In those damp, slow moments before dawn, the fevered market awaits, hearts trapped in the confines of their chests—each man and woman exchanging charts like faded love letters. It is whispered now, half in hope and half in dread, that Hyperliquid contemplates a leap as shocking as a duel at sunrise. Some, who last month called for rain, now predict thunderbolts of price—new highs, and why not? Do not the numbers, those mute witnesses, trail behind every feverish hope? On-chain activity, revenue, TVL—all, like obedient peasants, tilling higher.

As Hyperliquid Waltzes Near $40, the Peasants Whisper

There it sits, this enigmatic Hyperliquid, just below $40—close, but stubbornly not there, about 12% shy of its moment of unrestrained glory. To the casual eye, the price does not tremble. But under this respectable façade, a heart beats rapidly. A mere $220 billion in volume last month, as if counting kopecks before a czar’s ball, and now we behold the sum of $1.1 trillion. Dominance? 75% in decentralized perps space. Protocol revenue? Why, it’s earning over $1 million each day—enough to make Dostoevsky quit gambling (almost).

JefferyCrypt, who surveys the scene like a minor aristocrat in a crumbling manor, is certain the ecosystem stretches its limbs—soon to be seen in the price, or so he mutters between sips of tepid tea. The TVL, meanwhile, leaps from $330 million to $1.8 billion in a scant three months; $4 billion has been marshalled across the bridge. Even Tolstoy would blush at the scope of such ambition, and he’d never moved more than a few peasants at a time.

The Triangle—Not Just for Musicians at the Village Fête

After many a fruitless trudge sideways upon the price chart, Hyperliquid now sketches, with all the suspense of a serialized novel, a symmetrical triangle. Callum, that analyst with the pinched look, swears the posturing has reached a sharp end—breakout pressure mounting like a provincial scandal. Price hovers at $38.94—so near $40 one can almost feel the draught from its passing breath.

With foundational numbers to make even the most reluctant suitor swoon—volume, TVL, ecosystem metrics—all ticking up, the only thing standing in the way is the $40–$41 resistance, as forbidding as a mother-in-law’s stare. If buyers do storm the barricades, the open pastures of previous highs, and unironed price discovery, await. Perhaps even the bulls will compose poetry (badly, but with feeling).

Liquidity—That Mysterious Map of Hope (or Doom)

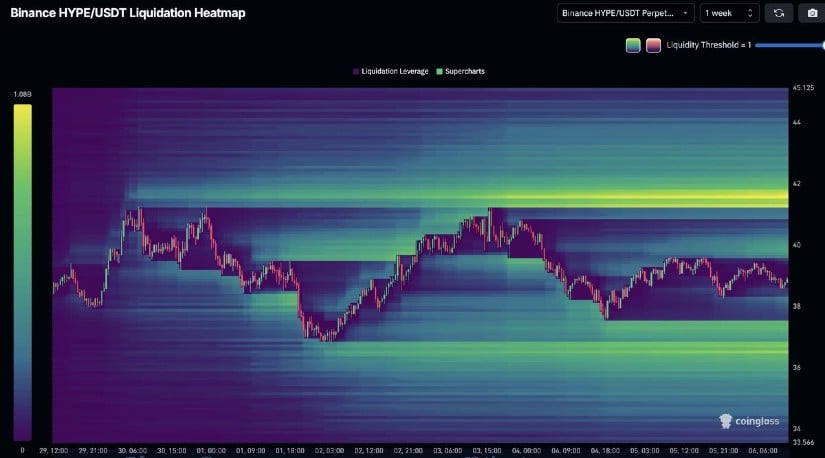

To our dear Ian Alloway, practical as any Russian postmaster, the data is as clear as morning frost—a heatmap now glows with the promise (or threat) of short liquidations at $41.70 ($897K, as precise as an old banker’s mustache), shadowed by a second cluster at $41.85. Resistance stands guard, as always—unhelpful, unkind, and a little bored.

Such splendid, tight clusters beg for drama—should the price loiter in their neighborhood, a wave of forced liquidations might be unleashed: forced exits, scrambled covers, and shorters running faster than pigeons startled by a dog. Presently, the path above $41 lies in enigmatic readiness, like an unopened letter from a long-lost paramour.

MACD: The Spoilsport at the Feast 🍷

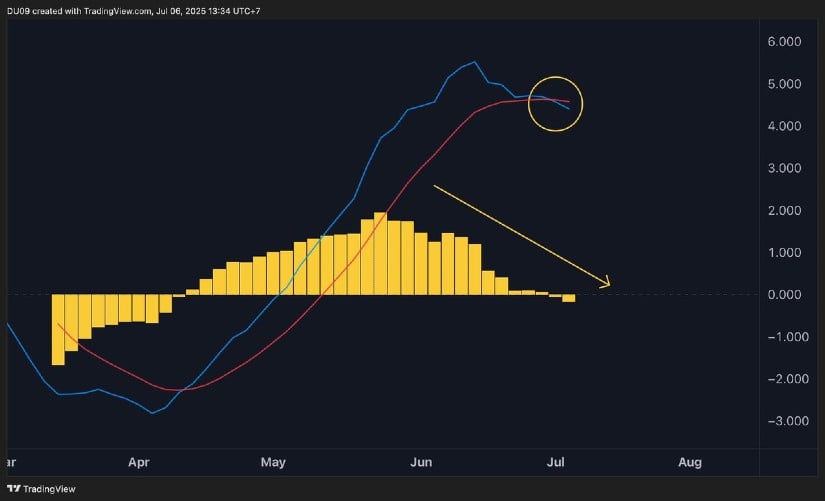

The mood is festive, but not unanimous. Duo Nine—ever the melancholy cousin—points at a fresh MACD cross on the tedious 3-day timeline, as if to say, “Enjoy yourselves…but don’t.” The histogram, swollen with recent runs, now fades; the MACD line slinks, quiet and guilty, beneath its signal. This isn’t disaster—it’s simply the hangover after a tipsy evening. A flag of caution raised, like a handkerchief waved from a departing train window.

Right on the heels of bullish liquidity and as the triangle draws tight, this gentle warning suggests the way forward may not be a straight, sunlit road, but a pothole-ridden lane frequented by hopeful cryptotraders and the occasional lost poet.

Hyperliquid: The Last Word, or At Least the Next Chapter 📚

The wind is rising, and the price nears its crossroads—$40 to $42, where every glance holds the weight of unspoken questions. The structure of the chart is clean, a rarity in this world; liquidity clusters await, bracing for jubilation or misery. Fundamentals ripple with potential, villagers peeking from windows.

Yet the MACD, with its weary sigh, signals that dreams may be delayed. A breakout is possible—but not guaranteed—like spring after a Russian winter. One last, enormous candle could settle the argument and leave bulls and bears alike searching for meaning (and perhaps their trousers).

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- DC K.O.: Superman vs Captain Atom #1 Uses a Fight as Character Study (Review)

- Jealous of the new Xbox Ally? — Here are 6 ways to give your original ROG Ally a glow-up

2025-07-07 00:24