to its chest, did not disclose the amount of tokens bought. 🤫💰

This move makes Caliber the first Nasdaq-listed firm to adopt a treasury reserve policy focused on LINK. The company, with the grandeur of a Russian novel, declared its intention to accumulate LINK over time using existing credit lines, cash reserves, and equity-based securities, with plans to stake tokens to generate yield. 📜💡

Technical analysis

- Trading Performance: LINK, ever the dramatic character, posted a modest 1% decline over the 24-hour period, with volatile intraday swings of 7% between $22.84 and $24.46, as shown by CoinDesk Research’s technical analysis model. 🌡️📉

- Volume Indicators: Trading activity surged to 3.78 million units at 14:00 on September 9:00 UTC, surpassing the 24-hour average and establishing support near the $23 price level, like a steadfast friend in a storm. 🌊🤝

- Resistance Testing: The intraday high of $23.49 met with selling pressure, akin to a poet facing a blank page, before declining through minor support levels, suggesting profit-taking activity and perhaps a prelude to further price discovery. 📉🔍

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- ANIIMO Brings Adorable RPG Action to Xbox and PC As Second Beta Signups Go Live

- Star Trek 4’s Development Hell Just Got So Much Worse

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

2025-09-10 15:49