This isn’t just another “number go up” moment – it’s like the universe finally decided to stop playing hide and seek with the price of Bitcoin. 🤯

Long-Term Holders Hit Pause on Selling

For months, long-term holders (LTHs) were the invisible ceiling above Bitcoin’s rallies – steadily distributing into strength. But Glassnode data shows that the LTH Net Position Change (3D) has moved back toward neutral territory after a period of sustained outflows. Translation: the big, patient money isn’t dumping anymore. 🧠

That shift matters. When the heavy distribution phase slows, the market can stop fighting the tide and start building a base. Think of it like the March-April consolidation zone earlier this year, when Bitcoin spent weeks ranging tightly before blasting higher once the LTH flow flattened out. 🧪

Speculators Get Squeezed – and That’s a Good Thing

Meanwhile, the short-term holders (STHs) – the fast money – have been taking their lumps. CryptoQuant’s STH-SOPR metric, which tracks whether short-term wallets are selling at a profit or loss, slipped to 0.992 in September, signaling a phase where weak hands were consistently capitulating. 🧪

But here’s the twist: last week, that number crept back up to 0.995. Still technically in loss territory, but it’s stabilizing. Historically, this kind of “mini washout” sets up one of two scenarios:

- A long, grinding correction as losses pile up, or

- A healthy reset where selling pressure gets absorbed quickly, clearing the runway for another bullish leg.

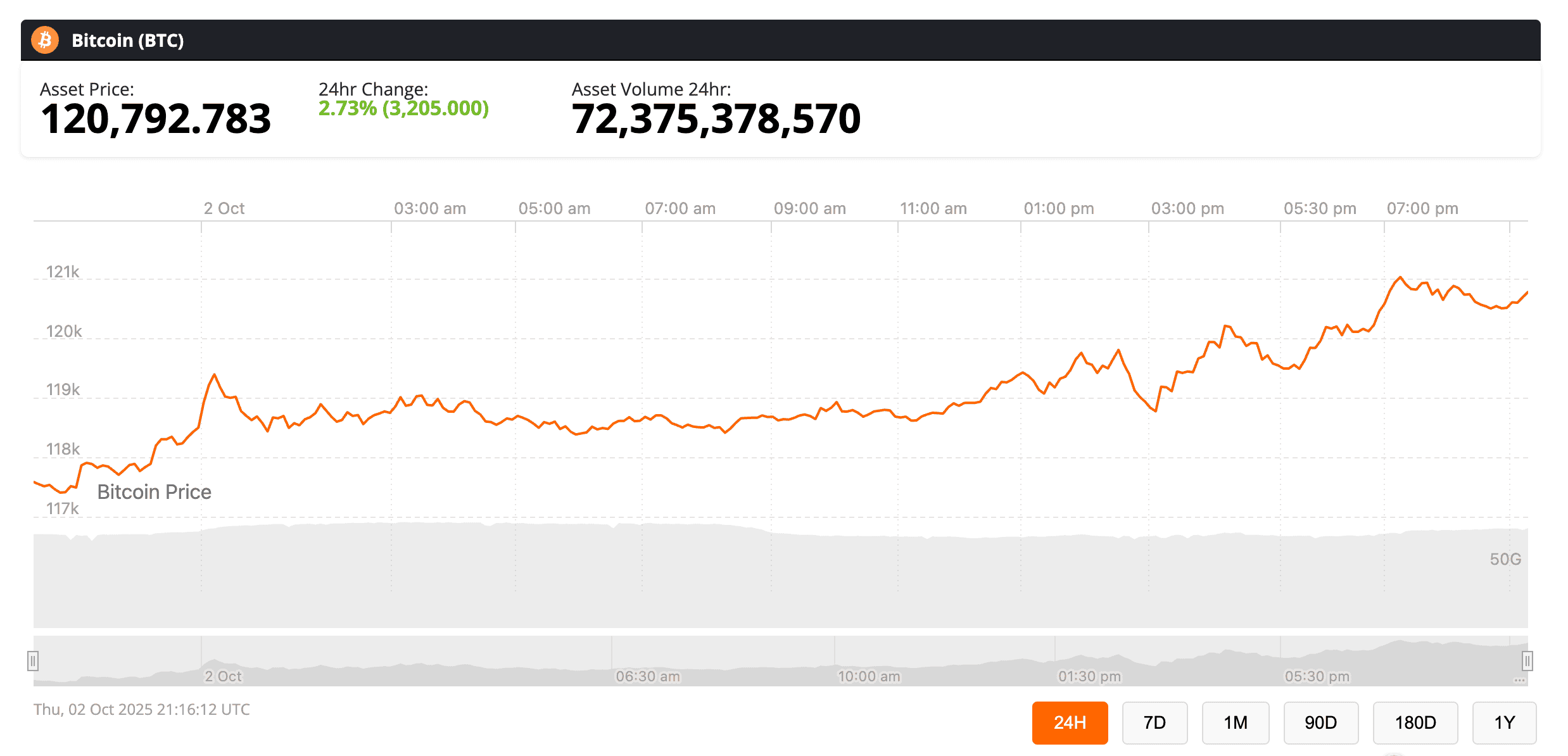

Given Bitcoin’s clean consolidation between $115K-$120K, the latter is starting to look more likely. 🚀

RVT Compression Hints at Market Detox

Another on-chain signal backing the accumulation thesis is the Short-Term Holder Realized Value (RVT) ratio, which has been compressing since May. RVT spikes typically coincide with frothy, speculative tops. Compression, on the other hand, signals the market is in “detox mode” – speculative profits are fading relative to network activity, which often precedes sustained accumulation phases. 🧪

If this trend holds, the $120K level could shift from resistance to a springboard. 🚀

JPMorgan’s Math Says $165K Is on the Table

In parallel, the TradFi crowd is running the numbers. JPMorgan estimates that Bitcoin could climb ~40% from current levels to $165,000 if it continues to track gold on a volatility-adjusted basis. The bank frames this within the so-called “debasement trade” – where both retail and institutions buy hard assets like gold and BTC to hedge against the slow-motion implosion of fiat credibility. 🧠

Flows into spot Bitcoin and gold ETFs have surged since late 2024, with retail traders leading the charge ahead of the U.S. presidential election. Gold ETFs caught up with Bitcoin ETFs after August, but both are seeing steady inflows. Institutions are still in the game via CME futures, though their pace has lagged retail’s newfound enthusiasm. 🧪

Notably, Bitcoin’s volatility ratio vs. gold has dipped below 2.0, meaning it’s less of a rollercoaster than it used to be relative to gold’s price swings. JPMorgan argues that Bitcoin remains undervalued by around $50K compared to their model – a rare moment where the bank is basically saying “the orange coin is cheap.” 🧠

Bitcoin hasn’t looked this “quietly coiled” since the spring. If this structural base between $115K-$120K holds, a decisive breakout attempt may not be far off – and this time, the ceiling may not be whales cashing out, but macro tailwinds blowing in. 🚀

Read More

- Darkwood Trunk Location in Hytale

- Hytale: Upgrade All Workbenches to Max Level, Materials Guide

- Best Controller Settings for ARC Raiders

- How To Watch A Knight Of The Seven Kingdoms Online And Stream The Game Of Thrones Spinoff From Anywhere

- Ashes of Creation Rogue Guide for Beginners

- PS5’s Biggest Game Has Not Released Yet, PlayStation Boss Teases

- Olympian Katie Ledecky Details Her Gold Medal-Winning Training Regimen

- Donkey Kong Country Returns HD version 1.1.0 update now available, adds Dixie Kong and Switch 2 enhancements

- Arc Raiders Guide – All Workbenches And How To Upgrade Them

- Nicole Richie Reveals Her Daughter, 18, Now Goes By Different Name

2025-10-03 02:24