The world’s most valuable company, with a fortune as wide as the Pacific, has not only silenced critics but also whispered promises of $500 billion in revenues by 2026. We’ll see how long that lasts.

With a Flick of Its Silicon Wand, Nvidia’s Q3 Results Unleash Magic – But for How Long?

In an ironic twist of fate, the fate of the AI bubble now lies not in the hands of tech prophets or Wall Street sages, but in the mighty palms of a chip-making titan, Nvidia. And when the numbers were read aloud-stronger than expected-Nvidia’s Californian fortress breathed a sigh of relief. For now, the AI bubble is… held at bay.

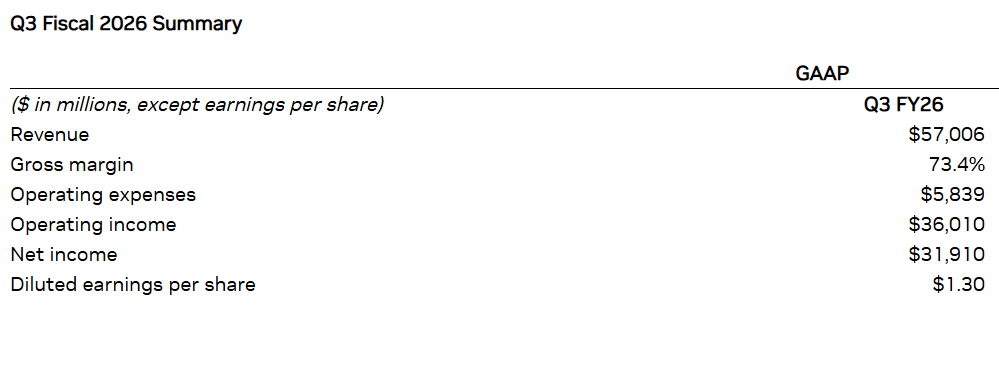

Nvidia, with its quarterly numbers flashing green in a sea of red, declared a record-breaking $57 billion in revenue for Q3-up 22% from the previous quarter and 67% from the same time last year. Earnings per share? Analysts had predicted a modest $1.26, but Nvidia spat out a hefty $1.30 per share. Talk about overshooting expectations.

And the forecast for Q4? Brace yourselves-$65 billion in revenue, with a profit margin so fat it might as well have its own zip code. CEO Jensen Huang didn’t just stop there. He boldly claimed, “This is how much business is on the books. Half a trillion dollars worth so far,” before CFO Colette Kress showed no signs of dialing it back. “We’re just getting started,” she said, practically daring the critics to blink.

And yet, here’s the tricky bit: how long will this meteoric rise continue? The AI boom has sparked as much skepticism as it has excitement. Among the more… curious criticisms is a little phenomenon known as “round-tripping.” Oh, you know, the delightful practice where Nvidia funds AI firms like OpenAI, which then proceed to buy vast quantities of Nvidia chips to power their grandiose data centers. Sounds like a game of monopoly, right?

As Bryan McMahon, an independent AI researcher, put it, “Like the mythical ouroboros, the snake that eats itself, the AI economy turns equity investments from Nvidia and others into purchases of their own products. It’s self-sustaining-or is it?”

And just two days ago, Nvidia was at it again, cutting a $10 billion check to Anthropic to help deploy its Claude models on Microsoft’s Azure cloud platform. Microsoft, of course, uses Nvidia chips. What a beautiful little circle of capital recycling! But here’s the real question: what happens when this merry-go-round of cash can’t keep up with the unrelenting demands of AI expansion?

But for now, Nvidia’s ship sails on, unscathed by the storm of skepticism. The company’s shares surged by 5% after the Q3 results were announced. Opening at $194, Nvidia’s market cap has now surpassed a cool $4.7 trillion. Feels like the AI bubble might just be a figment of our over-caffeinated imaginations.

“There’s been a lot of talk about an AI bubble,” Huang said, taking the stage with all the gravitas of a man who knows something we don’t. “From our vantage point, we see something very different.” And yet, we all wonder: does Nvidia see the future, or just a mirage?

FAQ ⚡

- Why did Nvidia’s stock jump after earnings?

It crushed Q3 expectations with a dazzling $57B in revenue, putting AI bubble fears to bed-at least for now. - What’s Nvidia’s next move?

They’re eyeing over $500 billion in future revenue, with Q4 sales pegged at a neat $65B. - Why are some analysts still cautious?

“Round-tripping” is the buzzword. Nvidia funds AI firms that buy back their own chips. It’s like funding your own paycheck. - Is the AI bubble narrative dead?

Not quite. Nvidia’s results have temporarily calmed the storm, but we’ll see how long the ride lasts.

Read More

- Ashes of Creation Rogue Guide for Beginners

- Can You Visit Casino Sites While Using a VPN?

- Best Controller Settings for ARC Raiders

- Transformers Powers Up With ‘Brutal’ New Combaticon Reveal After 13 Years

- The Deeper Meaning Behind Purple Rain & Why It Was Used in Stranger Things’ Series Finale Explained

- Unveiling the Quark-Gluon Plasma with Holographic Jets

- 5 Xbox 360 Games You Forgot Were Awesome

- Marvel Wants You to Believe Wolverine Is the Greatest Anti-Hero (But Actually He’s the Worst)

- If you ditched Xbox for PC in 2025, this Hall Effect gamepad is the first accessory you should grab

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

2025-11-20 20:27