Oh, what a to-do! Bitcoin, that mischievous scamp, has gone and tumbled below the 1.0 mark on its STH-SOPR, whatever that gobbledegook means! 🧐 According to the boffins at CryptoQuant, this is the first time since April that short-term holders are selling at a loss. Poor dears, they’re folding like a cheap deckchair under the weight of selling pressure. 😢

When this STH-SOPR doodah dips below 1.0, it’s like a canary in a coal mine-except the canary is a Bitcoin holder, and the mine is the market. It screams, “Capitulation!” and “Fear!” and all sorts of other dramatic things. The current value? A teeny-tiny 0.8% loss. But oh, what a shift in sentiment! After weeks of prices bouncing around like a kangaroo on a trampoline, this is quite the spectacle. 🎭

Historically, these moments of short-term panic are like a good sneeze-unpleasant but necessary. Retail traders throw in the towel, uncertainty reigns, and the market gets a good old shakeout. But fear not, dear reader! This often paves the way for stabilization, as the weak hands scurry off and the long-term investors swoop in like vultures at a picnic. 🦅🧺

Bitcoin’s Wobbly Knees: A Short-Term Frown or Long-Term Crown? 👑

CryptoOnchain’s wise owls have chimed in, saying the STH-SOPR is still below 1.0, which is about as cheerful as a raincloud at a barbecue. As long as it stays there, it’s like a stubborn mule blocking the path to upward momentum. Every price rally? Met with selling pressure. Short-term holders are desperate to break even, creating a ceiling that’s as unyielding as a grumpy grandmother. 🌧️

But here’s the twist! This very behavior could be the seed of a bullish bloom. History tells us that when short-term holders are busy realizing losses, it’s often the final act of a market correction. It’s like a spring clean, sweeping out the cobwebs and handing Bitcoin over to the long-term holders, who are as steady as a rock in a storm. When capitulation peaks, it’s often the signal that the market is ready to bounce back with the vigor of a jack-in-the-box. 🎉

So, while Bitcoin’s current wobbles suggest ongoing weakness, this could be the very foundation of the next uptrend. Keep your eyes peeled for the STH-SOPR to reclaim that 1.0 mark-that’s when the party really starts! 🎈

Bears Growl, Bulls Stumble: The Great Bitcoin Tug-of-War 🐻🐂

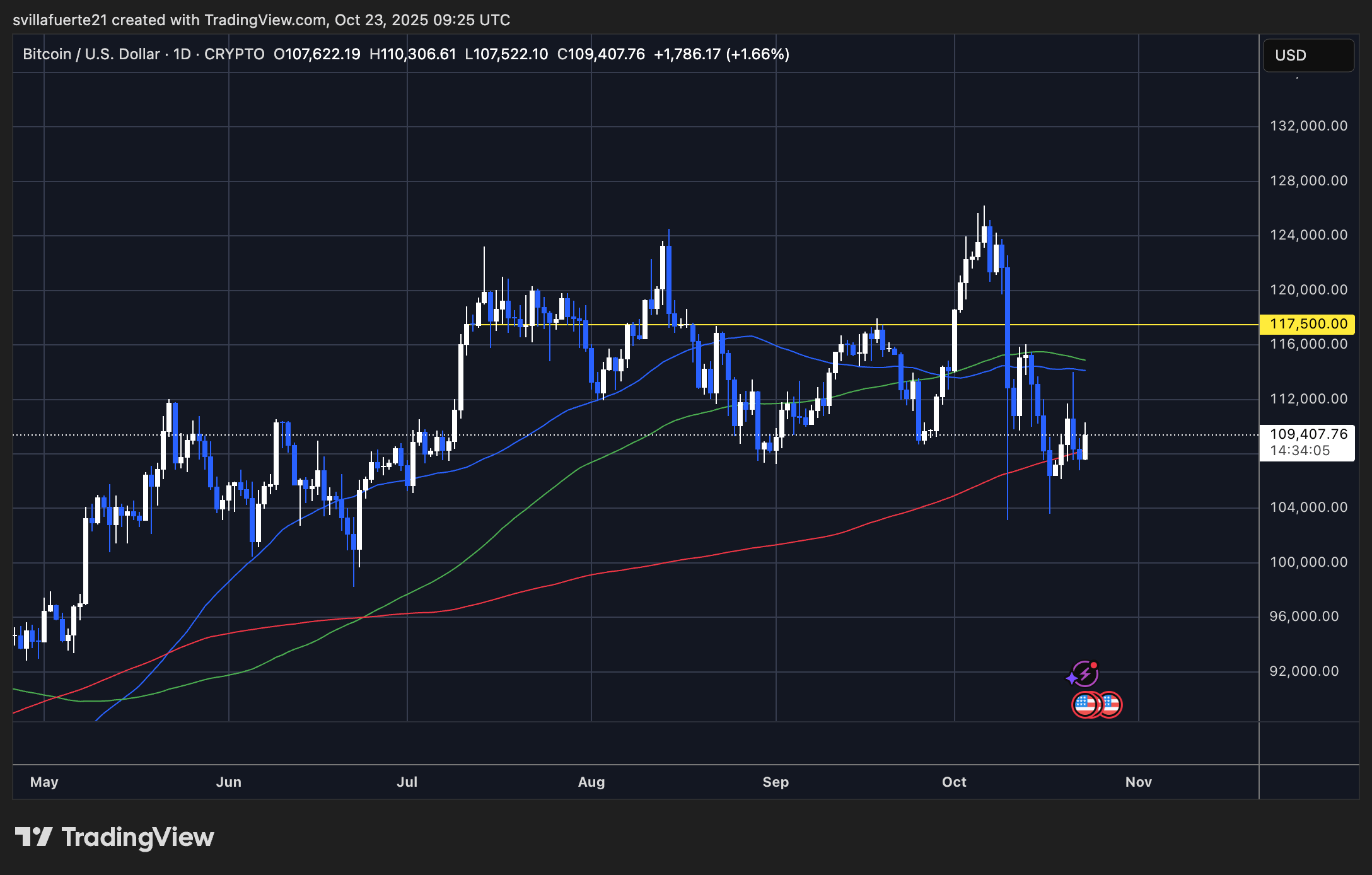

Bitcoin is currently hovering around $109,400, like a hesitant tightrope walker. It’s facing resistance at higher levels, trapped beneath the 50-day and 100-day moving averages, which are converging near $112,000-$114,000. This zone has been as unwelcoming as a porcupine at a hug convention, repeatedly acting as a supply wall. 🦔

The 200-day moving average, sitting around $106,000, is providing some support, but it’s being tested like a student on exam day. The inability to sustain a close above $110,000 highlights the persistent selling pressure, with traders de-risking faster than a cat leaping from a bath. 🛁

If Bitcoin manages to reclaim $112,000, it could sprint toward $117,500, the key horizontal resistance. A breakout above this level would be as triumphant as a dog catching its tail, opening the path to $123,000. But beware! If $106,000-$107,000 support crumbles, Bitcoin could slide toward $102,000 or even $98,000, faster than a sled on a snowy hill. 🛷

Read More

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Resident Evil Requiem cast: Full list of voice actors

- How to Build a Waterfall in Enshrouded

- The 10 Best Episodes Of Star Trek: Enterprise

- Best Thanos Comics (September 2025)

- Best Shazam Comics (Updated: September 2025)

- Vera icon Brenda Blethyn reveals her emotional reaction to filming final scenes on show

2025-10-24 00:26