You know that dizzying world of meme coins, where a funny picture and a viral tweet can turn into digital gold? Well, according to a fresh Galaxy Research report, the real winners aren’t the jokers trading from their couches-they’re the sneaky infrastructure folks. Who knew building the casino floor is better than playing the slots? 😏

Picture this: Launchpads, DEXs, and those pesky automated bots are raking in the dough like it’s their job. Meanwhile, most folks out there are just piling into what Galaxy calls a zero-sum game with negative expected value. Translation: You’re more likely to leave broke than buy that yacht. It’s gambling with a shiny crypto veneer.

The Meme Coin Conundrum: Everyone Plays, Few Profit 😅

Meme coins have been lurking online since forever, tokens born from internet hoaxes or cultural belly laughs with zero practical use beyond tugging at your wallet strings. Lately, though, creation’s gone from hassle to highway, flooding the market with millions of these digital doodles. And why not? Quick riches sound irresistible, right? Wrong, says Galaxy Digital-they’re all about “cultural arbitrage,” basically front-running viral trends like buying the next big TikTok rage before the FOMO hits everyone else.

As the report hilariously puts it,

“Trading them is less about fundamentals and more about what can be described as ‘cultural arbitrage’: predicting or front-running attention cycles, e.g., buying the token for a viral TikTok trend before the market recognizes it is viral. In the long run, the vast majority of market participants end up losing money trading meme coins, and in many respects, it’s just plain gambling.”

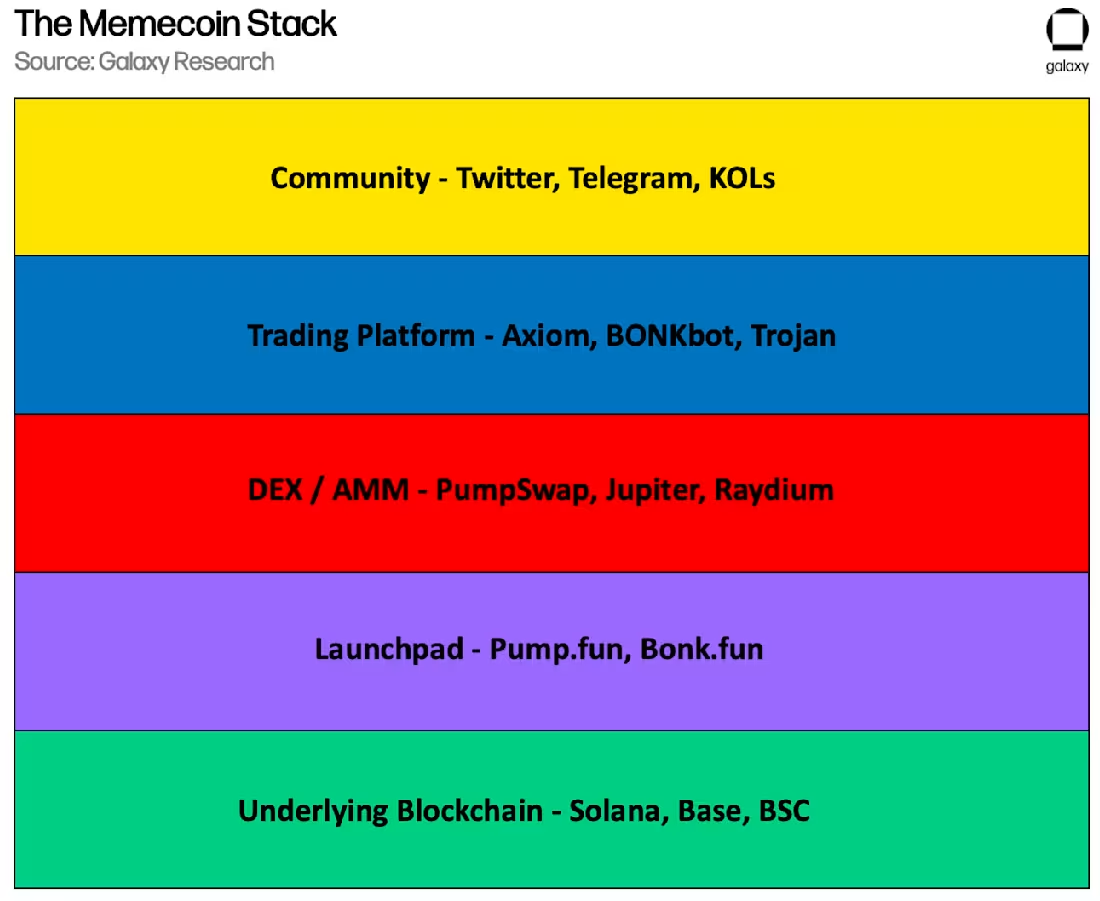

Analyst Will Owens sees the meme coin scene as a stacked cake, where money flows straight to the bakers-er, the creators and traders of the underlying tech. It’s like building the amusement park and charging admission while everyone inside rides the rollercoaster of ruin.

At the bottom of this stack? Blockchains like Solana, hosting a jaw-dropping 32 million tokens-a 300% jump since early 2024. They rule 56% of the 57 million meme coins across chains like Ethereum, Base, and BNB. Solana’s cheap fees and lightning speed make it the go-to spot, though meme trading there has dipped from 60% to 20-30% of DEX volume.

“Base and BSC also host significant activity, while Ethereum hosts bigger tokens and a less cutthroat culture,” the report reads.

Then come the launchpads, turbocharging token births. Solana’s Pump.fun, launched in 2024, turned creation into an assembly line with bonding curves that promise liquidity on the cheap. They’ve spat out 12.9 million tokens-40.31% of Solana’s horde-with a combined market cap pushing $4.8 billion (down from a giddy $10 billion peak).

“The power-law distribution of value among Pump.fun tokens is astonishing. Out of nearly 12.9 million tokens launched on the platform, just 12 account for more than half of all fully diluted market cap (FDMC). Those dozen tokens collectively represent $2.69 billion, or 56% of the total $4.8 billion FDMC, while the other 44% is split among the remaining millions of tokens,” Owens noted.

Pump.fun’s not just sitting pretty; it’s cashing in on fees from creations and trades. It slouched a bit in summer 2024 against rivals like LetsBonk but bounced back with snazzy tricks like Project Ascend’s flexible fees and streamer tie-ups for celebrity launches. Talk about upgrading the dog and pony show!

Up next: DEX aggregators and AMMs like Jupiter, Raydium, Orca, and Pump.fun’s own PumpSwap, soaking up value from post-launch chaos. Bots like Axiom, BONKbot, and Trojan let folks “snipe” tokens at launch and trade like maniacs, turning it into a PvP bloodbath where everyone’s swinging swords made of code.

“Axiom, for example, has broken $200 million in cumulative revenue with a team of less than 10 individuals,” the report highlighted.

Oh, and don’t forget the deployers, insiders, and KOLs-those tweet-masters holding onto stash in secret wallets, dumping on us suckers while hyping it on X or Telegram. It’s all coordinated shilling, where groupthink replaces any real value. Pure theater, and they’re the stars.

“X (formerly Twitter) communities and Telegram groups amplify memes and coordinate shilling campaigns. Communities are incentivized to push their token higher, with collective belief substituting for fundamentals. KOLs are a huge part of this layer,” the analyst wrote.

Retail Traders: The Ultimate Punchlines? 😂

Flip side? Most traders are schooled by the system. Galaxy says the median hold time for Solana meme coins is a blink: 100 seconds, down from 300 a year ago. No diamond-hands here-just rapid-fire trades scooping tiny gains from fellow gamblers.

“This means that the average participant isn’t ‘holding’ a token for hours, let alone days. Instead, they’re rotating rapidly, scalping a few percent profit against other traders in what is essentially a PvP trading game,” Owens detailed.

Risks? Honeytraps, rug pulls (insiders yanking the rug), and vamp clones sucking life from originals. Think LIBRA, where traders lost millions while insiders cashed out like bandits. It’s a paradox: Meme coins lure newcomers to crypto with shiny promises, but the frenzy just fattens the infrastructure elites. For most, it’s negative EV all the way-a casino where the house laughs last (and hardest). Gamblers beware-you’re not the star, you’re just the punchline! 🤪

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 7 Horrific What If…? Stories To Read This Halloween

- Disney’s $1 billion investment in OpenAI brings Mickey Mouse to Sora AI’s doorstep — will it redefine Hollywood’s future?

- Lazarus cast: Who stars in Harlan Coben’s Prime Video thriller?

2025-10-02 08:53