Ah, the eternal dance of digits and dollars! Bitcoin ETFs, those mischievous minions of the financial realm, have once again extended their absurdly long winning streak, gobbling up $553 million in inflows. Leading this circus of capital are the ringmasters Blackrock and Fidelity, while ether ETFs, not to be outdone, snatched another $113 million from the jaws of indifference.

Crypto ETFs: A Never-Ending Masquerade of Gains for Bitcoin and Ether

Behold, the torrent of treasure into crypto exchange-traded funds (ETFs) shows no sign of abating, even on the fateful Thursday, Sept. 11. Both bitcoin and ether funds feasted on the insatiable appetite of investors, as if the world had suddenly decided that digital coins are the new black bread of the financial feast.

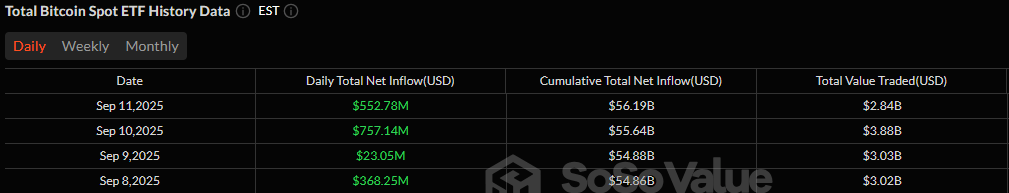

Bitcoin ETFs, those voracious vultures of value, notched their fourth consecutive day of gains, hoarding $552.78 million. Blackrock’s IBIT, the undisputed tsar of this financial farce, devoured a staggering $366.20 million, while Fidelity’s FBTC, not to be outshone, gobbled up $134.71 million. Bitwise’s BITB, ever the loyal courtier, contributed another $40.43 million. Even the lesser nobles-Invesco’s BTCO with $5.71 million, Franklin’s EZBC with $3.31 million, and Vaneck’s HODL at $2.43 million-joined the banquet. Trading volumes, robust as a Cossack’s mustache, reached $2.83 billion, propelling bitcoin ETF net assets to a princely $149.64 billion.

Ether ETFs, not content to play second fiddle, also kept pace, attracting $113.12 million in fresh inflows. Fidelity’s FETH, the grand duke of this digital domain, carried the bulk with $88.34 million, while Bitwise’s ETHW added $19.65 million and Grayscale’s ETHE chipped in $14.58 million. Additional crumbs were gathered by Grayscale’s Ether Mini Trust at $4.58 million and Franklin’s EZET at $3.36 million. The lone dissenter, Blackrock’s ETHA, suffered a $17.39 million outflow, but this minor rebellion was insufficient to halt the triumphant march of capital.

Together, bitcoin and ether ETFs amassed over $660 million in a single day, a testament to the renewed fervor of institutional investors. Will this rally continue, or is it but a fleeting mirage in the desert of financial speculation? Only time, that eternal jester, will tell. 🎭💸

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Ashes of Creation Rogue Guide for Beginners

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 50-Hour Square Enix RPG Joins Xbox Game Pass

- Joe Jonas Reacts to Troll Asking If Jonas Brothers Have “Serious Debt”

- Binance & Trump’s Crypto Ventures: A Tale of Stablecoins & Paradoxes 😏💎

2025-09-12 16:08