A rude awakening? My dear, “rude” is paying taxes on imaginary profits in an industry sovereign even unto itself. Alas, the revel is nearly over. The IRS, a body with all the subtlety of a Victorian inquest and twice the paperwork, is preparing its grand aria: the compliance audit! Crypto taxpayers, beware—you stand on the precipice of moral instruction… and some quite pointed letters. 📬

Sixteen years of Bitcoin and still, taxpayers and their well-groomed CPAs cling to the fiction that “all is fog and mist.” How deliciously quaint! Meanwhile, the IRS has emerged from the shadows, paperwork in one hand and the other extended expectantly. The cat-and-mouse game is finished. The auditor now owns the cheese shop.

Last year they gave us Revenue Procedure 2024-28: a “guidance” which is, in reality, less a gentle suggestion and more a velvet-wrapped cosh. Now there are deadlines, safe harbors, and all the lovely ingredients of a truly Kafkaesque nightmare. The message is clear—either don the monocle of compliance or expect an unpleasant knock on the digital door. 🕵️♂️

Already, letters bearing numbers as cryptic as a cryptographic seed phrase—6174, 6174-A, 6173—flutter down upon the nation like ill-omened ravens. Typically, the season is serene, but lately the phones ring with the freqency of a bad poet’s metaphors. Taxpayers clutch their letters in trembling hands. Crypto tax firms, psychologists by necessity, can only murmur: “You are not alone.” Misery, it seems, is decentralised.

The IRS’s cunning: pairing Rev-Proc 24-28 with the dazzling arrival of Form 1099-DA, blindsiding those who spent their tax season whistling “To the Moon!” in hopeful ignorance. The 2025 tax year shall be less a moon landing and more a forced landing. There will be no more refuge in “Unclear Guidance and Friends”—the IRS has become unexpectedly eloquent, and the penalties, my dear, are most explicit. Still, wild west cowboys abound, blissfully armed with nothing but bravado and outdated spreadsheets.

Brokers must now dispatch Form 1099-DAs to both the IRS and taxpayers, but (and here my sarcasm blushes) the “catch” is divine: the form will utterly disregard reality and present a cost basis of $0. Is it performance art? The IRS seems to think so! To them, every trade resembles a miraculous moment: “Look Ma, pure profit!”

Picture it. You acquire 1 ETH for $2,200, courier it across cyberspace to Coinbase, sell it for $2,500. Yet since cost basis is but a ghost, paperwork shows you minted $2,500 from pure imagination. Fairy tales do come true—especially when written by accountants with a taste for the absurd. Unless you, gentle reader, tracked your numbers with the devotion of a Victorian naturalist, the IRS will presume the worst (and who can blame them, given the company they keep?).

A Widespread Catastrophe—The Origin of Comedy

This, tragically, is no isolated incident. Hundreds of thousands—perhaps millions—will discover that in tax season, fortune does not favor the bold, but the boring record-keeper. Inflated profits lead to tributes paid unnecessarily or, for the overconfident, an audit invitation more dreadful than a summons to dine with one’s in-laws.

Most CPAs, poor souls, are no match for the labyrinthine logic of wallets and staking rewards. Confusing transfers for sales, forgetting to look for tokens airdropped in the dead of night—truly, crypto taxation is the great equalizer. Taxpayers imagine their CPAs have everything in hand; CPAs assume the 1099 is more accurate than a Swiss clock; and in the end no one checks, except the IRS, which checks with all the grace and subtlety of a steam-powered guillotine. 🌩️

This is the crack through which the misfortune seeps. The IRS is counting on confusion. Gone is the defense of “But the rules were unclear!” The rules are now written, carved, and, for extra measure, stapled to your forehead. The time for reform is immediate—that is, if you prefer correction to penance.

Crypto is no longer the pastime of the eccentric or the criminally creative. Millions have bought, sold, staked, lent, transferred. Most kept records with the seriousness of a child’s diary; some didn’t even bother with that. The result: A tax system swollen with cartoons, footnotes, and supposed gains, but the taxman’s patience has a time limit.

The common mistakes? Childishly simple: wallet transfers mistakenly declared as sales, phantom profits, invisible cost bases; staking rewards adrift in taxless limbo; DeFi escapades written in invisible ink. And each year, taxpayers—aided by professionals with all the crypto expertise of a goldfish—rely on CSV exports born for obscurity, not the IRS gaze. 🥲

None of this is unusual. It is the rule. At scale, the IRS now has the tools, the motivation, and—astonishingly—the paperwork to make an example of us all.

This is not about gray areas. It is about mistaken expectations. On one side: taxpayers dreaming of autonomy, frontiers, and digital sunsets. On the other: the IRS, with the cold efficiency of a well-oiled abacus, poised to end fantasy with a single audit. In that gap, dear reader, dwells risk—and, perhaps, the faintest echo of humor. After all, nothing ruins a joke faster than a tax audit.

Nota bene: These musings belong, in their entirety, to the author, who claims no responsibility should the IRS come knocking—or the editors at CoinDesk, Inc., shake their heads in sorrow.

Without Operational Alpha, Bitcoin Treasury Company Premiums Will Collapse

ICP Rebounds From Intraday Lows as Support at $4.80 Holds Firm

NEAR Protocol Surges Past $2.19 Resistance on 61% Volume Spike

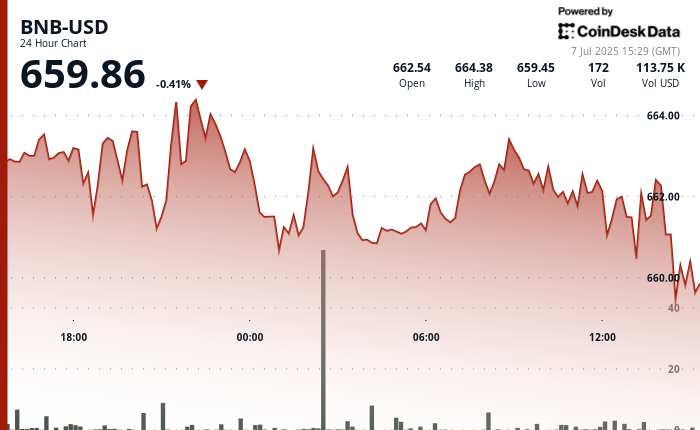

BNB Holds Near $660 as Traders Weigh Breakout Potential

Kevin O’Leary: U.S. Must Learn From Bitcoin Miners to Win ‘AI Wars’

BONK Reclaims Momentum as Solana ETF Buzz and Ecosystem Growth Drive Rally

Core Scientific, Bitcoin Miners Tumble on CoreWeave Buyout; Jefferies Says Price in Expected Range

Strategy Books $14B Q2 Bitcoin Profit, Sets $4.2B STRD Preferred ATM Offering

Bitcoin’s Potential Bull Market Resistance: $115K or $223K?

Vitalik Buterin’s New Proposal Seeks 16.7M Gas Cap on Ethereum to Rein In Transaction Bloat

UAE Authorities Debunk Reports of Getting Golden Visa by Staking Toncoin

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- 10 Movies That Were Secretly Sequels

- How to Build a Waterfall in Enshrouded

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Best Werewolf Movies (October 2025)

- Best Controller Settings for ARC Raiders

2025-07-07 21:08