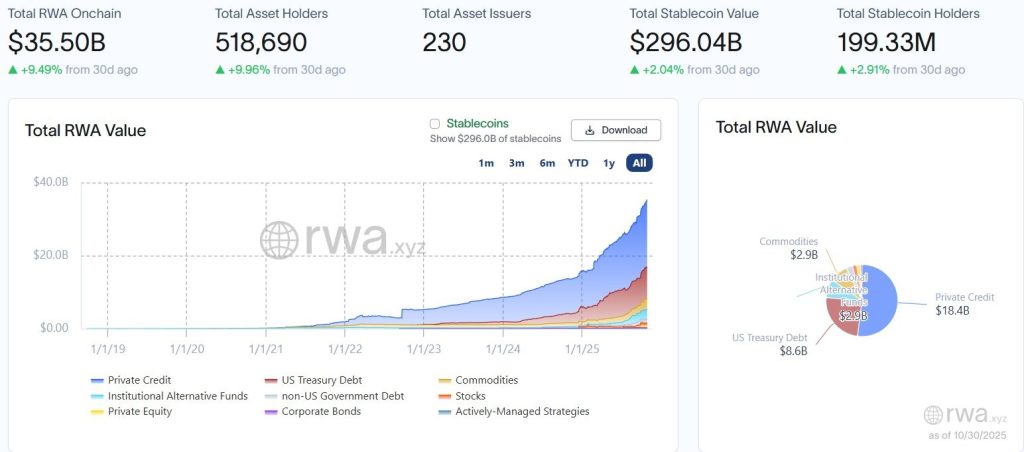

It appears the esteemed gentlemen at Standard Chartered – bless their cautiously optimistic souls – have peered into their crystal ball (or perhaps a particularly complex spreadsheet) and declared a rather… significant prediction. They envision a future, you see, where tokenized real-world assets – RWAs, as the young people say – will blossom from a modest $35 billion today into a positively staggering $2 trillion by 2028. And wouldn’t you know it, Ethereum, that ever-reliable digital estate, is expected to be the host of this particularly grand ball.

But how, one might ask, is such a leap possible? 🧐

What’s Driving the Tokenization Boom

Geoff Kendrick, a chap who apparently holds the title of “head of digital assets” at the bank (a title that sounds remarkably futuristic, doesn’t it?), postulates that this growth is not mere fancy, but a logical progression. A 57x jump, he insists, is entirely plausible in the span of a mere three years. One must admire his confidence, though I confess I find myself reaching for a pinch of salt.

The key, it seems, lies in these… “stablecoins”. Apparently, they’ve enjoyed a rather robust year, increasing by nearly 47% to reach a respectable $300 billion. This, in turn, has created abundant “on-chain liquidity” – a phrase which, frankly, feels a bit like something conjured by wizards. It apparently lays the groundwork for these… expanded DeFi products and, naturally, tokenizing things of actual value.

Standard Chartered, with a solemn air, identifies three pillars supporting this grand edifice:

- A growing acceptance, amongst the suited and booted, of these digital novelties.

- Sufficient liquidity – enough, apparently, to handle transactions of substantial size, which is reassuring.

- The proliferation of blockchain-based lending and borrowing. Because why not?

Kendrick, with a flourish of optimism, declares this a “self-sustaining system.” One almost expects a chorus of angels to descend and proclaim the dawn of a new financial age. 😉

Ethereum to Lead the Tokenization Wave

Our Mr. Kendrick further averred that Ethereum’s strength resides in its… longevity. Ten years of smooth operation, he notes – a veritable eternity in the world of technology – and an unparalleled network of trust. One wonders if he’s also accounting for the inherent unpredictability of human beings. Nevertheless, the numbers are impressive:

- $750 billion in tokenized money market funds – a sum that rather boggles the mind.

- $750 billion in tokenized U.S. equities.

- $250 billion in tokenized U.S. funds.

- $250 billion in less liquid assets – private equity, commodities, corporate debt, even real estate! My, my.

The presumption, naturally, is that much of this will reside on Ethereum, further cementing its position as the blockchain for all things tokenized and DeFi. One can almost hear the quiet smugness emanating from the Ethereum Foundation. 🤭

DeFi’s Next Frontier: Real-World Assets

For years, DeFi existed primarily as a playground for those deeply immersed in the cryptocurrency world. Now, Kendrick believes that the arrival of RWAs signals a genuine disruption of the traditional financial order. Imagine, if you will, these assets trading on decentralized exchanges, potentially rivaling the venerable stock markets of yore! A truly revolutionary concept, or perhaps just… a rather elaborate gamble?

And as if on cue, the American legislators are dabbling in some appropriate legislation, the GENIUS Act and the Digital Asset Market Clarity Act, in an attempt to inject some needed clarity. Kendrick predicts this clarity will attract institutions, setting off a virtuous cycle of growth.

Should it all come to pass, and I say should, Ethereum might very well become the bedrock of global finance. Though I, for one, shall be observing from a comfortable distance with a cup of tea and a healthy dose of skepticism.

Read More

- Gold Rate Forecast

- Wednesday Season 2 Completely Changes a Key Addams Family Character

- 10 Most Badass Moments From Arrow

- The Simpsons Kills Off Marge Simpson In Shocking Twist

- 7 Characters The Hulk Has Definitely Smashed

- How Mariska Hargitay’s Husband Supported Her After Sexual Assault

- Timothee Chalamet heist film

- Jimmy Kimmel Slams ‘Angry Finger Pointing’ Following Charlie Kirk Shooting After Building a Career off Angry Finger Pointing

- BTC PREDICTION. BTC cryptocurrency

- Vanessa Kirby Reveals Pedro Pascal Got ‘Snappy’ During Fantastic Four Events

2025-10-31 09:28