In a universe stuffed with digits and the occasional existential crisis, Bitcoin has suavely sidestepped the mundane and swaggered past the $120,000 frontier. Imagine a tiny, very determined spaceship doing handbrake turns in a galaxy of spreadsheets-that’s basically Uptober in motion. 🚀

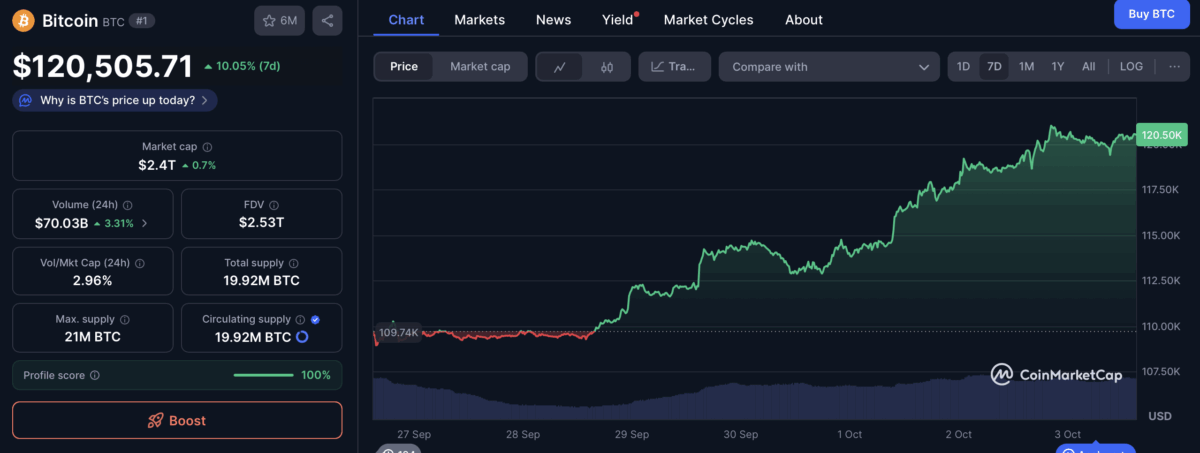

As this message is being composed by someone who clearly forgot to drink coffee, BTC is hovering around $120,505-up 0.7% in 24 hours, and a more convincing 10.2% over the last week. The grand total of market cap now groans past $2.4 trillion, which is a lot of zeroes to pretend matter.

Traders have christened the month “Uptober,” as if the calendar suddenly learned to appreciate fiscal whimsy. Many believe this is merely the warm-up act; the main performance could still pirouette into view. The short-term target sits at about $124,685 to $125,071 within the next 30 days if the momentum keeps its jaunty stride-these numbers are only a whisker above the all-time high, which is exactly the kind of target that makes you nod with grave optimism.

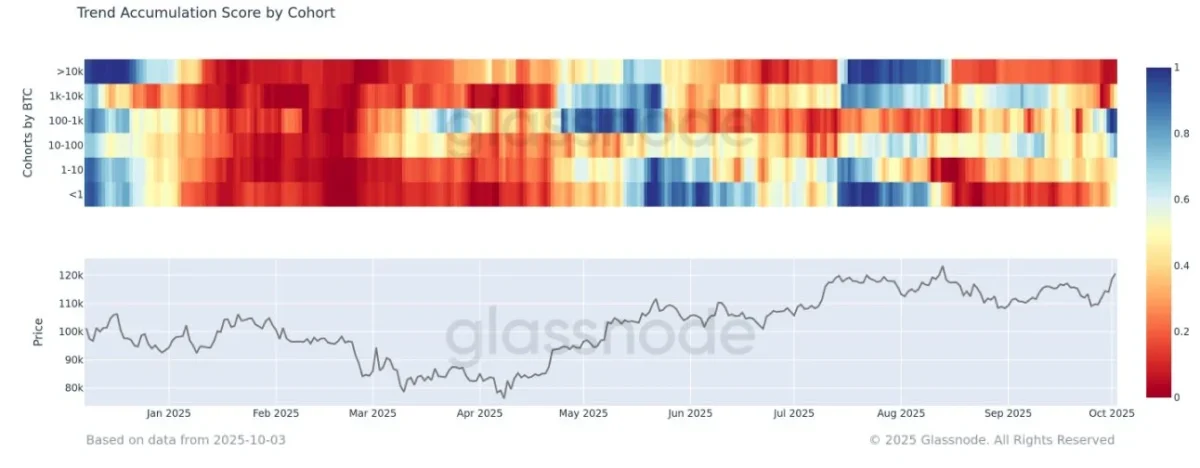

This recent rebound is powered, in no small part, by mid-sized holders who’ve been steadily carting more Bitcoin into their personal black holes of accumulation. Glassnode’s Trend Accumulation Score for these folks has spiked to 0.62 over the last 15 days, which is basically code for “they’re buying and not apologizing about it.”

Usually, a score above 0.5 means more buying than selling, and a score near 1 signals a full-blown accumulation ceremony. Wallets holding between 100 and 1,000 BTC have shifted toward the enthusiastic side after last week’s polite selling, while those with 10 to 100 BTC are resuming purchases. The tiniest wallets-those with less than 10 BTC-have dialed back their selling activity, which is either very brave or very confusing to the rest of us who pray for consistent action.

Analysts may yet be convinced, though, because BTC might just stroll past $135k this quarter. Geoff Kendrick, Standard Chartered’s Global Head of Digital Assets Research, suggests the climb could continue. “Net Bitcoin ETF inflows are now at $58 billion, of which $23 billion has been in 2025. I would expect at least another $20 billion by year-end,” he said, which is either reassuring or the universe’s polite way of saying “hold on for dear life.”

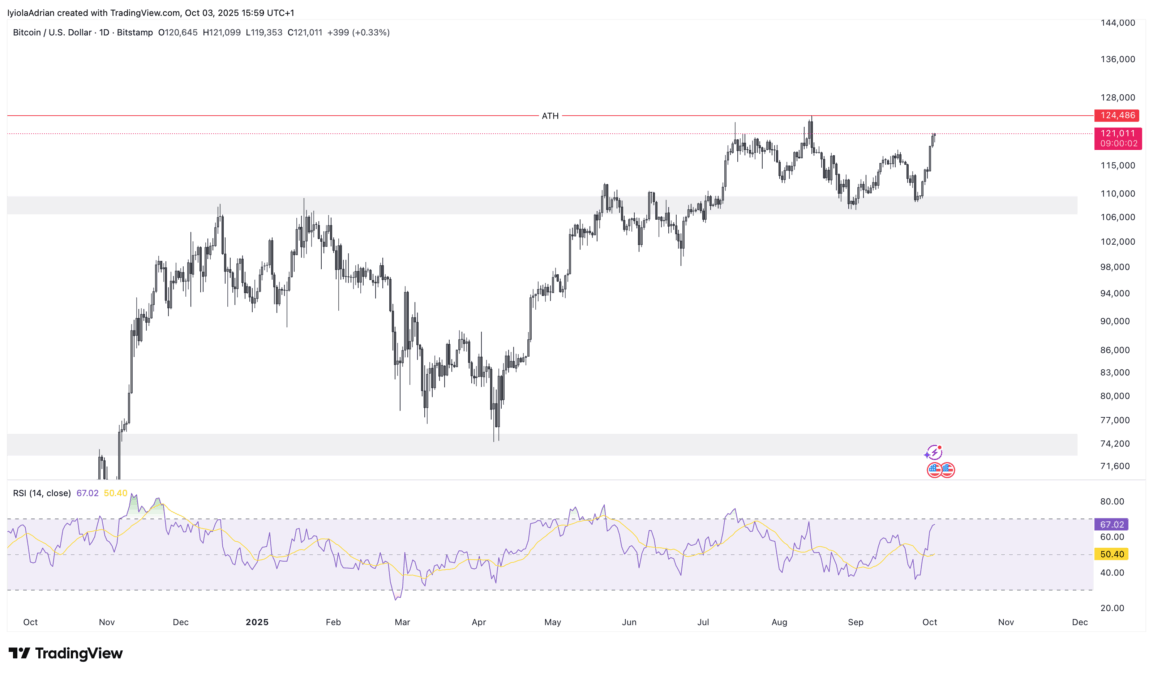

From a technical map, the chart shows a jaunty double-bottom pattern with a sturdy support zone around $108k-$110k. With prices currently lounging above $115k-the proverbial bottleneck in this waltz-the breakout seems to be wearing a confident grin. The Relative Strength Index sits at 66, indicating the bulls still have a few wagons to push and a few galaxies to conquer.

Read More

- Ashes of Creation Rogue Guide for Beginners

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Best Controller Settings for ARC Raiders

- Can You Visit Casino Sites While Using a VPN?

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Michael B. Jordan Almost Changed His Name Due to NBA’s Michael Jordan

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

- Crunchyroll Confirms Packed Dub Lineup for January 2026

- New Look at Sam Raimi’s Return to Horror After 17 Years Drops Ahead of Release: Watch The Trailer

- Marvel Wants You to Believe Wolverine Is the Greatest Anti-Hero (But Actually He’s the Worst)

2025-10-03 20:20