Ah, the relentless torrent of Bitcoin ETFs, flooding portfolios for six unbroken days, pouring forth $260 million as if the very gates of fortune swung wide open. And Ether ETFs, like an eager understudy, follow suit on their fifth straight day with $360 million-proof that the masses remain hypnotized, drunk on the mirage of digital gold.

Bitcoin ETFs – The Never-Ending Carnival Rolls On, Ether ETFs Jump in the Wagon

The great crypto circus continues its grand performance as ETFs strut boldly into the week, hauling a combined mountain-$620 million-just as if institutional investors believed the sky would never fall. Behold the faithful disciples of bitcoin and ether, clinging desperately to their digital idols, inflow streaks stretching longer than a Dostoevskyan monologue on human suffering.

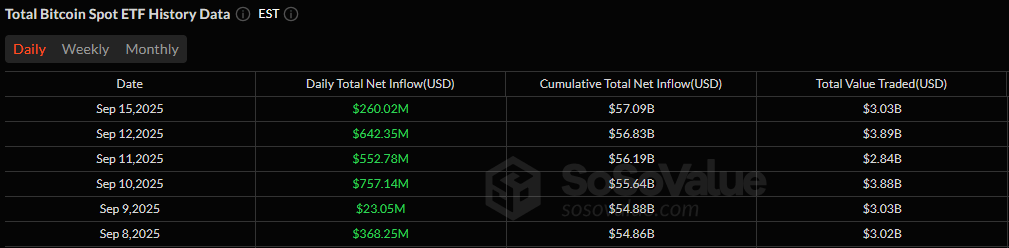

Bitcoin ETFs, undeterred by reason or despair, added $260.02 million-six days of unyielding green light. Blackrock’s IBIT, that behemoth of avarice, singlehandedly lifted an amassing $261.82 million weight as if Atlas briefly felt benevolent. Fidelity’s FBTC, ever the modest player, tossed in $7.54 million, while Grayscale’s Bitcoin Mini Trust coyly added another $6.13 million.

Franklin’s EZBC, the loyal foot-soldier, contributed a humble $3.34 million. Ah, but the tragic note-Bitwise’s BITB, in a rare act of rebellion, fled the scene, shedding $18.81 million. Yet, no matter the slight stumble, the momentum was undeterred; the total value traded thundered at $3.03 billion, net assets swelling to a monstrous $151.72 billion. Madness? Perhaps-but do tell me, isn’t madness just a fine word for hope?

Ether ETFs, never to be outdone by their elder sibling, dazzled with their fifth consecutive dance of inflows, amassing a tidy $359.73 million. The show was stolen by Blackrock’s ETHA, hauling a staggering $363.19 million as if to say, “Behold! I am the master puppeteer.” Grayscale’s ETHE tried to steal some limelight with another $10 million added to the coffers. Fidelity’s FETH, the black sheep of the evening, dared to break rhythm with a $13.46 million outflow-but fear not! The overall strength remained unbroken, with total trades reaching $2.09 billion and assets swelling to $29.72 billion.

Thus it stands: both bitcoin and ether ETFs seemingly locked in Ludovico’s icy grip of hope and madness. If this bravado continues, September may be remembered not just as a month but a saga-perhaps the grand prelude to a fantastic final quarter, or the beginning of a tragicomic farce. 🥳

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Ashes of Creation Rogue Guide for Beginners

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- OMG, Binance Coin Is Basically a Rocket Ship to $1,000 🚀💸

- American Pie Actor Seann William Scott’s Monthly Income Revealed

- 50-Hour Square Enix RPG Joins Xbox Game Pass

2025-09-16 17:03