Oh, what a tale of woe and wonder! Arbitrum’s ARB token, that elusive creature of the crypto wild, stirs once more. With technical charts scribbling like a drunkard’s diary, on-chain metrics humming a tune of “maybe, maybe not,” and a community so confident they’ve probably already bought their yachts (just kidding, no yachts yet), the stage is set for a performance only Gogol could appreciate. Liquidity sweeps like a broom of fate, and price clings to key zones like a beggar to a feast-could this be the prelude to a bullish crescendo? Only time will tell, or perhaps only the tea leaves of a soothsayer.

ARB’s Breakout: A Ballet of Liquidity and Desperation

Behold, the liquidity sweep! ARB, with the grace of a startled goose, has reclaimed its lost territories, forming a “textbook reclaim pattern” (a phrase so technical it sounds like a spell from a grimoire). From $0.38 to $0.40, the price wobbles like a toddler on a tricycle, then charges toward resistance like a bull in a china shop-except the china shop is a chart, and the bull is hope. The $0.50 pivot looms, a gatekeeper to a realm of $0.65-$0.70 dreams. Will it hold? Or will it crumble like a stale cake at a funeral?

Technically speaking, the chart now resembles a spiderweb spun by a caffeinated arachnid. Resistance at $0.35? A mere speed bump for bulls, who charge forward with the fervor of a horde of maniacal squirrels guarding their acorns. If the $0.50 pivot falters, expect a parade of bears to march in, waving flags of “buy the dip” (a phrase that makes as much sense as a square circle). But should the bulls prevail? Ah, the $0.65-$0.70 liquidity pocket awaits, a treasure chest for those who dare to dream-and perhaps a trap for those who don’t.

Macro Divergence: The Oracle of Bullish Whispers

Let us now consult the oracle of higher timeframes, where ARB’s weekly chart dances a sly waltz of bullish divergence. Lower lows, higher RSI lows-it’s like watching a magician pull a rabbit out of a hat, except the rabbit is a 200% rally. The 50-week EMA, once a stoic sentinel, now flirts with flattening, whispering secrets of 2023’s L2 recoveries. Could history repeat itself? Perhaps, but history also repeats itself with the reliability of a broken clock striking midnight twice daily.

The macro support against Bitcoin? A fragile lifeline, thin as a spider’s thread. If volume confirms this farce, ARB might ascend to 0.000058 BTC, a number so small it could fit in a teacup. But remember, dear reader: in crypto, even teacups can overflow, and overflows often end in chaos.

Fundamentals: A Symphony of Developer Hype

Arbitrum’s fundamentals sing a siren song to developers, promising cross-chain messaging, L2 precompiles, and gas models so efficient they’d make a monk weep. Is this the stuff of which empires are built? Possibly. The ecosystem now boasts a “developer-friendly EVM-compatible chain” (a title so grand it deserves a medal). With these tools, Arbitrum struts into the Layer 2 arena, a peacock among chickens, while the community cheers like it’s the final act of a Shakespearean tragedy.

On-Chain Activity: A Carnival of Transactions

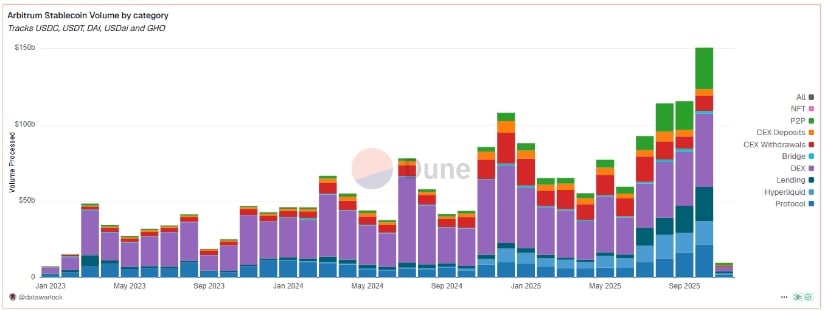

Rand’s data, that numerical jester, reveals a $27 billion stablecoin circus in October, a 45% leap from September. Peer-to-peer payments? A carnival of activity, where every transaction is a balloon animal and every user a grinning child. Does this herald a new era of adoption? Perhaps. Or perhaps it’s just a flash mob of temporary insanity. Either way, the correlation between throughput and valuation is as clear as mud-or as a mud pie, depending on your perspective.

Capital returns to the ecosystem like a prodigal son with a suitcase of cash, and the market whispers, “This feels familiar.” History, that fickle flirt, may yet wink again, but don’t bet your last kopeck on it.

Short-Term Breakout: A Tragicomedy of Errors

BlackBeard’s 4H chart now resembles a drunken sailor’s map, with ARB trying to escape a descending channel. RSI bounces, volume swells-it’s all the makings of a breakout, or perhaps a breakout of madness. Resistance at $0.48 looms like a dragon guarding a hoard, while $0.54 and $0.62 whisper promises of glory. But Asia session flows? A fickle mistress, to be sure. Bulls may charge, but consolidation phases have a way of turning parades into funerals.

Will the structure hold? Only the gods of volatility know. And they’re currently on vacation in Bali, sipping coconut water and ignoring all calls.

Final Thoughts: A Farce in Five Acts

Arbitrum, that eternal jester of the blockchain, now waltzes across technical, fundamental, and on-chain stages. Liquidity grabs, bullish divergences, and rising throughput-all signs of a recovery, or merely the prelude to a spectacular crash? The community dances with optimism, developers return like pilgrims to a holy site, and traders hold their breath, hoping $0.50 isn’t a mirage. If the bulls conquer this pivot, the path to $0.70 may open-but remember, in crypto, even the most certain paths often end in a swamp.

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- A Guide to Derek Hough and Julianne Hough’s Family

- One Piece Just Confirmed Elbaph’s Next King, And He Will Be Even Better Than Harald

- Why Stranger Things’ Conformity Gate conspiracy should be game-changing for TV

- Street Fighter 6’s Upcoming Roster Addition Alex Gets Teaser Trailer Ahead of Spring Release

- 4 Dark Robin Futures Revealed in DC K.O.: Knightfight

- XRP’s Week Ahead: Bulls, Bears, or Boredom? 🌊💰

2025-11-11 03:06