Imagine, if you will, the sum of $311 billion in gold, but not in gilded bank vaults where men in ill-fitting suits and even drearier ties whisper about interest rates. No, it’s luxuriating under Turkish pillows, gleefully thumbing its nose at regulations and the scowls of central bankers.

Beneath Mattresses and Beyond Banks: Türkiye’s $311B Golden Comedy

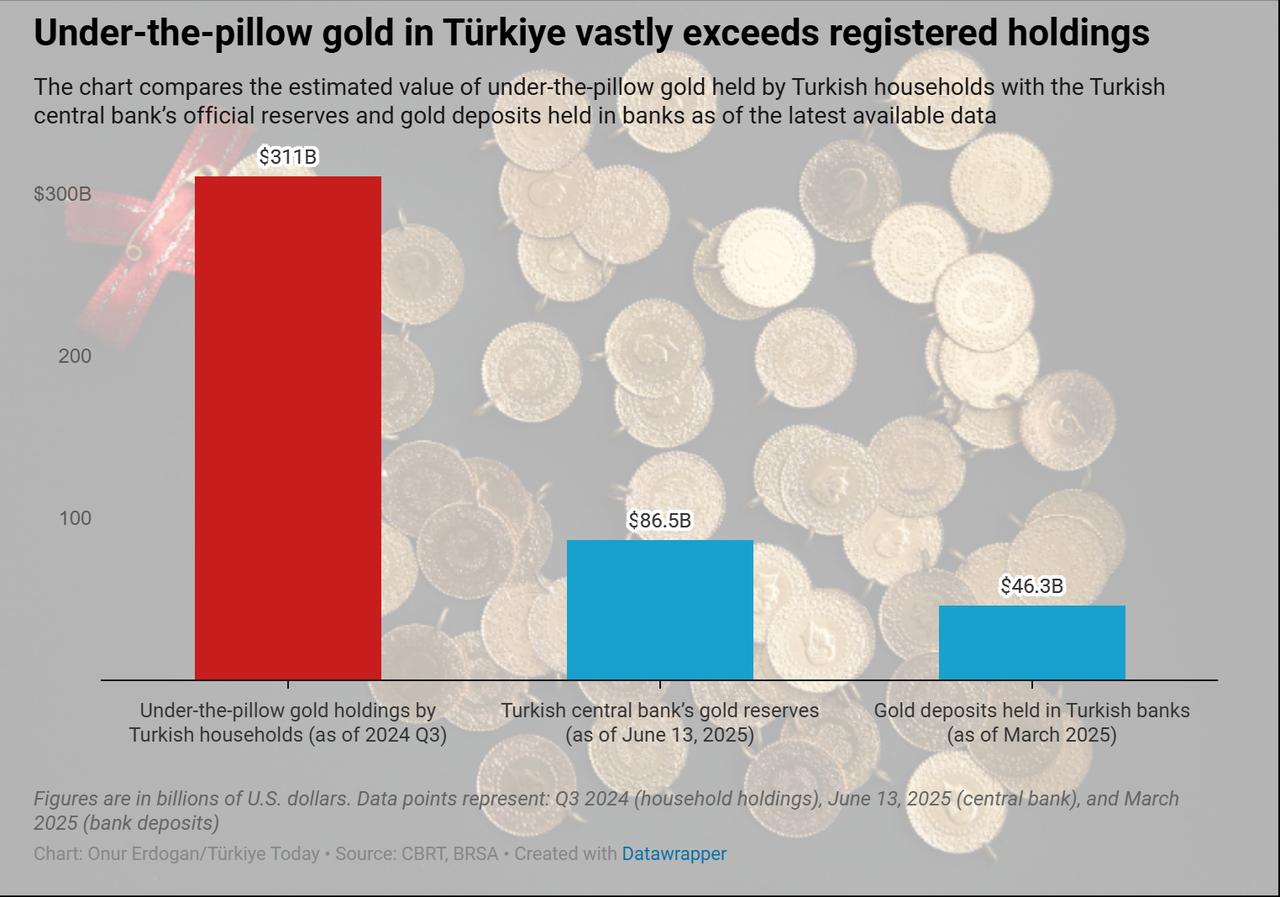

The estimable Onur Erdogan—no relation, unless family reunions are measured in carats—spills the beans (or perhaps the gold nuggets) in Türkiye Today. His figures, straight from the bowels of central bank estimates, reveal a clandestine trove of bullion so immense that the Bank’s meagre $86.54 billion in official reserves and Turkish banks’ $46.26 billion in gold deposits must feel like copper coins at a sultan’s wedding.

This extravagant domestic stash, as Erdogan’s treatise meticulously details, isn’t simply a testament to Turkish thrift. It’s an economic prank worthy of Molière, contributing a $6.27 billion caprice to the country’s current account deficit (January–April 2025), mainly thanks to ravenous gold imports. Tradition, you see, is a stubborn guest—impossible to dislodge once ensconced on your divan.

Gold—in its resplendent form as jewelry—reigns over weddings, ceremonies, and familial hoardings with an authority even mothers-in-law would envy. In 2023, Türkiye seduced the world as the fourth-largest gold jewelry market. Demand? 42 tonnes. That’s a lot of wristwear, and possibly chiropractors. While investment bars and coins are gaining vogue, old habits shimmer brightest at crowded family gatherings. 💍🍬

With inflation soaring higher than poetic metaphors and the Turkish lira wilting like an unloved flower, one scarcely wonders why Anatolian households opt for tangible gold. As inflation pirouetted at 85.51% in October 2022, trust in the national currency plummeted to depths even philosophers don’t care to probe. And, as an added delight, private stashes slip merrily past taxes and tedious reporting, further seasoning this national farce with a pinch of fiscal mischief.

March 2025 saw a fresh attempt to tame the golden beast—a dainty 0.2% tax on bank-acquired gold. Banks now collect coins while pillows collect the rest. Renowned economist Mahfi Egilmez, quoted in Türkiye Today, suggests this shadowy bullion cache acts as the nation’s unspoken war chest: there for stormy days, earthquakes, or simply the Monday blues. It even oils the country’s mysterious capital inflows, the balance of payments equivalent of “don’t ask, don’t tell.” 🕵️♂️

What of government pleadings and schemes—dating back to the 1980s, President Erdogan’s 2016 appeal, or the ever-dazzling 2022 Gold Conversion System? Alas, extracting gold from Turkish homes is as futile as convincing a dandy to wear polyester. Deep cultural roots, economic uncertainty, and pure stubborn common sense keep most of this treasure—quite literally—under wraps. The bankers groan, the government sighs, but the nation sleeps soundly atop its sparkling fortune. 🛏️✨

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Pokémon Legends: Z-A’s Mega Dimension Offers Level 100+ Threats, Launches on December 10th for $30

- James Gunn & Zack Snyder’s $102 Million Remake Arrives Soon on Netflix

- Ashes of Creation Rogue Guide for Beginners

- Ben Napier & Erin Napier Share Surprising Birthday Rule for Their Kids

2025-07-07 16:57