After what feels like an eternity of financial hibernation, the coin, that obstinate little beast, has finally stirred-with buyers twitching their wallets and peering nervously over the precipice of hope. Resistance levels tremble as investors, ever the eternal optimists, dream of heights hitherto unscaled, plotting a fresh chapter in this bullish soap opera.

Breakout Potential and Resistance Tests

For what seemed like a dozen disastrous coffee breaks, Optimism languished beneath a descending trendline, as forbidding as a stern headmaster’s glare, keeping buyers firmly in their place. Yet recently, some intrepid souls manoeuvred the coin dangerously close to the $0.85 resistance level-the reputed gatekeeper to potential glory or utter humiliation.

Should the coin muster sufficient gall to break free here, anticipators will salivate over a climb to $1.00, $1.20, and ultimately the mythical $1.50-where, of course, those ever-watchful sellers will undoubtedly await, like cunning cat burglars watching the window of opportunity. Such a break would signify a seismic shift, restoring that rare commodity known as investor confidence.

Like the cautious suitor inching closer under moonlight, the coin’s formation of higher lows lays a delicate foundation. Holding steadfast above $0.80 is akin to a badge of honour, signaling sellers’ defeat-or at least their inability to drag this rebel back down. This slow accumulation reeks of something serious brewing beneath the surface; if resistance were to flip support, we might just witness the genesis of a proper upward jaunt.

Furthermore, volume dynamics-a term as dry as the Sahara but much more important-play the role of skeptical chaperone. A breakout with volume swelling behind it suggests buyers have genuinely caught the fever, vanquishing the threat of a false dawn. Should these stars align, we might, just might, see the token surge with both conviction and cha-cha-cha.

Market Performance and Liquidity Flow

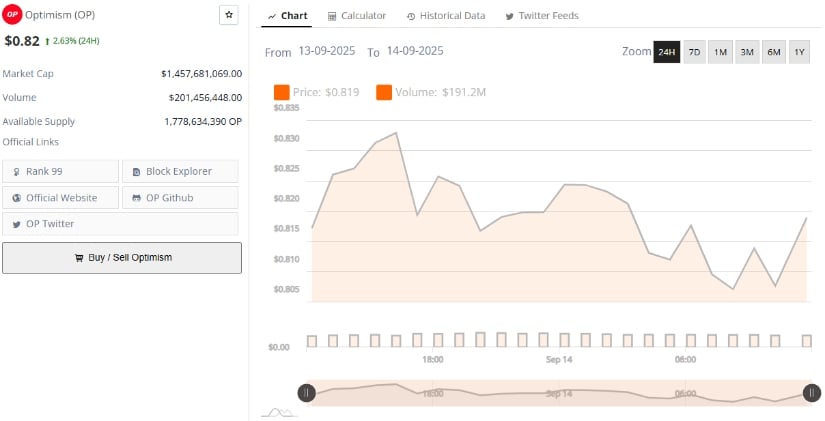

At the precise moment of this scribbling, the coin trudges along at $0.82, chalking up a modest yet admirable 2.63% increase over the past 24 hours. With a market cap of $1.45 billion, it swaggeringly holds the 99th rung on crypto’s chaotic ladder.

Daily trading volume hums along at $201 million-proof positive that both penny-pinching retail folk and their institutional overlords are flocking back with wallets agape. Such bustling liquidity is the financial equivalent of a well-stocked buffet, inviting yet to be devoured tastefully.

This steady uptick in trading activity assures us that demand persists, even while broader markets play their customary game of “Will They, Won’t They” fall off the cliff. This influx of liquidity acts as the reliable life raft, cushioning against any ill-advised nosedives and lending the price a kind of reluctant stability. Should the volume continue its theatrical crescendo, Optimism may yet dazzle us on the rally stage.

Technical Indicators and Bull Run Outlook

Adding a dash of mathematical mysticism, Optimism’s technical indicators chime in with their usual cryptic optimism. The Chaikin Money Flow (CMF) at a modest 0.09 whispers of net inflows, while the MACD, perched gallantly above its signal, heralds an accelerating ascent-together composing a symphony of short-term optimism.

The chart structure cheekily suggests that a break past $0.85 could propel the price toward the tantalizing $1.50-passing through the usual gauntlet at $1.00 and $1.20, where profit-takers lurk like vultures awaiting a picnic. Yet these waypoints may simply serve as stepping stones, lifting this wandering asset toward loftier valuations.

Looking onward, all eyes rest on the fickle beast of market confidence and the promises of Layer-2 adoption. Should this breakout come to fruition, the ensuing bull run might just elevate valuations beyond $1.50, signaling a rare and welcome revival following a lengthy slumber of consolidation. Cheers to blind hope, and may the charts be ever in your favour! 🍸

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Resident Evil Requiem cast: Full list of voice actors

- Best Thanos Comics (September 2025)

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- The 10 Best Episodes Of Star Trek: Enterprise

- Best Shazam Comics (Updated: September 2025)

- How to Build a Waterfall in Enshrouded

2025-09-14 15:28