The final trading day of the week turned into a bloodbath. Bitcoin, that ancient beast, decided to take a nosedive, finding itself hugging the earth at a precise $82,000-an odd, almost poetic number. It didn’t just fall; it plummeted with style. In the blink of an eye, it triggered a liquidation storm, one that wiped out nearly $2 billion in long positions in just 24 hours. CoinGlass reports this as one of the biggest wipeouts since the October massacre. That’s right, folks-watch out for falling wallets.

TL;DR

- BTC lands at a perfect $82,000 bottom after losing a hefty $10,000 this week. The timing, though? Impeccable.

- XRP nosedives to $1.8467 but the Bollinger Bands hold strong, suggesting there’s still hope-somewhere.

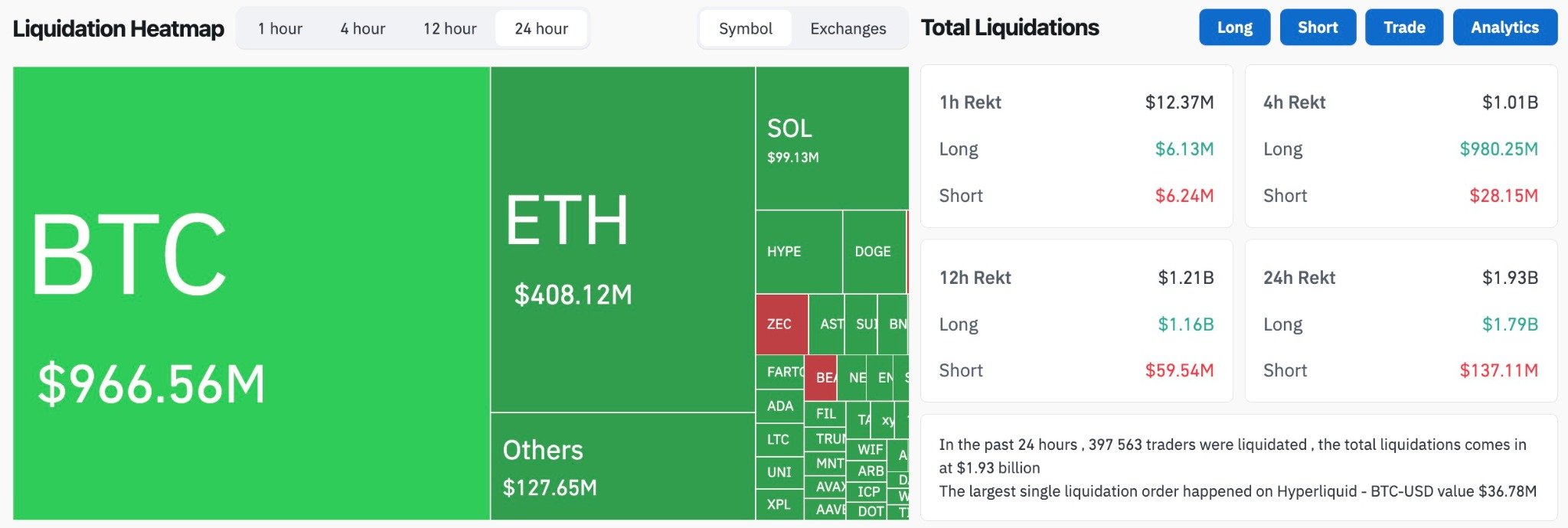

- Liquidations hit $1.93 billion in 24 hours. Spoiler alert: it’s mostly long positions taking the fall.

Bitcoin Finds Its $82,000 Bottom (Or Was It A Trap?)

Bitcoin lost a staggering $10,000 this week, but the grand finale arrived today. In an hour so fast it could have been a speedrun, BTC dropped 5%, landing squarely at $82,000. Not a penny more, not a penny less. Precision like this only happens when the universe (or the liquidation engine) is in a particularly cruel mood. One second it was at $85,000, then boom-straight to $82,000, as if it had a date with destiny. Is it a final capitulation, or just the beginning of a deeper abyss? Who knows. But hey, we’re all here for the drama, right?

The wick? It’s not just a wick. It’s a cosmic sign-or maybe just a big ol’ red flag that tells us this is either the end or a new beginning. The real question is whether BTC can rise above $84,000-$85,000 to give us a taste of hope, or if this drop is only the first chapter of a tragic novel.

As the week closes, BTC is still clinging to its $82,000 grave, stuck at the bottom of a multi-week downtrend. A familiar echo of October’s shockwave haunts the market. Let’s just say, it’s not the kind of deja vu anyone’s enjoying.

XRP Hits the Wall… But Wait-There’s Hope?

XRP finally gave in to the pressure and slipped under the fabled $2 mark during the morning chaos. It reached $1.8467, but let’s not jump to conclusions-this wasn’t as catastrophic as it seemed. While Bitcoin was busy making dramatic exits, XRP’s drop was a little more measured. It’s almost like XRP knew it had to save some energy for later.

But here’s the silver lining: XRP’s monthly Bollinger Bands aren’t throwing in the towel yet. The price didn’t break the midband, meaning it’s not the end of the road-just a little bump. Sure, there was a red candle, but no big meltdown. If BTC finds some strength, XRP could easily bounce back-watch out for that $2-$2.10 range.

The market’s not ready to give up on XRP just yet. But if it does, we can all just blame the market’s existential crisis. After all, what’s crypto without a little drama?

$2 Billion Liquidation Tsunami: Hold On to Your Seats!

In case you missed it, CoinGlass reports that nearly $2 billion in liquidations were triggered within 24 hours. That’s $1.93 billion, if we’re going to be exact. And when you break it down, Bitcoin took the brunt of the damage, with $966 million gone in a blink. Ethereum wasn’t far behind, losing $408 million. Solana? Well, it contributed $99 million to the cause. The real kicker: $36.78 million was erased in a single BTC/USD order on Hyperliquid. Talk about a whale of a loss.

The liquidations didn’t stop with futures. Oh no, there are rumors flying around Twitter that crypto funds are collapsing under the weight of this market wipeout. Big players are allegedly liquidating billions of assets to cover internal losses. But of course, no official word yet-just the sweet, sweet sound of market chaos.

Meanwhile, Bloomberg’s got their eye on Strategy (MSTR). Apparently, JPMorgan believes there’s a good chance this asset gets kicked off major indices thanks to its overreliance on digital assets. If that happens, MSTR could see $2.8 billion in outflows. We won’t know until January 2026, so feel free to panic in 2026. Or not. You do you.

Crypto Market Outlook: Will We Ever Get Out of This Hole?

Friday’s session was a bloodbath-a leverage-clearing bloodbath, to be specific. Whether the market can recover above the $83,000 mark remains to be seen. If it does, we’ll probably call it “stabilization.” If not? Well, buckle up-this could be the beginning of another downward spiral. The $2 billion liquidation wave has reset everything, so the close of this week will tell us if we’re in for a bounce or a crash. Stay tuned.

Bitcoin (BTC): It’s stuck at $83,800 with resistance around $85,000-$86,500 and support at $82,000 and $79,500.

XRP: Trading near $1.94 with a ceiling at $2.00-$2.10, and support at $1.86, then $1.74 (monthly midband). Oh, the suspense.

Read More

- Best Controller Settings for ARC Raiders

- Donkey Kong Country Returns HD version 1.1.0 update now available, adds Dixie Kong and Switch 2 enhancements

- How To Watch A Knight Of The Seven Kingdoms Online And Stream The Game Of Thrones Spinoff From Anywhere

- Ashes of Creation Rogue Guide for Beginners

- PS5’s Biggest Game Has Not Released Yet, PlayStation Boss Teases

- When to Expect One Piece Chapter 1172 Spoilers & Manga Leaks

- New Netflix Movie Based on Hugely Popular Book Becomes An Instant Hit With Over 33M Hours Viewed

- Darkwood Trunk Location in Hytale

- Hytale: Upgrade All Workbenches to Max Level, Materials Guide

- Sega Insider Drops Tease of Next Sonic Game

2025-11-21 13:28