Oh, what a dramatic turn of events! Uniswap’s coin, ever the showman, has taken a sharp reversal after a brief flirtation with last week’s range high, leaving analysts in a state of confused admiration. One might say it’s the financial equivalent of a tragic opera-beautiful, bewildering, and slightly overwrought. 🎭💸

Weekly Range Sweep Triggers Reversal

According to the post, the move triggered a sharp drop of over 25%, indicating the sweep functioned as a distribution event, not a continuation. One might argue that the market is merely being its usual self-generous with highs and stingy with lows. 🧠💣

The shaded zone on the chart traces the move from the Monday high, through the mid-range, and toward the lower boundary, confirming the reversal behavior. A tale as old as time: rise, fall, repeat. 🌀

The analyst points out that when early-week ranges are violated and then reversed, they often signal deeper retracements rather than breakout setups. For the, this means that while initial momentum appeared strong, the reversal suggests caution until support zones hold and new trend structure forms. A reminder that even the most promising ventures can be derailed by a single bad day. 🚂📉

Technical Setup Suggests Consolidation or Breakout Decision

Another post on x from another analyst depicts the UNI/USDT pair, showing a descending trendline that has capped prices after prior lower highs and lower lows. The chart indicates an earlier sharp run into the $12.30 high, followed by profit-taking and recent consolidation between roughly $7 and $8. A classic case of “highs, lows, and a dash of confusion.” 🧩

Commentary from X suggests that the coin must reclaim the descending resistance to reset momentum. Failure to do so may keep the price locked in the consolidation band. Conversely, a breakout above trendline resistance could shift the structure toward an upward move. The key is volume confirmation and breaking above the resistance zones. A game of chicken, one might say, with the market as the ultimate driver. 🚗💨

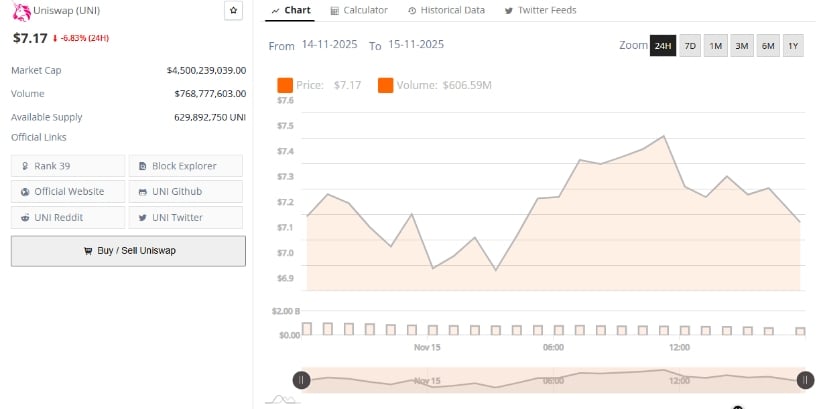

UNI Consolidates Near $7.17 as Market Stabilizes

As of November 15, 2025, data from BraveNewCoin shows the coin trading at $7.17, reflecting a 6.83% daily decline amid wider market consolidation. Despite the short-term retracement, structural support remains firm between $6.30 and $6.50, aligning with mid-range Fibonacci zones that have historically served as accumulation areas. A testament to the resilience of the unyielding investor. 🦄

The coin’s market capitalization stands at $4.50 billion, with daily trading volume of $1.11 billion and 629.89 million Tokens in circulation, ranking it #39 globally by market cap. While short-term volatility persists, analysts point to continued on-chain stability and steady liquidity inflows as signs that buyers are maintaining control of the mid-range structure. A battle of wits between the bulls and bears, with no clear victor. 🐂🐻

Whether consolidation within the $7-$8 region forms a launch base or extends into a deeper pullback will depend on market participation as liquidity conditions evolve. A cliffhanger if ever there was one. 🎬

Indicators Show Early Recovery but Resistance Remains Strong

At press time, UNI trades near USDT 7.329, reflecting a +4.82% daily gain. On the Bollinger Bands, price sits above the basis line (~USDT 6.452), with the upper band near USDT 8.637 and the lower band near USDT 4.266, highlighting elevated volatility. The most recent high at USDT 12.30 remains major overhead resistance. A mountain to climb, but perhaps one worth the effort. 🏔️

The MACD shows the MACD line at 0.259, above the signal line at 0.053, with a green histogram indicating early bullish momentum. However, prior peaks near upper bands have led to sharp retracements, so a valid upside ideally requires a breakout above the resistance zones. Until then, the price may consolidate or pull back before any strong directional move. A waiting game, with the stakes ever higher. 🎲

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 10 Movies That Were Secretly Sequels

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Goat 2 Release Date Estimate, News & Updates

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- Tom Green Marries Amanda Nelson in Intimate Ceremony

2025-11-15 23:04