Pray, Attend:

- The IMF, in its wisdom, frets that dollar stablecoins might usurp the humble currencies of lesser nations, thus elevating the allure of Bitcoin, that scarce and haughty darling of the digital realm. 🌍💸

- Bitcoin, for all its grandeur, remains shackled by its own design-slow confirmations, fickle fees, and a dearth of smart contracts. Layer 2 solutions, however, are afoot, promising to transform this tortoise into a hare. 🐢🐇

- From Lightning to sidechains, the race is on to capture Bitcoin’s liquidity, each project vying to be the belle of the DeFi ball. 🎠✨

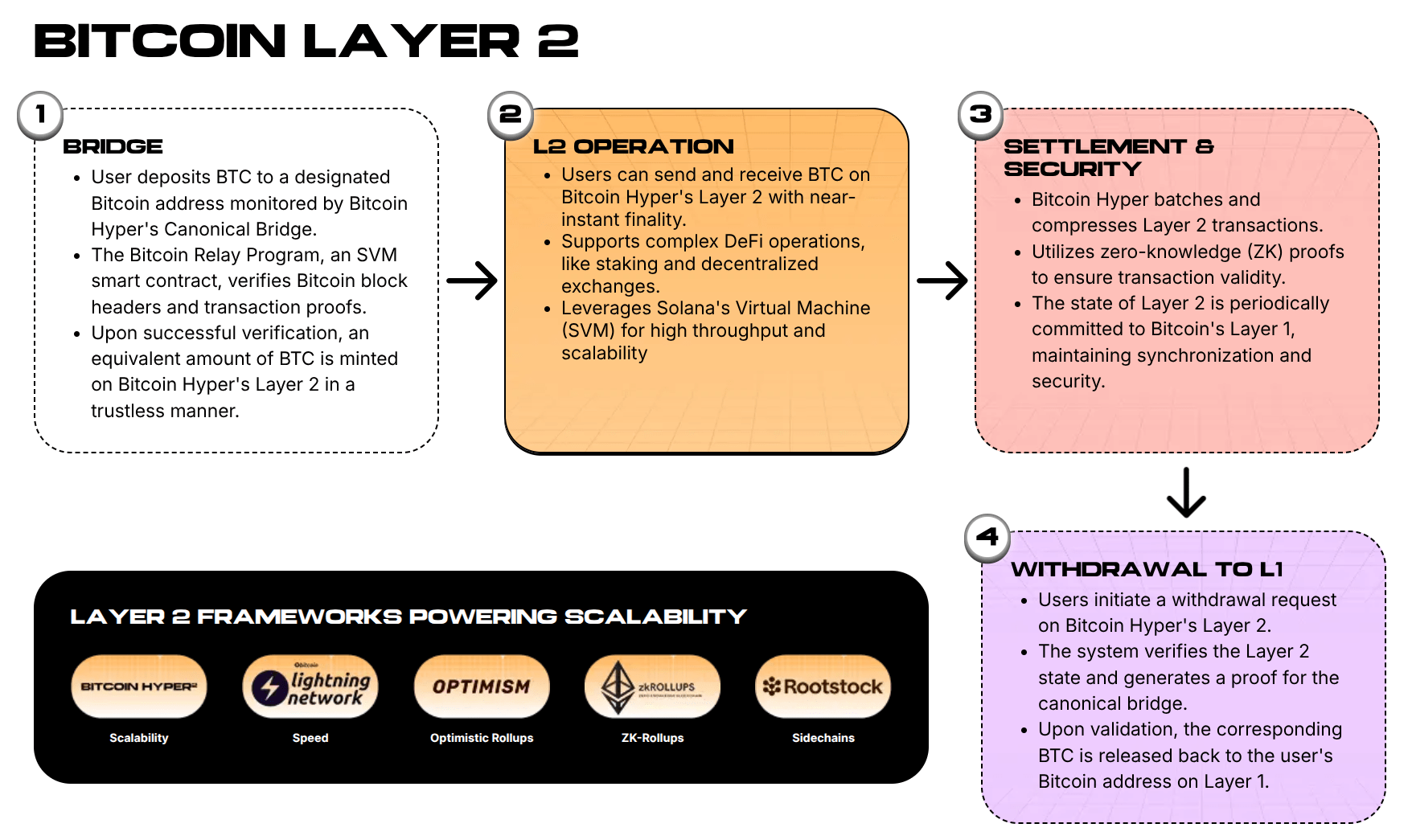

- Enter Bitcoin Hyper, a Layer 2 solution with the audacity to marry Bitcoin’s stoic charm to the Solana Virtual Machine’s zest, offering smart contracts at a pace that would make even the most impatient gentleman swoon. 💍⚡

Stablecoins, it seems, are the talk of the town-or rather, the bane of central banks, according to the International Monetary Fund (IMF). In a recent missive, they warn that these digital upstarts might hollow out weaker currencies, leaving the Peruvian sol, Nigerian naira, and Turkish lira to wither like unloved wallflowers at a ball. 🕊️💔

Yet, the IMF does not entirely condemn these innovations, acknowledging their merits in cheaper and swifter payments, and a user experience as smooth as a well-rehearsed dance. Not all is gloom in this tale. 🌟💃

But beneath this technocratic fret lies a deeper narrative-one of scarcity and sovereignty. Bitcoin, with its unyielding cap, stands as a hedge against the whims of central banks, a beacon for those who prefer their assets untarnished by the printing press. 🛡️⚖️

Thus, the focus shifts from mere price speculation to the infrastructure that makes Bitcoin more than a curiosity. If Bitcoin is to reign as a neutral reserve, the true opportunities lie in the tools that render it programmable, spendable, and useful in the grand theater of DeFi. 🛠️🎭

Bitcoin Hyper ($HYPER)

Why Bitcoin Layer 2 Infrastructure Is the New Darling

When the IMF flags stablecoins as a systemic risk, it inadvertently admits the fragmentation of monetary power. No longer must one choose between local fiat and a bank account; now, the options include dollar tokens and non-sovereign assets like Bitcoin, all at the tap of a screen. 📱💫

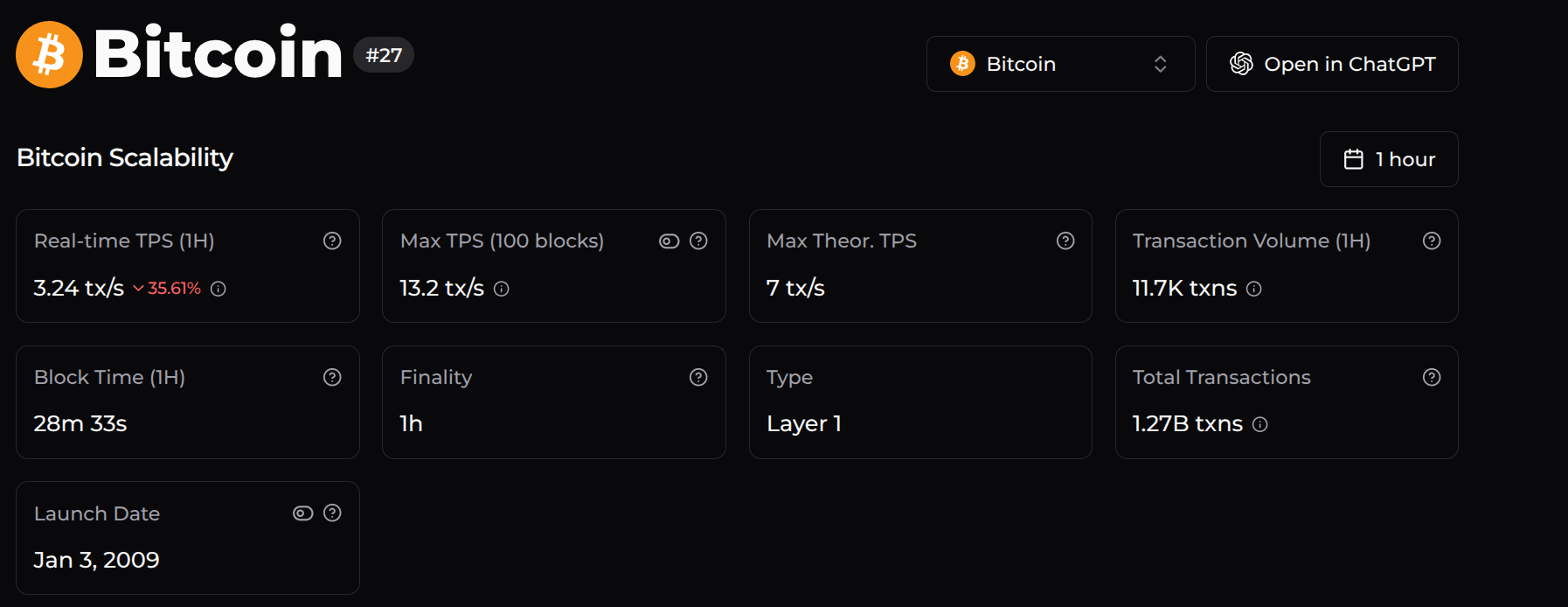

This shift has not only bolstered Bitcoin’s appeal but also exposed its limitations. On-chain Bitcoin, with its glacial confirmations and meager transaction rates, is ill-suited for the fast-paced world of modern finance. Layer 2 solutions, therefore, are not just desirable-they are necessary. ⏳⚙️

Competing projects, from the Lightning Network to Stacks and Rootstock, are vying to bridge this gap. Each seeks to transform Bitcoin’s dormant liquidity into programmable capital, a task Bitcoin Hyper approaches with particular panache. 🏆🚀

How Bitcoin Hyper Elevates $BTC to High-Speed Capital

The crypto trilemma-speed, security, and decentralization-has long been a conundrum. Bitcoin Hyper, however, sidesteps this dilemma by reimagining the network’s architecture. Bitcoin remains the secure anchor, while a modular SVM Layer 2 adds the speed and functionality of a racehorse. 🏇🔒

What does this unlock?

Rust-based Smart Contracts: Developers can craft dApps as complex as those in Solana’s ecosystem, from gaming to NFTs and DEXs. 🎲🖼️

Latency: Sub-second finality that outpaces even Solana’s benchmarks. ⏱️💨

Security: State is periodically anchored to Bitcoin, preserving its ‘hard money’ ethos. 🔗💎

The market has taken notice. The presale has surpassed $29M, with whales making purchases as large as $500K. At $0.013375 and with staking yields of 40%, Bitcoin Hyper positions itself as the execution layer for the next bull run. 🐳📈

Our experts predict $HYPER could reach $0.08625 by the end of 2026, a potential ROI of over 544%. Pray, do not miss this upgrade. 🌟💰

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Ashes of Creation Rogue Guide for Beginners

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Gigi Hadid, Bradley Cooper Share Their Confidence Tips in Rare Video

- Gold Rate Forecast

- Alien films ranked: Which is the best entry in the iconic sci-fi franchise?

- Katy Perry and Justin Trudeau Hold Hands in First Joint Appearance

2025-12-05 16:56