Alright, so I’ve been hanging around these TradFi and crypto people, and let me tell you, the one thing that’s actually interesting? Blockchain. Yeah, I know! You thought it was just for buying meme coins and flexing on Twitter, but apparently, it might actually help asset managers escape the Stone Age.

These big fancy asset managers – they’re moving trillions (with a “T”, not an “M”!) around like they’re auditioning for a financial Fast & Furious sequel – and yet, somehow, they’re doing half of it with software that was cool back when Seinfeld was on the air. You got spreadsheets here, Excel there, some guy probably named Keith emailing “capital calls” like he’s inviting people to a Tupperware party. Hey, Keith, you wanna send me a fax while you’re at it? Maybe throw in a carrier pigeon? 🐦💸

You got manual waterfall calculations, quarterly PDFs (love that for me), and a “technology stack” built on hopes, prayers, and apparently duct tape. The whole back office is like Jenga, except when it collapses, some billionaire starts yelling and someone gets fired.

But now – plot twist – here comes blockchain. And it’s not here to make you rich overnight, or to convince you to buy virtual land next to Snoop Dogg. It’s supposedly a real upgrade, like moving from dial-up to wifi. Asset managers could finally ditch the piles of paperwork, the endless reconciliations, the “oops, Greg put my name in the wrong cell” email chains.

Modernizing Fund Infrastructure (About Time)

The average investment shop? It’s like that kitchen drawer everyone has with old ketchup packets, a broken spatula, and three universal remotes that do absolutely nothing. You’ve got a herd of administrators, custodians, transfer agents, and every one of them has their own “special” system. None of them talk, so you spend half your life reconciling who owes what to whom. Transparency? Forget about it. Speed? Only if “waiting for your aunt to understand Uber” counts as fast.

Now, blockchain comes along, and suddenly everyone has to share one real-time ledger – nobody can hide, nobody can fudge the numbers. Well, isn’t that just terrifying! Smart contracts run your boring payment waterfalls automatically, capital calls won’t get lost with all the spam, and, get this, settlements happen now, not in “3-5 business days, because the bank is feeling lazy.” PDFs? Wire delays? Gone. People can check balances instantly – like checking if you still have hair after age 40. 🤑

Investors get digital shares; the ops team doesn’t have to go bald from stress; auditors don’t have to invent creative new ways to say “we found an error but we’ll never find it again.” Blockchains aren’t a magic trick. They’re just what you should’ve done ten years ago. Look, it took you long enough! Maybe you can finally use that dusty smartphone for something other than Candy Crush.

The Next Generation of “Hey, That Wasn’t Possible Before” Funds

You think that’s all blockchain can do? Oh, please. That’s just the appetizer. Real innovation is in new products. We got tokenized credit funds (yeah, that’s a thing now) – Apollo did it, $100 million moved on-chain, no fax machine required. Franklin Templeton has this “Benji” thing going, where you get money market yields tracked down to the second. BlackRock, they’re in too, because of course they are – they follow the money like a bloodhound. 🕵️♂️💰

What about slice-and-dice ownership, secondary liquidity, instant trading? All of it. It’s like the ETF, except way too fast for your uncle Harold to understand, and hedge funds, but you can actually see what’s going on instead of hoping your manager isn’t secretly vacationing with your money in Ibiza.

Now, on-chain yield vaults – these things basically run themselves. Smart contracts stake, trade, do all sorts of financial wizardry, and there’s no middleman slowing you down. It’s programmable finance: “set it and forget it” but without Ron Popeil and with a lot more zeroes. You don’t need to trust a guy named Stu with your PDF; it’s all on the blockchain, clear as day. You want transparency? Have all the transparency. Don’t choke on it.

you don’t need to throw away your fancy suits or stop schmoozing at those weird steakhouse dinners. Just, maybe, finally upgrade from spreadsheets and email chains before your grandkids start using quantum computing to redeem their allowance. Blockchain isn’t here to eat your lunch; it’s here to clean your kitchen, so maybe stop dropping crumbs everywhere and let it work.

The tech is here. It works! The first brave souls have tried it, and last I checked, they didn’t implode. But hey, keep ignoring it and see how that works out for you – you’ll be the one explaining to your boss why you still can’t find that capital call from 2021. Meanwhile, the rest of the industry is already on-chain, sipping a latte, and laughing at your PDFs. ☕️😂

Disclaimer: Yeah, yeah, these are just my opinions, not CoinDesk’s – if you want something official, go read a press release.

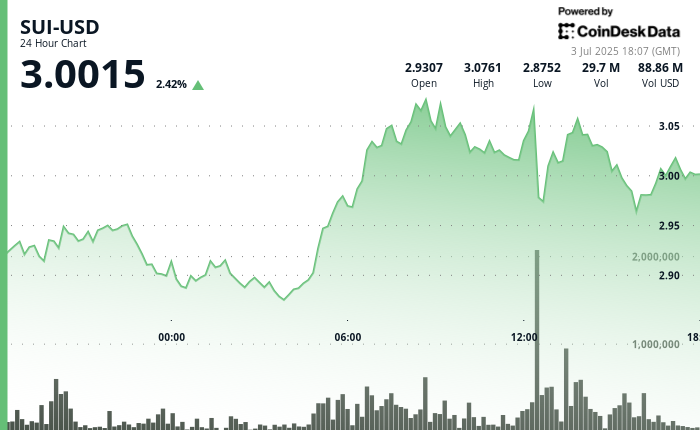

Sui Reclaims $3 After Week-Long Rally Sparked by Lion Group’s Treasury Plans

Solana Treasury Firm Expands SOL Holdings and Staking Strategy With $2.7M Purchase

Tom Lee’s Bitmine Surges 3,000% Since ETH Treasury Strategy, but Sharplink’s Plunge Warrants Caution

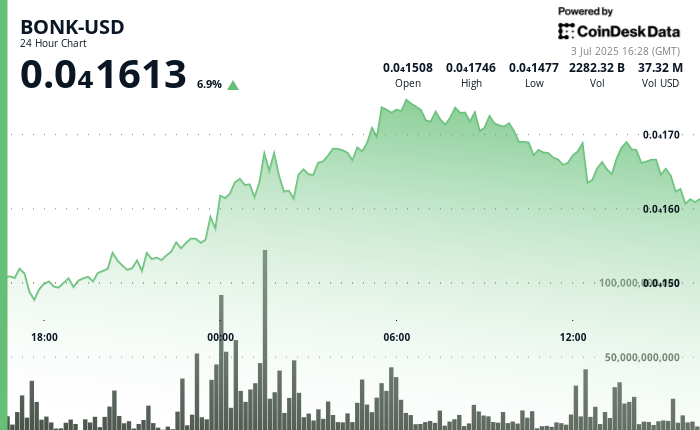

BONK Leads Memecoin Amid Crypto Rally While the Token Approaches 1M Holder Milestone

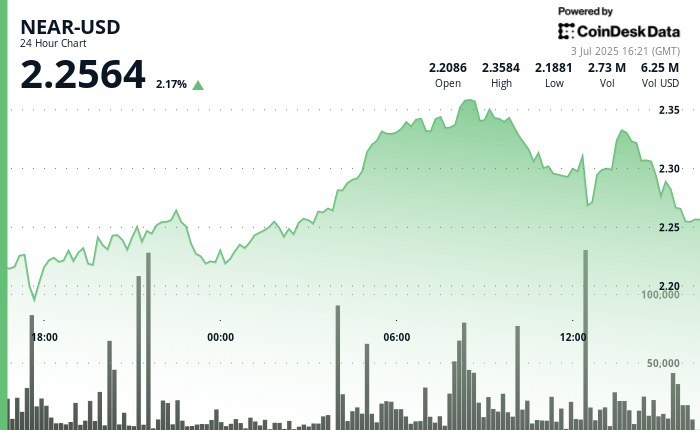

NEAR Protocol Surges 10% Before Profit-Taking Halts Rally

U.S. June Jobs Data Blows Through Forecasts, With 147K Added, Unemployment Rate Falling to 4.1%

A Major Currency Outpaces Bitcoin With More Possible Momentum Ahead: Macro Markets

Crypto Tax Proposal That Didn’t Make it to Trump’s Budget Bill Pushed on Its Own

IMF Rejects Pakistan’s Proposal to Subsidize Power for Bitcoin Mining: Reports

Read More

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- ‘Crime 101’ Ending, Explained

- Ashes of Creation Mage Guide for Beginners

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Dark Winds Season 4, Episode 1 Ending Explained: Who’s Hunting Billie

2025-07-03 22:47