It seemed like Paramount Skydance was about to buy Warner Bros. Discovery without competition, but now Comcast is also interested in the deal.

A recent report in the *New York Post* (October 9th) indicates that Comcast has been secretly considering a potential acquisition of Warner Bros. Discovery for several months. They’ve been watching David Ellison’s attempt to take over the company with Skydance and deciding if they should make their own offer. Although Paramount and Skydance are currently leading the way, even the possibility of Comcast getting involved has caused significant disruption in the entertainment industry.

Why Comcast’s Entry Matters

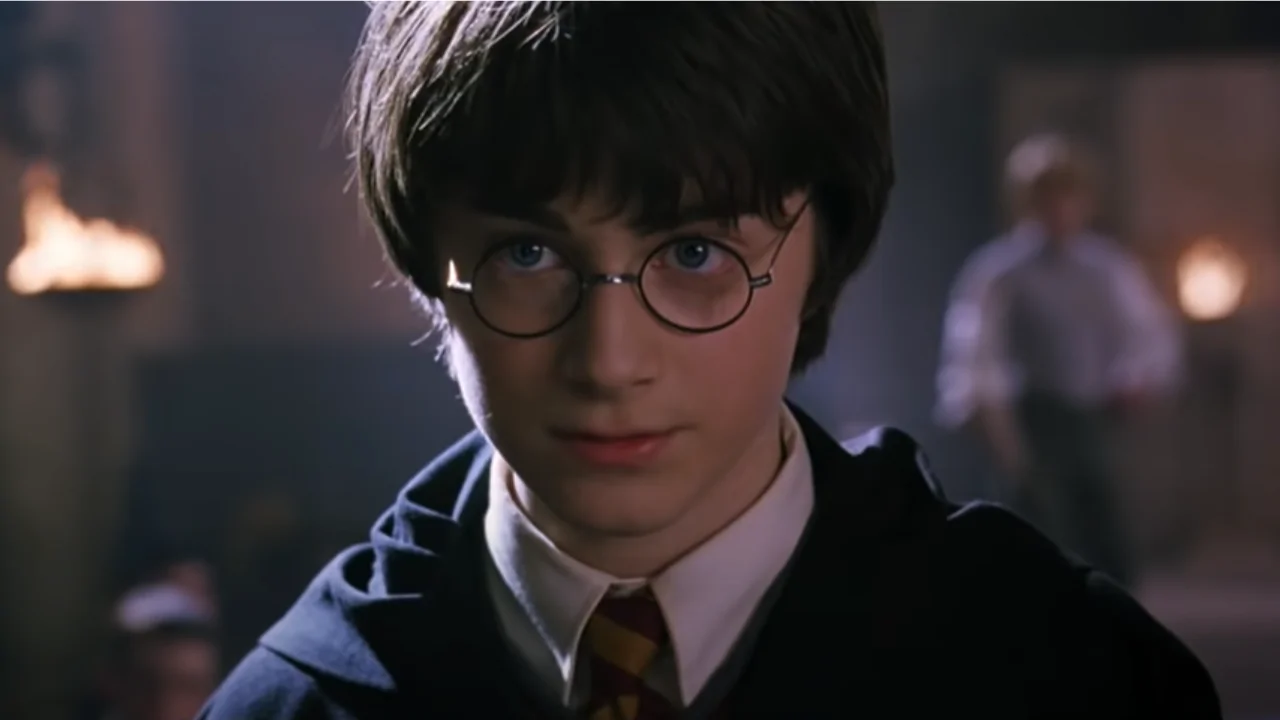

If Comcast, which owns NBC Universal, starts competing with Paramount, it won’t be simply a battle over shows and movies. It will also be about combining different parts of their businesses to create something bigger. Universal already has incredibly popular theme parks, like the Wizarding World of Harry Potter in Orlando and Hollywood.

But there’s a catch.

Universal Pictures doesn’t have the rights to the Harry Potter movies or video games – Warner Bros. Discovery does.

If Comcast were to acquire the rights, it would instantly bring all of the Harry Potter theme park attractions and movies under one company, Universal. This would eliminate complicated licensing agreements and creative limitations, giving Universal much more freedom to develop the Potter brand within its parks – especially now that Epic Universe has opened in Orlando.

The Video Game Factor

Another element in play — though not necessarily a total bright spot — is WB Games.

After the massive success of *Hogwarts Legacy* in 2023—earning over $1 billion worldwide—Warner Bros. Games seemed to be thriving. However, things have slowed down recently. *Suicide Squad: Kill the Justice League* didn’t perform well, receiving poor reviews and low sales, and *Multiversus* has had trouble keeping players engaged since its re-release earlier in the year.

Despite recent challenges, WB Games is still a very valuable asset. It owns the rights to hugely popular franchises like Harry Potter, DC Comics, and Mortal Kombat. For Comcast, buying these properties would create great opportunities to promote them through Universal’s theme parks, movies, and online services.

Buying WB Games isn’t about immediate earnings; it’s about creating long-term connections between theme park rides, movies, and video games, all under one company – similar to how Disney brings Marvel and Star Wars together. This is an area Comcast hasn’t been able to tap into before.

Comcast is different from companies like Sony, Microsoft, and Warner Bros. Discovery because it doesn’t have its own team that makes and sells video games. NBCUniversal does allow other companies to create games based on its popular franchises like Jurassic World and Fast & Furious, but it doesn’t actually develop those games itself. Essentially, Comcast doesn’t have a game development and publishing group similar to PlayStation Studios, Xbox Game Studios, or WB Games.

Buying Warner Bros. Discovery would immediately transform Comcast’s position in the video game industry. WB Games boasts well-known studios like Rocksteady, the creators of the Batman Arkham series, NetherRealm, known for Mortal Kombat, and Avalanche, the team behind Hogwarts Legacy, giving Comcast an instant and strong presence in the market.

Regulatory Storm Clouds

Still, there’s a reason Comcast has remained cautious.

According to *The Post*, a merger between Comcast and Warner would likely face intense review from antitrust regulators. This is because Comcast already owns NBC, Universal Pictures, the streaming service Peacock, and a large broadband network. Regulators might see the deal as an unfair expansion of power, particularly as Washington is becoming more critical of large mergers in the media and technology industries.

Unlike some other recent deals, the proposed partnership between Paramount and Skydance is relatively straightforward. Because it combines two media companies, rather than a cable provider and a studio, it may face fewer hurdles in the approval process, even though Comcast has more financial resources.

Comcast vs. Paramount: The Stakes

The future of Warner Bros. Discovery – and control of incredibly popular franchises like DC Comics, Game of Thrones, The Matrix, Lord of the Rings, and Harry Potter – is on the line.

If Paramount succeeds, it will improve its collection of movies and streaming shows and become more secure after merging with Skydance.

If Comcast succeeds, it would build a huge entertainment company covering movies, TV, internet, video games, and theme parks – potentially becoming as powerful, or even more so, than Disney’s current setup.

Either outcome would reshape the industry overnight.

A Perfect Fit or a Regulatory Nightmare?

From a business standpoint, it makes sense. Comcast owns Universal Studios Hollywood and Orlando, popular theme parks where guests enjoy attractions like the Harry Potter-themed areas. However, Universal currently has to pay Warner Bros. licensing fees to continue operating those popular Harry Potter attractions.

If Comcast completely acquires Warner, it would control everything related to Harry Potter – the movies, products, video games, and theme park attractions. This level of ownership over intellectual property is something Disney has had for a long time, and Comcast has probably wished for.

From a legal and regulatory perspective, combining Warner Bros. Discovery and NBCUniversal would create significant challenges. It would make Comcast the biggest entertainment company ever, and antitrust regulators would likely require the companies to sell off parts of their businesses or even split up entirely before approving such a merger.

What Happens Next?

I’m following the Warner Bros. Discovery situation closely, and it sounds like the board isn’t feeling pressured to make a quick decision. They’re willing to consider all options, which is good. Paramount and Skydance have already made a bid around $20 a share, but people in the know think Comcast might come in with an even better offer if they decide to join the bidding war. It’s shaping up to be quite a competition!

The entertainment world is preparing for a major competition as companies fight to acquire popular movie and TV series franchises, which could dramatically change who owns them.

If Comcast decides to move forward with a major acquisition, the fate of popular fictional worlds like Hogwarts, Gotham, and Westeros could be determined not in Los Angeles, but at Comcast’s headquarters in Philadelphia.

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Katy Perry and Justin Trudeau Hold Hands in First Joint Appearance

- XRP: Will It Crash or Just… Mildly Disappoint? 🤷

2025-10-15 19:59