While the token has shown signs of stabilization on lower timeframes, its broader trend remains under pressure-like a toddler on a trampoline, trying desperately to stay upright. Traders are now fixated on open interest levels and daily indicators, wondering if this is a prelude to a reversal or just another leg down. 🤷♂️

Analyst Insight: FLOKI Shows Slow Recovery but Faces Rejection Near $0.000050

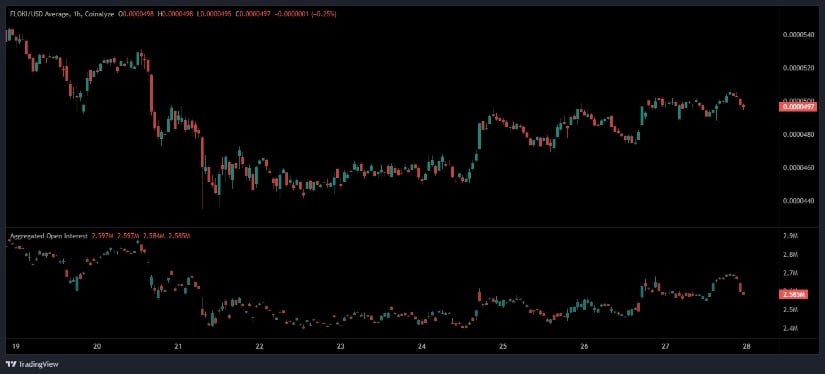

Short-term price action shows FLOKI slowly recovering after an early sharp decline, like a hangover after a wild party. The token rebounded from the $0.0000470 to $0.0000480 zone before attempting an upward push. The structure on the 1-hour chart has shifted from volatile declines to the formation of consistent higher lows, hinting at improving sentiment among short-term participants. Despite this, price action near the $0.0000500 level shows clear rejection, suggesting that buyers are struggling to break through a nearby supply zone that has capped momentum. 🚧

Across the mid-range portion of the chart, the coin entered a tight horizontal consolidation pattern, like a squirrel trying to decide whether to go left or right. This sideways movement began after bulls attempted a breakout around the 25th, but follow-through remained limited and quickly lost strength. While the trend remains mildly bullish within the short-term structure, the lack of aggression from buyers prevents any strong directional shift from taking hold. 🐿️

Open interest mirrors this cautious behavior, declining during the initial sell-off and flattening during the consolidation phase between 2.55 million and 2.60 million. This drop in open interest is consistent with reduced leveraged positioning, often signaling caution or partial profit-taking from speculative traders. As memecoin approaches resistance again, the falling open interest highlights a lack of conviction behind the latest push, suggesting that any breakout above $0.000050 will likely require renewed liquidity and a larger inflow of fresh positions. 🧠

BraveNewCoin Market Overview: FLOKI Rises 1.44% as Market Cap Approaches $480M

BraveNewCoin data shows the token trading at $0.00004957, marking a 1.44% gain over the last twenty-four hours. The memecoin’s market capitalization stands at $478,738,848, supported by daily trading volume of $46.5 million. With a supply of 9.65 trillion tokens, the asset currently ranks 158th, maintaining a mid-cap position in the broader digital asset sector. Despite the modest price improvement, trading behavior remains quiet, reinforcing the notion that the market is still in a cautious, wait-and-see mode. 🤔

Over the past day, volume hovered around the $36 to $46 million range, showing that participation is present but far below levels seen during stronger bullish cycles. Price fluctuated between $0.0000490 and $0.0000510 throughout the monitoring period, confirming the narrow band within which the coin has been oscillating. This restricted movement indicates hesitation from major players as the market awaits clearer signals from both technical indicators and broader sentiment. 🧭

The slight increase in daily price performance has not shifted the overall tone, which remains neutral-to-bearish. The coin’s inability to stretch meaningfully above $0.000050 keeps it pinned beneath key resistance, while market participants track its behavior closely to determine if continued tightening in volatility will lead to a stronger directional move. 🧪

TradingView Technicals: Downtrend Persists as MACD and CMF Signal Weak Participation

On the 1-day timeframe, FLOKI continues drifting lower after a steady multi-week decline, with price holding around $0.0000496. The chart clearly shows fading bullish momentum since late October, where repeated lower highs and consistent breakdowns beneath support zones have reinforced a bearish structure. Candles have become smaller, and volatility remains compressed, signaling weak participation and gradual selling pressure rather than sharp capitulation. 📉

The MACD indicator confirms the weakening trend, with the MACD line staying below the signal line and holding in negative territory. Although the histogram shows a slight reduction in bearish momentum, no bullish crossover has formed, leaving buyers without technical confirmation of a reversal. Previous MACD recovery attempts earlier in November were shallow and quickly reversed, demonstrating that upward momentum has remained fragile for several weeks. 🧪

The Chaikin Money Flow remains firmly negative at approximately −0.15, showing persistent capital outflows and continued distribution. As long as CMF stays below the zero line, the assets’ upside potential remains limited, and buyers will need to return with stronger volume to shift the balance. Without improved inflows, rallies are likely to encounter resistance quickly, keeping the token confined within its current compressed structure. 💸

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- XRP: Will It Crash or Just… Mildly Disappoint? 🤷

- Katy Perry and Justin Trudeau Hold Hands in First Joint Appearance

2025-11-29 00:28