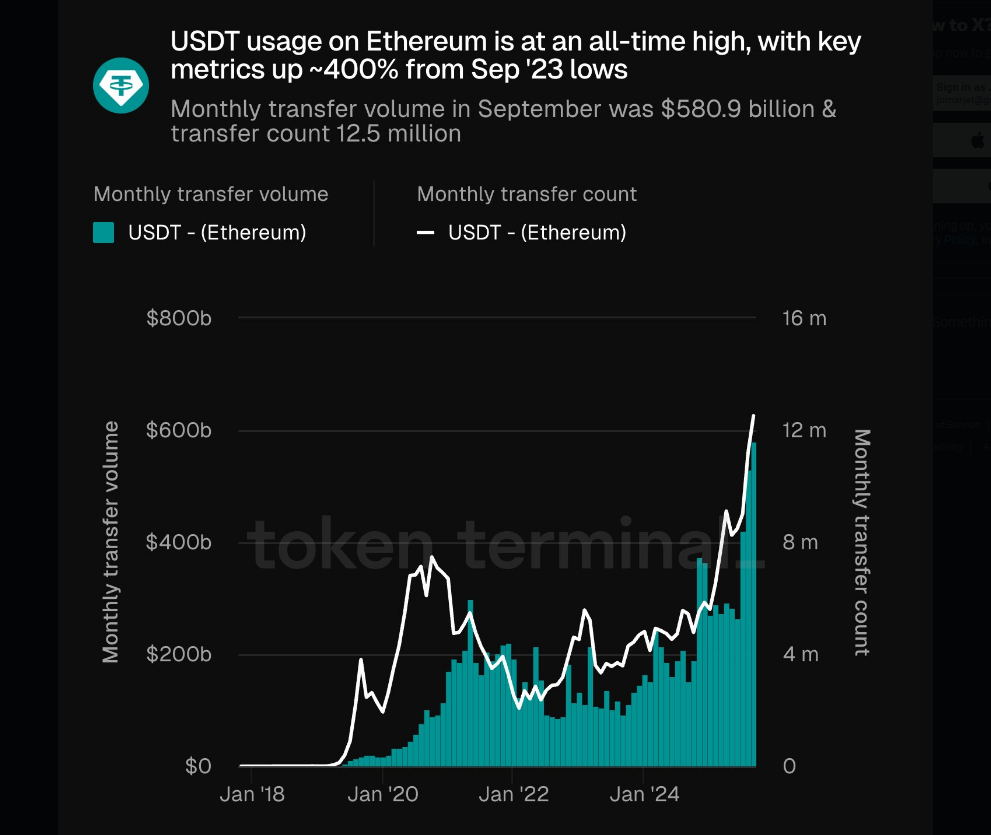

In a land where electronic transfer reigns supreme, the ethereal sages of Ethereum have noted-a nigh 400% increase-in the celestial swipes of stablecoins over the bygone month! These digital coins, they say, have performed a ballet worth $581 billion, spanning nearly 12.5 million transfers, as documented by the oracle known as Token Terminal. A veritable carnival of transactions, it seems!

Yet, the capricious kingdom of Ethereum, ever the ever-changing entity, has somewhat shrunk by 4.50%, flirting with support near the peculiar figure of $3,738. As fate would have it, certain traders have deigned this a splendid opportunity to acquire these shifty currencies. Oh, the chimerical dance of the markets! 🕺

The Whales Make Their Move

As if a myriad of ghosts had descended upon the realm, behemoth entities emerged from the ether, their coffers brimming for the grand spectacle. Behold, a mysterious conjurer known as 0x86Ed, appearing out of thin ether, lavished $32 million to grasp 8,491 ETH in but three short hours-a spectacle recounted in the jestful scrolls of Arkham Intelligence, no less!

Anon, another enigmatic figure, keepeth vigilant watch. Guided by the seer, LookOnChain, this account deftly plucked 284K USDC from the grasp of Hyperliquid after recent tribulations, its motives clear: to steadfastly embrace its prolonged devotion to ETH. 🏛

In the month of October, whispers of stablecoin exchanges on Ethereum reached a surreal $1.91 trillion, a déjà vu of bygone heights, they say-clear proof that the fates of these transactions continue unabated.

USDT finds itself soaring to unprecedented usage heights on Ethereum, harking back to its modest September shadows by nearly 400%. September’s tally amassed a grand $580.9 billion in volume with 12.5 million transfers. Ethereum’s grand tapestry, embroidering an approximate $500 billion worth of craftsmanship, crowns the formidable @Tether_to as a paragon of business.

Institutions Join the Fray

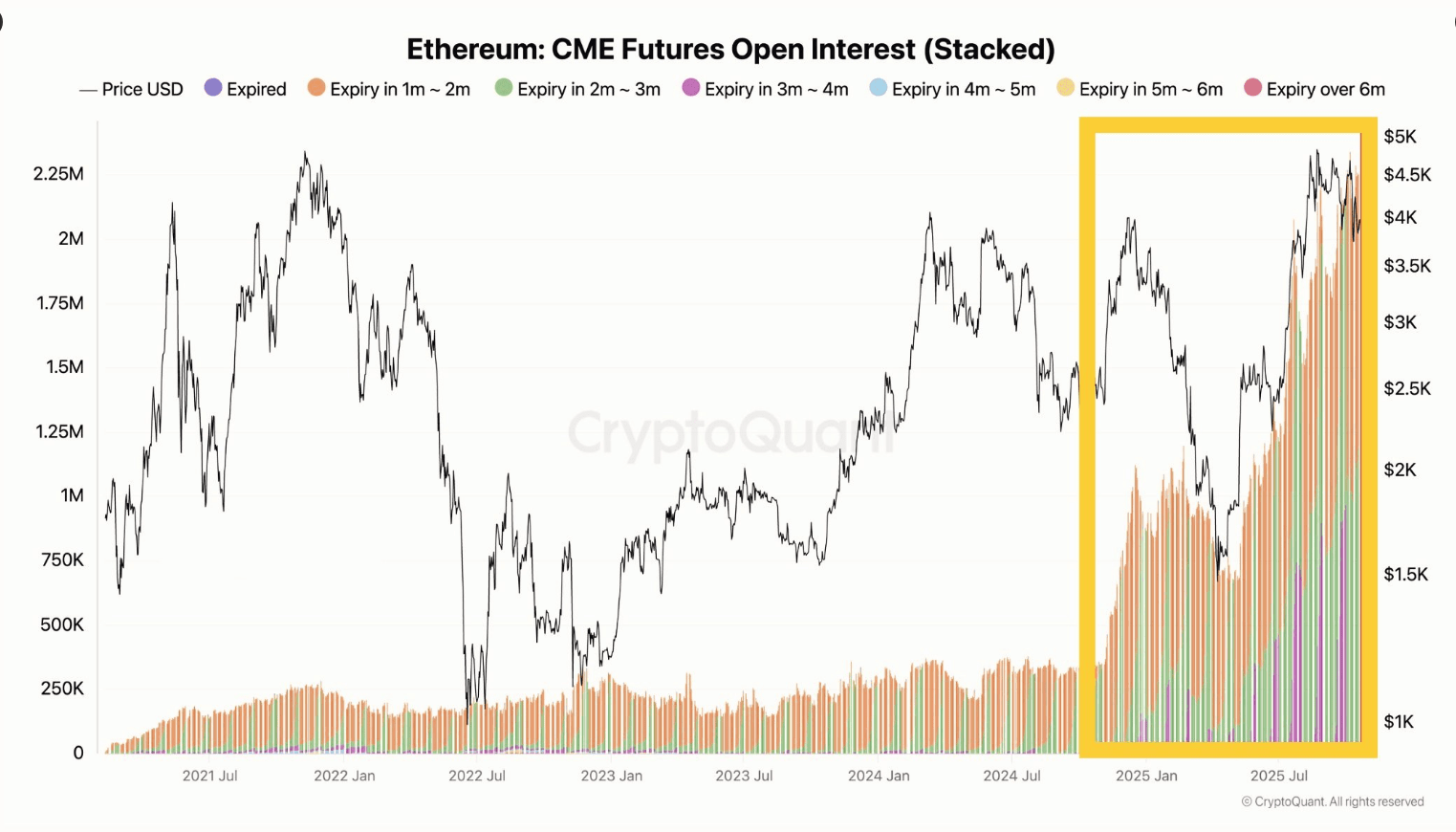

Behold, the titans of industry! CryptoQuant and the ancient repositories of exchange scrolls corroborate an upsurge of institutionally vested sentiment. Futures, those mystical oaths betwixt traders and the arcane CME, have ambitiously risen-portending a grand scheme among the learned few.

Fundstrat’s sage, Tom Lee, unfolded to the assembled a prophecy: Should the ratio of ETH to its brother, BTC, clear the enigmatic 0.087 resistance, ETH might embark toward the lofty domain of $5,000. Meanwhile, Matt Sheffield, the esteemed CIO of Sharplink Gaming, boasts of a legacy unburdened by past liquidations, for the magnitudes of antiquated payment systems (like the venerable SWIFT and its $150T yearly tableau) serve as a silent testament to the boundless potential awaiting Ethereum’s stablecoin expansion.

The tide of substantial wealth cascades toward #Ethereum, and the institution’s fervor burgeons without heed…

The burgeoning CME future’s interest foretells the astute investors’ preparations for a momentous #ETH advancement…

Mystical Markers in Technical Scribe’s Tome

The augurs of the technical realm bear witness to celestial alignments-today’s ETH prices dance tantalizingly near $3887, almost brushing with the formidable Fibonacci retrace of 0.618 at $3781. The trajectory towards $3,640, a shadow of this 0.786 retracement, with its litmus at $3443.

Technologies of arcane lore divine the possibility of a triple bottom pattern, whispering tales of re-accumulation from the venerable Wyckoff-hinting at futures of grandeur, perhaps reaching the legendary heights of $5125, soaring on the wings of the 1.618 extension. 🧭

In the grand dance, the ingress of stablecoin flows, the sudden pleasures of whale acquisitions, and the scholarly increase in futures-betting all join as harbingers of a bullish ode to the $5000 echelon. Alas, the stage is fraught with jest and jeopardy-charts may falter, block chains may shift without causing a trifle of change, and only those sage traders, diligently noting the ETH/BTC covenant, the invalidation of $3443, and the elusive fate of grandiose ledger entries, will revel in the forthcoming acts.

Read More

- Best Controller Settings for ARC Raiders

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Adapting AI to See What Doctors See: Zero-Shot Segmentation Gets a Boost

- Ben Stiller’s Daughter Ella Details Battle With Anxiety and Depression

- All Her Fault cast: Sarah Snook and Dakota Fanning star

2025-10-25 05:14