According to researchers at Cryptoquant, demand for bitcoin and ethereum in the U.S. has cooled significantly across spot and derivatives markets after the September rally.

Cryptoquant: Coinbase Premium Drop Signals Fading U.S. Buying Pressure

A new Cryptoquant report reveals that U.S. investors are finally taking a breather from bitcoin and ethereum, trading their crypto summer camp for a hammock. It’s less “buy the dip” and more “sleep through the dip,” folks.

The blockchain analytics firm notes that spot exchange premiums, ETF flows, and futures basis rates all scream “profit-taking” louder than a toddler on a sugar rush. Researchers sigh that spot bitcoin ETFs in the U.S. have turned into net sellers, logging a seven-day average outflow of 281 BTC – a slump that would make even the most bullish analyst reach for the coffee. ☕

Ethereum ETFs? They’ve been coasting on fumes since mid-August, like a car with a “Check Engine” light and no gas. Investors seem to have forgotten what “adding exposure” means after those September highs. 🤷♂️

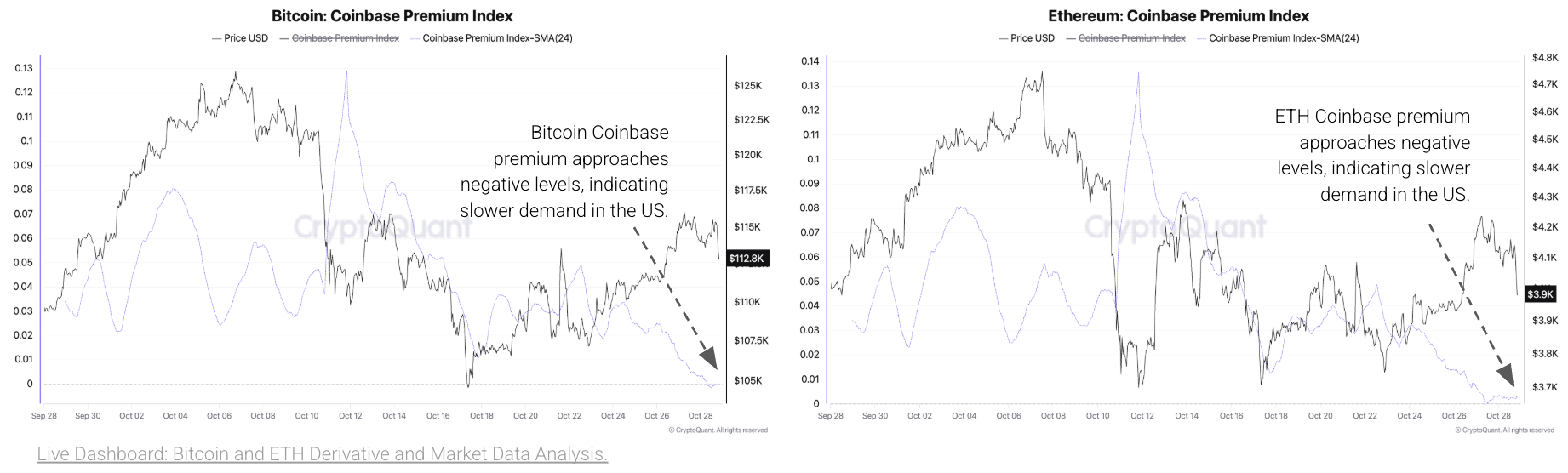

The report adds that spot demand on U.S. exchanges has gone from a roaring fire to a candle flicker. Cryptoquant’s data show the Coinbase premium for both bitcoin and ethereum is now flirting with zero, which is about as exciting as a Monday morning. Historically, price rallies come with a premium, so this flatline? That’s just the market saying, “Nah, not today.” 😬

Cryptoquant’s futures analysis isn’t much brighter. The CME bitcoin annualized basis has slumped to 1.98%, a number so low it could make a leveraged ETF blush. Ethereum’s six-month futures basis? A meek 3.0%, which is basically the market whispering, “We’re here, but we’re not doing much.”

Cryptoquant’s researchers conclude that after bitcoin hit $126,000 and ethereum touched $5,000, investors are now waiting for a plot twist like a Netflix binger paused at the cliffhanger. Institutions and retail traders alike are playing it safe, probably Googling “how to avoid FOMO.”

In short, Cryptoquant’s latest metrics suggest U.S. crypto fever has hit pause-like a TikTok video on shuffle. The market’s now in “reassess and recharge” mode, which is code for “don’t touch your wallet.”

FAQ ❓

- What did Cryptoquant’s new report find? Cryptoquant researchers found that U.S. demand for Bitcoin and Ethereum has slowed across both spot and futures markets, like a car with a flat battery.

- What does the Coinbase premium reveal, according to Cryptoquant? The near-zero premium is the market’s way of saying, “We’re here, but we’re not buying,” for both Bitcoin and Ethereum.

- How are ETFs performing based on Cryptoquant data? U.S. Bitcoin ETFs are outflowing like a leaky faucet, while Ethereum ETFs are stuck in neutral since mid-August.

- What’s next for Bitcoin and Ethereum per Cryptoquant? Traders are waiting for a plot twist, a black swan, or maybe just a better coffee. ☕

Read More

- The Most Jaw-Dropping Pop Culture Moments of 2025 Revealed

- Ashes of Creation Rogue Guide for Beginners

- ARC Raiders – All NEW Quest Locations & How to Complete Them in Cold Snap

- Best Controller Settings for ARC Raiders

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Ashes of Creation Mage Guide for Beginners

- Where Winds Meet: Best Weapon Combinations

- My Hero Academia Reveals Aftermath Of Final Battle & Deku’s New Look

- Hazbin Hotel season 3 release date speculation and latest news

- Bitcoin’s Wild Ride: Yen’s Surprise Twist 🌪️💰

2025-11-03 00:38