On a quiet, unassuming day, the on-chain analytics firm Santiment decided to share a little tidbit of information that could either be a revelation or a cause for concern, depending on your perspective. It turns out that Shiba Inu (SHIB), the beloved meme coin, has a rather peculiar trait: a staggering 62% of its supply is held by just ten whales. 🐳

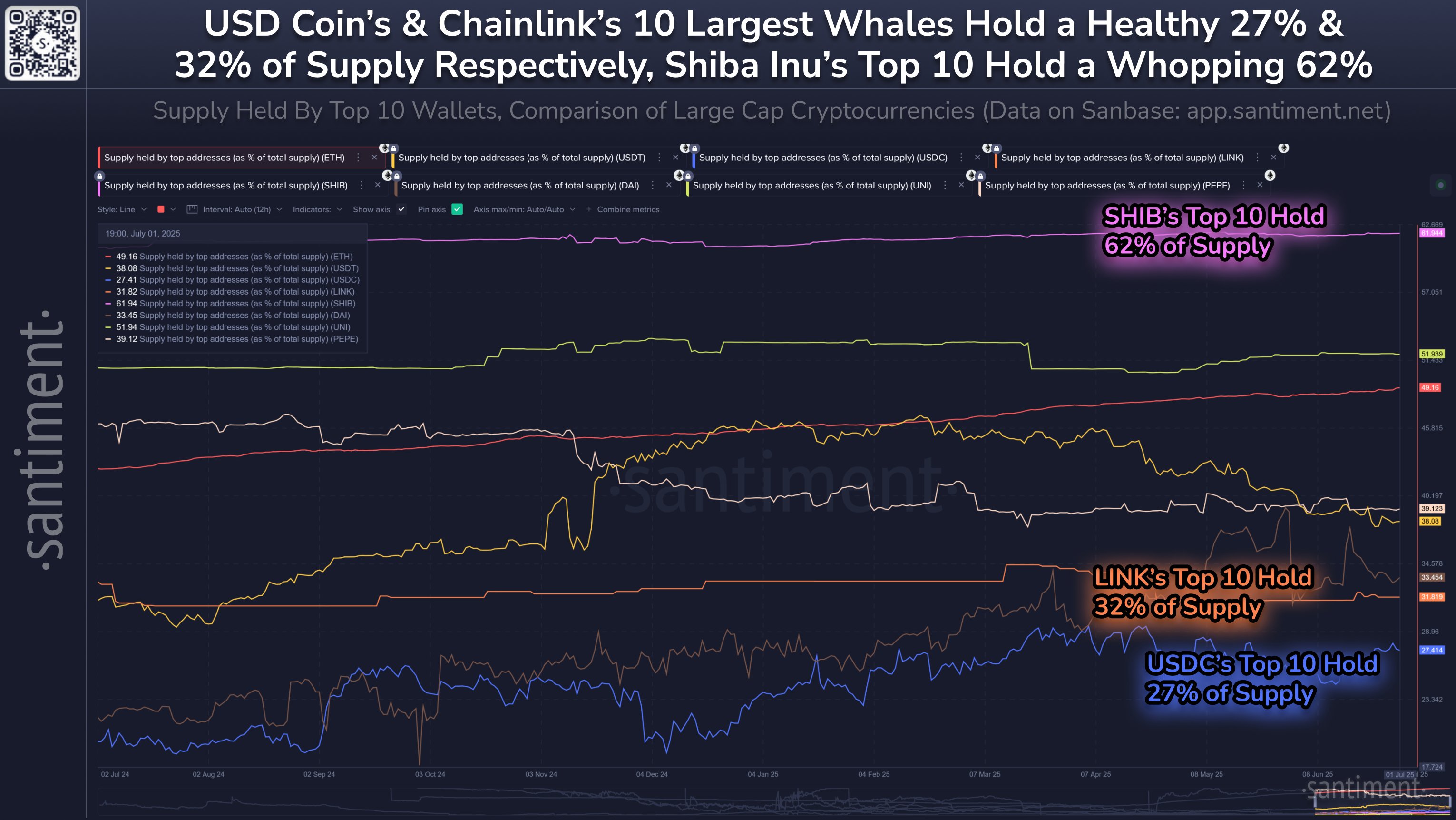

In a recent post on X, Santiment unveiled a chart comparing the concentration of supply among the top ten wallets for eight cryptocurrencies: Shiba Inu, Ethereum (ETH), Pepe (PEPE), USDT, USDC, DAI, Chainlink (LINK), and Uniswap (UNI). The chart, a visual feast for the data enthusiast, is as follows:

Among the assets, the stablecoin USDC stands out for its relatively low concentration of supply, with only about 27% held by the top ten addresses. Chainlink and DAI are not far behind, with 32% and 33% respectively. However, the real stars of the show are Uniswap and Ethereum, with 51% and 49% of their supply controlled by these massive entities. But none can hold a candle to Shiba Inu, where a whopping 62% of the supply is in the hands of the top ten whales. For comparison, Pepe, another memecoin, has a more modest 39% concentration.

Now, one might wonder, is this a good thing? Generally, the centralization of supply in just a few hands is not a sign of a healthy cryptocurrency. After all, tokens are power, and when that power is concentrated, it can lead to instability. This is particularly true for proof-of-stake (PoS) assets like Ethereum, where the largest holders can wield significant influence over the network.

Santiment, ever the wise sage, offers a piece of advice for the retail trader: “It’s generally safer to hold coins with less supply held by the most elite whales. There is less risk of sudden dumps or price manipulation should an asset’s largest whales decide to exit their positions.” In other words, if you’re a small fish in this big pond, you might want to think twice before swimming too close to the whales.

But what about the market sentiment? According to the Fear & Greed Index, a tool that measures investor sentiment, the cryptocurrency market is currently teetering on the edge of extreme greed. The index, which ranges from 0 to 100, is currently at 73, indicating a strong sentiment of greed among traders. Historically, markets have a knack for moving in the opposite direction of the crowd’s expectations, especially when the index is at its extremes. For now, the market is just a few points away from entering the extreme greed zone, but the tension is palpable.

As for Shiba Inu, the coin is currently trading around $0.0000115, up over 3% in the last seven days. Whether this is a sign of things to come or a fleeting moment of joy for its holders, only time will tell. 🕰️

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Ashes of Creation Rogue Guide for Beginners

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- The 4 Most Influential Comic Book Movies of All Time (That Aren’t Marvel or DC)

- 50-Hour Square Enix RPG Joins Xbox Game Pass

- There Are Big Concerns About Plants vs Zombies’ PS5, PS4 Re-Release

2025-07-05 07:17