Well, it seems like Bitcoin (BTC) is getting all dressed up for a grand performance, and analysts are all abuzz, pointing to OBV divergences and institutional whale hoarding as the stars of the show. But let’s not get ahead of ourselves – are we really looking at a potential rally, or just another “buy the rumor, sell the news” situation? Only time will tell! 🧐

OBV Divergence: Buying Pressure or Just Fancy Footwork? 💃

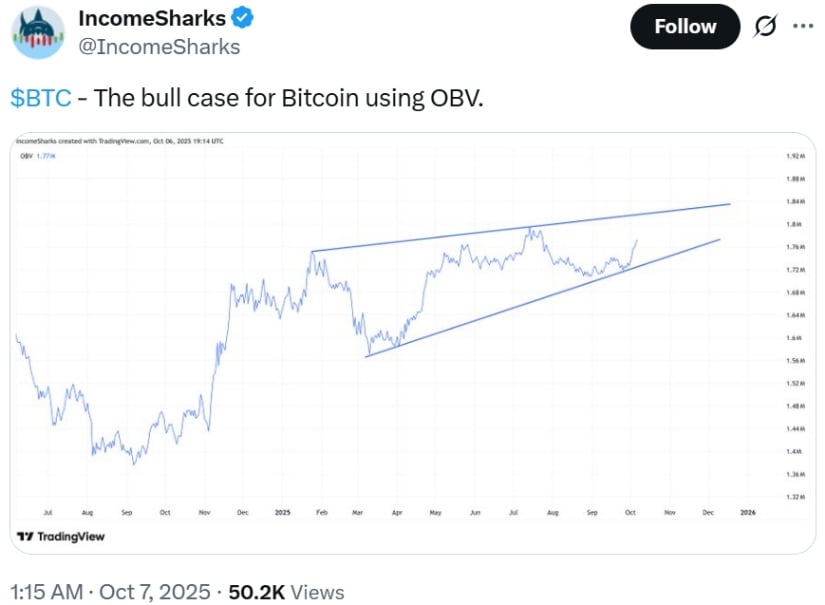

According to the ever-optimistic @IncomeSharks, Bitcoin’s OBV (On-Balance Volume) is throwing us some signs that we might want to pay attention to. This technical metric measures the buying and selling pressure by accumulating trading volume, and right now, it’s breaking through a long-term uptrend line since mid-2024. Basically, the OBV is giving us a wink, rising even while prices are just kinda chilling, consolidating or dipping ever so slightly. A sure sign that buying pressure is outpacing selling, or is it just a case of “hopeful thinking”? 🤷♂️

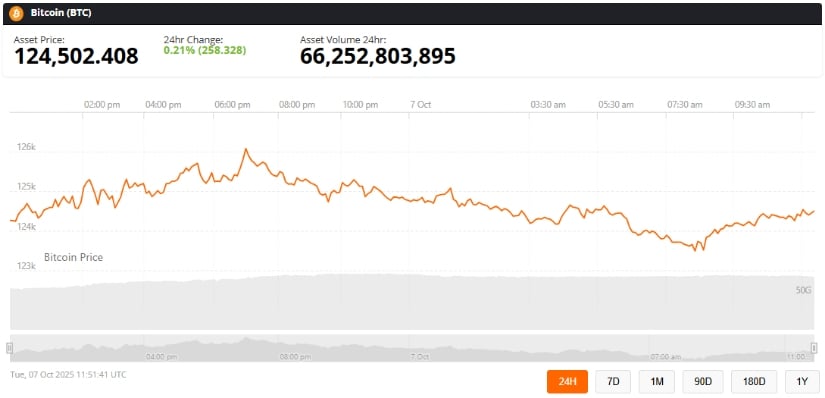

“Historically, OBV divergences like this have led to major Bitcoin rallies,” they say. And why not believe them? They even cited some fancy peer-reviewed research from 2018, because who doesn’t love a good academic citation, right? At the time of this little revelation, Bitcoin was hanging around the $124,000 mark, with some optimistic predictions floating around that we could see prices above $130,000 if this momentum holds. But hey, don’t pop the champagne just yet. 🍾

Of course, we’ve also got Bitcoin ETF inflows and the upcoming halving in 2024 throwing their two cents into the mix – both of which historically tend to push investors into a “buy” frenzy. But will that really keep the price from crashing? Stay tuned…

Whale Accumulation: Big Fish in a Big Pond 🐋💸

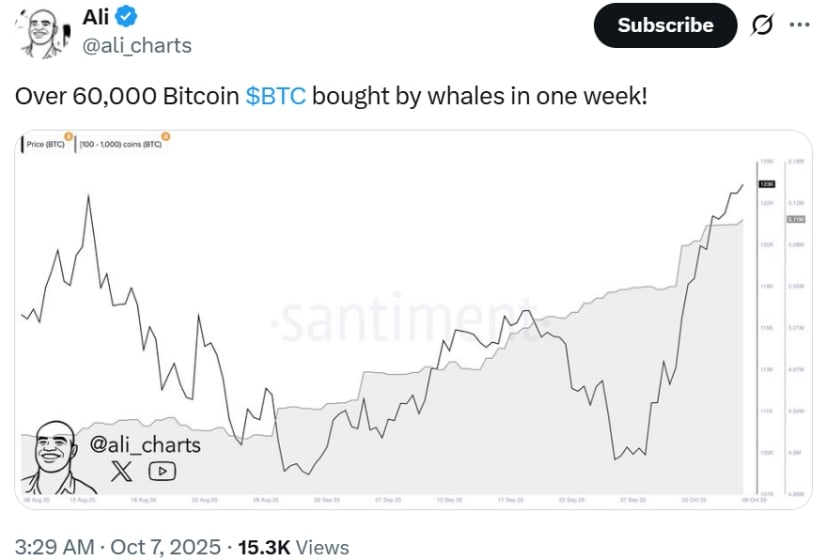

Meanwhile, the whales are having a good time. According to @ali_charts, Bitcoin whales (those holding between 100 and 1,000 BTC) have gone on a shopping spree, scooping up over 60,000 BTC in a single week. That’s one serious shopping cart! Total whale holdings now stand at over 5.1 million BTC, up from 4.88 million BTC just since August 2025. So, what’s going on here? Is this a show of confidence, or just a case of them buying up the market because they can? 🤔

Some folks think whale accumulation is a sign that institutional players are confident about Bitcoin’s future, while others believe this could lead to market manipulation. After all, big players can swing the market like a wrecking ball if they feel like it. According to Federal Reserve research, large-scale purchases can influence liquidity, and by extension, market volatility. So, buckle up – this rollercoaster could get wild! 🎢

Technical Patterns: Is It All Just a Coincidence? 🧐

From a technical perspective, things are looking… interesting. Bitcoin’s weekly chart is showing the formation of two rounded bottom patterns, often referred to as “cup-like” formations (because, you know, everything is better when it’s shaped like a cup ☕). These patterns, historically, are said to precede upward price movements, with success rates ranging from 70-85%. Seems promising, right? But then again, when do patterns *not* look promising in the crypto world? 🤨

“Rounded bottom formations indicate accumulation phases that usually lead to major upward moves,” says crypto analyst @Karman_1s. So, will this cup-shaped pattern fill our wallets, or will it just be a cup of disappointment? Who knows! But hey, 70-85% of the time, it’s been right…

Market Outlook: Buckle Up, It’s Gonna Be a Bumpy Ride! 💥

While Bitcoin is giving off some serious “buy me!” vibes, analysts are also cautioning that macroeconomic factors like interest rates and global financial conditions could throw a wrench into the party. Investors are advised to keep an eye on the ETF inflows, whale activity, and those pesky technical patterns. One thing’s for sure: if you’re not paying attention, you might just miss the train to the moon! 🚀

If you’re looking for investment opportunities, you might want to check out products like the Fidelity Bitcoin ETF or BlackRock BTC ETF – they’re growing in popularity and providing more ways for both retail and institutional investors to get involved. But remember: with great opportunity comes great risk! Bitcoin crashes are never out of the question…

Final Thoughts: Is Bitcoin the Next Big Thing? Or a Flash in the Pan? 💭

All in all, Bitcoin’s technical indicators and whale accumulation suggest that we might be in for an exciting ride. The OBV divergence, paired with those rounded bottom formations, is giving us the blueprint for potential price action upwards. And with institutional players piling in, there’s no shortage of confidence in the market.

But as always, folks, keep your wits about you. Bitcoin’s path to new highs could be more of a rollercoaster than a straight shot. So, grab your popcorn and let’s see if these bullish signals can actually translate into something real. Or maybe it’s just another “hype cycle.” Either way, it’s one heck of a show! 🎬🍿

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Can You Visit Casino Sites While Using a VPN?

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

- Crunchyroll Confirms Packed Dub Lineup for January 2026

- Marvel Wants You to Believe Wolverine Is the Greatest Anti-Hero (But Actually He’s the Worst)

- AKIBA LOST launches September 17

- New Look at Sam Raimi’s Return to Horror After 17 Years Drops Ahead of Release: Watch The Trailer

- One Piece Just Confirmed Elbaph’s Next King, And He Will Be Even Better Than Harald

2025-10-07 18:36