Oh, look at this! The asset has entered a prolonged downtrend, showing little sign of recovery as bearish momentum dominates the charts. 🚪 With open interest cooling and market sentiment subdued, the coin now faces the challenge of defending its multi-month support region to avoid deeper losses in the coming weeks. 💸

Highlights Breakdown Below “Dead Zone” Support 🕵️♂️

Analyst Lamatrade noted on X that $OP has dropped below its critical “dead zone”, a level that had previously served as structural support. The weekly chart reveals that the coin has consistently formed lower highs under a descending trendline since mid-2024, confirming a well-defined bearish structure. 🐍

The yellow-marked zone around $0.48-$0.58 has now flipped from support to resistance, marking a critical failure point for the token. 🧨

Lamatrade emphasized that the extended rejection from the trendline and the breakdown below the Ichimoku cloud indicate that buyers are losing control of the mid-term structure. The RSI hovering around the mid-40 range further reflects weakening momentum. 🎉

Unless the coin can reclaim the $0.58 resistance area, it risks extending its downward leg toward $0.45, the next significant support identified on higher timeframes. 🚀

Market Data Confirms Persistent Downtrend 📉

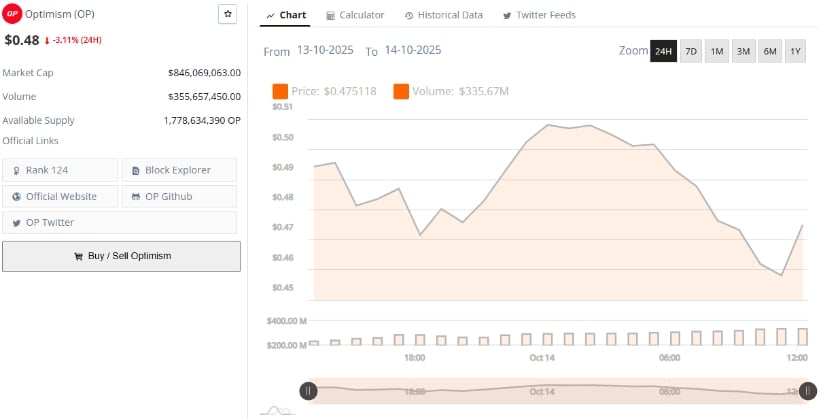

On one hand, BraveNewCoin data show Optimism is currently priced at $0.48, marking a 3.11% decline over the past 24 hours. The network holds a market capitalization of $846.06 million and records a trading volume of $355.65 million over the same period. 💸

With an available supply of 1.77 billion tokens, the project ranks 124th in global market standings, reflecting a sustained period of underperformance relative to other Layer-2 assets. 🤷♀️

Despite maintaining solid liquidity levels, the consistent price erosion suggests waning speculative demand. Trading volume spikes during sell-offs indicate that short-term holders may be exiting positions, while long-term participants appear to be waiting for clearer market signals before re-entering. 🕳️

For the coin to regain momentum, it must reclaim the $0.50-$0.58 resistance corridor and establish higher lows on the weekly chart. Failure to do so would likely keep sentiment bearish heading into late October. 🕯️

TradingView Indicators Reinforce Bearish Outlook 🧠

At the time of writing, OP/USDT is trading at $0.4732, showing a daily loss of approximately 5.76%, according to TradingView data. The chart reflects a sharp intraday decline, with large candlestick wicks on both ends, signaling elevated volatility and heavy selling pressure. 🧨

The Chaikin Money Flow (CMF) remains slightly positive at 0.10, hinting that some buyers are attempting to accumulate at discounted levels. However, the MACD histogram at -0.0262 and the signal line at -0.0349 confirm persistent bearish momentum, with sellers maintaining dominance. This setup suggests any short-term rebounds are likely to face strong resistance near $0.50 before the broader downtrend resumes. 🛑

Overall, the coin’s technical landscape paints a cautious picture. With the token trading below major resistance levels and momentum indicators leaning bearish, the immediate focus will be on whether bulls can stabilize price action around $0.45. A sustained recovery above $0.58 remains the key threshold that would signal the beginning of a potential trend reversal. 🔄

Read More

- Best Controller Settings for ARC Raiders

- Darkwood Trunk Location in Hytale

- Ashes of Creation Rogue Guide for Beginners

- Daredevil Is Entering a New Era With a Chilling New Villain (And We Have A First Look) (Exclusive)

- So Long, Anthem: EA’s Biggest Flop Says Goodbye

- 7 Announcements We’re Dying to See at Dragon Ball’s Genki Dama Festival This Month

- Katy Perry Shares Holiday Pics With Justin Trudeau & Ex Orlando Bloom

- RHOBH’s Jennifer Tilly Reacts to Sutton Stracke “Snapping” at Her

- Nintendo Switch Just Got One of 2025’s Best Co-Op Games

- A Guide to Derek Hough and Julianne Hough’s Family

2025-10-14 18:42