Alright, Japan. Tired of your bank account sleeping harder than you during that 3-hour corporate compliance meeting? Well, grab your calculators and loosen your kimonos: MetaPlanet is about to drop Bitcoin-backed preferred stock that could give your dusty yen the spa day it’s been begging for.

Japan’s interest rates are so low, you’d think they were in witness protection. So, MetaPlanet is offering yen-denominated securities at a juicy 9–10% yield—using Bitcoin as a backup plan. Finally, something in finance as unpredictable as my bangs in the humidity.

The Plot Twist in Japan’s Financial Drama

Time for a reality check: Adam Livingston, professional crypto whisperer, says Japanese households are sitting on cash piles totaling over 2,200 trillion yen (that’s 12 zeroes—that’s how much I wanted to charge NBC for “30 Rock” reruns). Most of it is parked somewhere earning less than 0.23% interest. You’d get more return finding coins in your couch cushions.

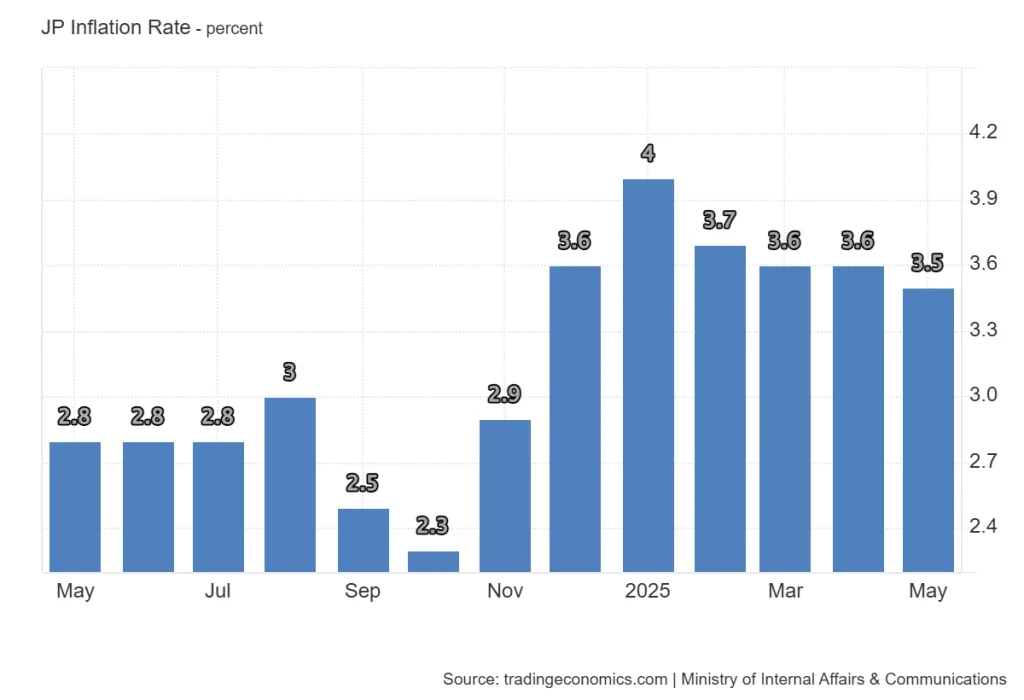

Inflation’s been swaggering around at about 3.5%. So, while you think you’re “saving,” you’re actually playing a fun new game called slowly losing money. Meanwhile, the 10-year Japanese government bond yield is flexing at 1.45%. If yield were a cooking show, that would be plain steamed rice, no seasoning.

Insurance companies, managing enough cash to buy their own anime franchise, are out here desperately looking for returns that don’t involve a Ouija board or buying Dogecoin. And regulators? They’re basically saying, “Hey, invent something that’s not a currency rollercoaster, please.”

Enter MetaPlanet: Now with 100% More Bitcoin 🍕🪙

MetaPlanet’s solution: let’s slap some Bitcoin underneath this preferred stock and offer yields spicy enough to make your bank statement blush. It’s still in yen (your grandpa approves), but now, for once, it’s offering annual yields you’d actually tell your friends about.

Bitcoin, that rebellious cousin who probably does CrossFit and never shuts up about being “decentralized,” is known for price gains and hating inflation. So yes, it makes for decent collateral… or at least a better conversation starter than your last certificate of deposit.

Retained post title / link shortcode as plain text per instructions

[post_titles_links postid=”478498″]

When a Company Buys More Bitcoin Than Most Millennials Have Avocado Toast 🥑

MetaPlanet already bags at least 13,350 BTC, worth $1.45 billion—give or take the mood swings of the crypto market. And guess what? The money from these shiny new preferred stocks? They’ll use it to buy even more Bitcoin. People collecting stamps: amateurs. MetaPlanet: collecting enough Bitcoin to make Satoshi Nakamoto sweat.

The dream? Hoarding 210,000 BTC—about 1% of the total supply. That’s not “go big or go home.” That’s “go big, buy the home, and fill it with mining rigs.” Once they’re sitting on this pile, they may even offer lower coupon rates in the future. Because nothing says “power move” like reducing your own costs for fun.

Japan’s Financial Renaissance: With Extra Sizzle

Adam Livingston insists this isn’t just a new shiny thing—it’s a shakedown of Japan’s financial traditions. Finally, a way for savers to actually make money (what a concept) without having to stress about the yen taking a vacation with the euro. This could be the long-awaited glow-up for Japan’s fixed-income scene.

Retained subscriber shortcode as plain text per instructions

[article_inside_subscriber_shortcode title=”Never Miss a Beat in the Crypto World!” description=”Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.” category_name=”News” category_id=”6″]

FAQs

Why is MetaPlanet doing this? Are they bored?

Nope! Japanese savers are stuck with interest rates so low they’re practically an urban legend. Inflation’s lurking above 3%, mocking every yen under your mattress. MetaPlanet’s Bitcoin-backed preferred stock comes along, offering the kind of yield your high school math teacher said didn’t exist. Regulators seem to be crossing their fingers in hopeful approval.

How much Bitcoin does MetaPlanet own? Do they accept donations?

They’re already sitting on at least 13,350 BTC (about $1.45 billion, assuming BTC isn’t on one of its famous rollercoasters). Their endgame? A massive 210,000 BTC, or 1% of the total Bitcoin supply. I don’t know about donations, but they accept vibes.

Will this actually make life better for Japanese savers?

For anyone tired of earning less than your cousin’s lemonade stand, yes—this offering looks pretty solid. Higher yields, no messy foreign currency drama, and a spark of new life in an ancient financial system. Will it set the standard? Time will tell. But at least it’s more ambitious than another commemorative stamp set.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- The Best Members of the Flash Family

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Dan Da Dan Chapter 226 Release Date & Where to Read

2025-07-04 11:09