Ah, the delightful dance of crypto! On Sunday, November 9th, Solana’s price decided to rise by 5% – as though it had just discovered that there was a world beyond its usual trading range. This uptick lifted the token above $165 for the first time in five days, thanks to a flurry of on-chain rotations among DeFi protocol enthusiasts. But, my dear reader, don’t rush to uncork the champagne just yet. There are signs that a short-term reversal could be just around the corner. Yes, the ever-ominous 20-day moving average stands tall as a stubborn wall, preparing to play the role of resistance. But then, who ever said crypto was a gentle affair?

Solana’s the top dog in DEX Volume (last 24h) – according to none other than the great Solana Sensei himself!

– Solana Sensei (@SolanaSensei) November 9, 2025

Solana, our feisty crypto champion, made its triumphant return above $165 on Sunday after a rather humdrum week of consolidation. This little surge was in sync with the broader market’s modest recovery, as most of the top 10 cryptocurrencies decided it was high time to put on their Sunday best. Bitcoin, for example, managed to gain 3%, nudging itself back up to the lofty heights of $104,000, while Ethereum trundled ahead with a 6% rise, settling at around $3,900. It’s as though the whole lot of them were all invited to a grand crypto soirée, and, as always, Solana was the one who couldn’t resist making a big entrance.

But let’s not get lost in the price action alone, as there’s more to this story than just numbers on a screen. The DeFi community, ever the connoisseurs of decentralized financial wizardry, displayed a clear fondness for Solana. According to data from Defillama, it was revealed by the ever-watchful Solanasensie on X, that Solana’s decentralized exchanges had broken the $5.11 billion mark in daily volumes, leaving Ethereum’s $3.8 billion and BNB Chain’s $2.95 billion in the dust. Who would’ve thought?

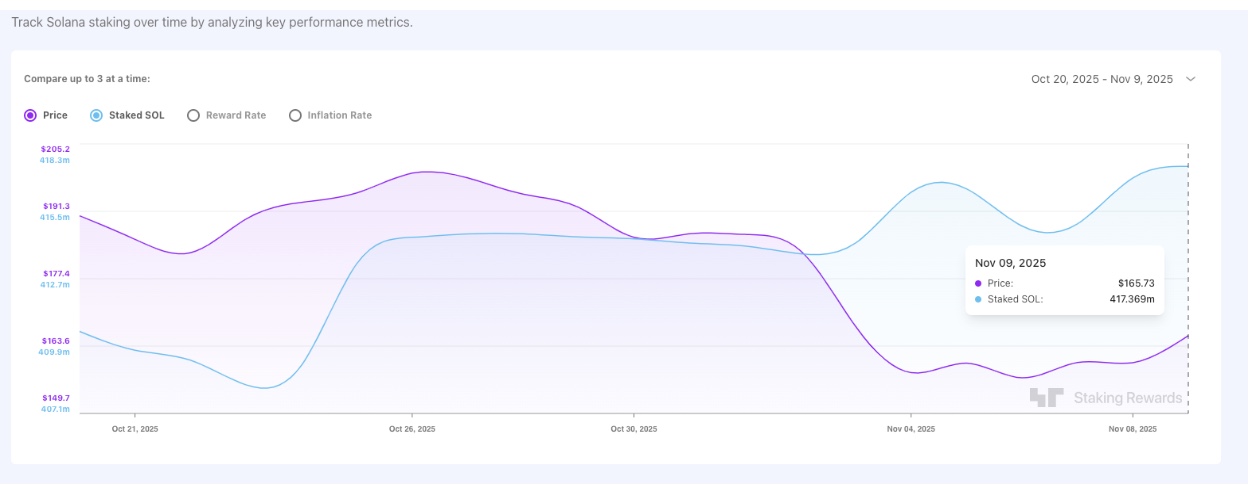

Total Solana Staked Increased by 2.9 million SOL ($475 million) | Source: StakingRewards.com

It appears that traders have been rotating capital within Solana-native DeFi protocols, like a game of musical chairs – but in this game, no one’s actually leaving, because passive yield is apparently far more attractive than, you know, leaving or holding stablecoins. A brilliant strategy, indeed, ensuring that capital stays snugly within the ecosystem. The numbers don’t lie: Between Friday and Sunday, Solana’s total stake surged by 2.9 million SOL, or $475 million, according to StakingRewards. This temporary reduction in short-term supply on exchanges may just serve to buffer Solana from the dreaded price pullback. And who wouldn’t want to insulate themselves from such a thing? We’ve all seen those sharp dips before. Not fun.

As always, strategic traders are keeping an eye out for some fresh institutional inflows or a macroeconomic catalyst to give them the go-ahead to take a larger position. After all, a breakout towards the $180-$200 range in the coming week is a rather tempting prospect. But, alas, who can say what fate holds for this wild crypto beast?

Solana Price Forecast: 62% Reversal Probability Caps Rally Below $180 Resistance

Solana, after a joyous weekend performance, has managed to reclaim the $165 level, but as always with these cryptos, there’s more drama in store. According to some highly scientific and ever-so-precise indicators, while the momentum is decidedly bullish, it’s highly likely that Solana will face some resistance before reaching the coveted $180 mark. Think of it as a difficult second album that may not live up to the hype.

With the Breakout Probability (Expo) indicator in play, Solana’s chances of a bullish breakout toward $180 are pegged at a mere 29%. Meanwhile, the probability of a downside move remains rather robust at 62%. Let’s just say that the bears have not completely left the building yet. One can almost hear their grumbling in the distance, waiting for their cue to step back on stage. The Bollinger Bands, that trusty pair of cryptographic spectacles, indicate a narrowing of volatility. The middle band sits at $180.06, eyeing that key resistance, while the lower band waits patiently at $149.58 to provide some relief if things go south.

Solana (SOL) Price Forecast | Source: TradingView

The momentum indicators, always so willing to show their true colors, add to the cautionary tale. The RSI (14) is hovering around 40.36, still above the oversold region but not exactly radiating confidence. And the MACD (12, 26) remains firmly in bearish territory, as negative histogram bars stare at us with all the subtlety of a hungry bear. The signal line sits at -9.24, while the MACD line lingers at -10.92. This all suggests that while the bears are taking a nap, they haven’t been entirely vanquished.

The win-to-loss ratio stands at a solid 1,307 to 733, giving a moderate 64.07% profitability, which, let’s face it, is neither here nor there. It suggests that a short-term rebound could be in the cards, but that might only happen once the spot volumes rise enough to keep Solana’s on-chain activity buoyant.

If Solana can manage to hold onto its gains and close above $170 on decent daily volume, we might just see it pushing towards that $180 resistance. But if it can’t hold $160, expect a retest of the $150 support zone. The drama is far from over, my friends.

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Ashes of Creation Rogue Guide for Beginners

- Best Controller Settings for ARC Raiders

- Can You Visit Casino Sites While Using a VPN?

- One Piece Just Confirmed Elbaph’s Next King, And He Will Be Even Better Than Harald

- Michael B. Jordan Almost Changed His Name Due to NBA’s Michael Jordan

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

- Crunchyroll Confirms Packed Dub Lineup for January 2026

- AKIBA LOST launches September 17

2025-11-10 08:44