Mercado Bitcoin, that hulking beast of a Latin American crypto bazaar, has decided to pile over $200 million in real-world assets (RWAs) onto the dear old XRP Ledger, showing all the restraint of a child in a cake shop. 🍰💰

This, I’m told, is one of the region’s grandest stabs yet at tokenization—a word that here means ‘turning things you recognize into things you’ll never see again, but on a blockchain’. Quite the wheeze for a company trying to make itself look fancy on the world stage.

XRP Ledger Tries On the RWA Crown, Adjusts It Repeatedly

So what’s on offer? We’re talking a smorgasbord of tokenized goodies—fixed-income doodads, equity-based whatsits—intended to let folks across South America and Europe swan around with regulated digital assets like they’re the toast of the season.

Silvio Pegado, Ripple’s LATAM managing director (and apparent enthusiast of stating the blindingly obvious), has piped up:

“Across Latin America, we’re seeing forward-looking institutions explore how tokenization can improve access and efficiency in financial markets. Mercado Bitcoin’s integration with the XRPL shows how public blockchain infrastructure is being trusted by institutions and is becoming a reliable foundation for bringing regulated financial products to the market,” he said (while, presumably, adjusting his monocle).

For those wondering, ‘tokenization’ is the deeply technical process of swapping Grandma’s bonds for digital trinkets you can admire on your computer, but never actually touch or tuck under your mattress. Market strategists are positively breathless: Analysts forecast this space swelling up to $600 billion by 2025 and either making us all rich or very confused (possibly both) on its way to a dizzying $19 trillion by 2033. 📈🤷♂️

The clever coves at Ripple and the Boston Consulting Group have declared that soaring institutional interest and some rather natty blockchain upgrades are fueling the growth.

Even the old guard—BlackRock, Guggenheim Partners, the sorts who usually regard crypto as slightly less trustworthy than a three-card monte dealer—are nosing around. This apparently means the financial system will look nothing like it does today, or that these firms just hate to miss a good party.

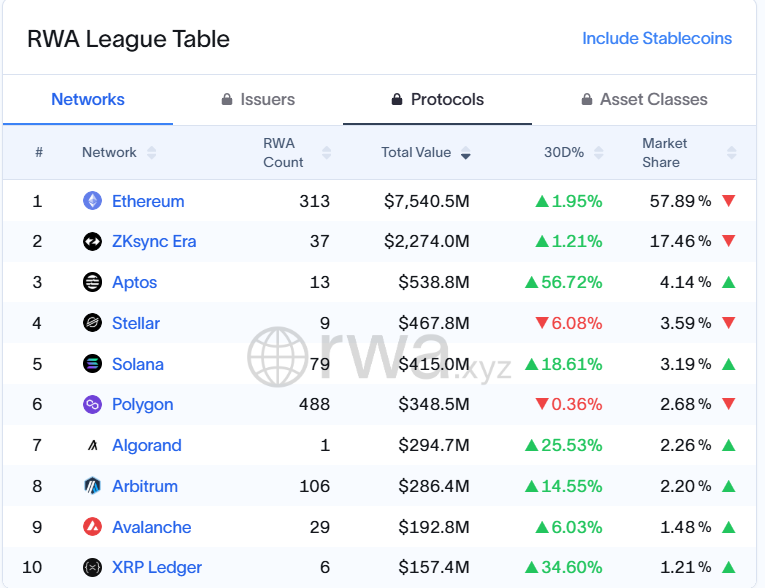

In this spirit, blockchain networks everywhere are done up in their Sunday best, jockeying for some of that sweet market share and hoping to distract everyone from Ethereum, which at this point is so far ahead, it’s probably stopped for a G&T. Ethereum sits pretty at the top with $7.5 billion in tokenized loot. Meanwhile, those diligent souls at RWA.XYZ have XRP Ledger in 10th place with a mere $157 million—think of it as the blockchain equivalent of bringing a plastic spork to a silver service dinner.

Ripple’s suits, undaunted, suggest that XRP Ledger’s swanky new features could narrow the gap quicker than you can say “another upgrade, Jeeves!”

Our man Pegado is back, reminding everyone that the XRPL runs as smoothly as Jeeves serving afternoon tea: always on time, never breaks the crockery. And it’s cheap and fast—just the thing for institutions obsessed with regulatory compliance and not paying more than they need for their blockchain amusements.

“With the kind of infrastructure the XRPL offers, it’s now possible to bring these [RWA] assets onchain in a way that meets institutional expectations for cost, speed, and compliance,” Pegado added, resisting the urge to drop his teacup in excitement.

And if that weren’t enough, there’s a veritable goodie bag of upgrades: a shiny new Ethereum Virtual Machine (EVM)-compatible sidechain (so all those Ethereum dapps can crash the party), batch transactions for the indecisive, cross-chain interoperability for the cosmopolitan, permissioned decentralized exchanges (decentralized, yet oddly controlled), and token escrow—the blockchain equivalent of hiding your best biscuits from the vicar. 🍪

Altogether, these enhancements are bound to make institutions look again at XRP Ledger—if not with love, then at least with grudging respect and a desire to cash in before the next blockchain hullabaloo arrives.

Read More

- The Most Jaw-Dropping Pop Culture Moments of 2025 Revealed

- 3 PS Plus Extra, Premium Games for December 2025 Leaked Early

- Best Controller Settings for ARC Raiders

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Hazbin Hotel season 3 release date speculation and latest news

- Ashes of Creation Rogue Guide for Beginners

- Where Winds Meet: Best Weapon Combinations

- TikToker Madeleine White Marries Andrew Fedyk: See Her Wedding Dress

- Superman’s Breakout Star Is Part of Another Major Superhero Franchise

- 7 Most Overpowered Characters in Fighting Games, Ranked

2025-07-05 18:13