Ah, December-when the financial world giddily pretends to recover from its annual hangover. Coinbase, ever the oracular whisperer of digital fortunes, has announced that the grand opening of this month saw a liquidity renaissance so flamboyant it might even make Scrooge smile. The odds of the Federal Reserve’s rate cut have soared to a THRILLING 92%-because what’s more festive than betting on central bankers’ mood swings? 🎄💸

Their own bespoke global M2 money supply index shows a recovery so confident, it’s practically winking at us through the economic fog, suggesting that a softer dollar could turn the market’s frown upside down by late 2025. Coincidence? Or the universe’s way of reminding us that hope, like crypto, is often irrational but irresistibly charming?

Coinbase, ever the prophet of doom and hope bundled into one, predicted a “reset” back in October, only to see November limp along like a tipsy Santa. Yet, behold! December might just redeem the year’s muddle with a rebound aim higher. Because, clearly, it’s beginning to look a lot like a recovery, dear reader. 🎅🏻✨

It’s beginning to look a lot like a recovery.

We think crypto could be poised for a December revival as liquidity winks back on, the Fed’s odds of a cut skyrocket, and macro tailwinds push us forward-like a boat with a full sail (or a drunk sailor… whichever). 🌬️

Why, you ask? Well:

- Liquidity is making a comeback (finally!)

- The so-called “AI bubble” is still puffing along-no pop yet-phew!

– Coinbase Institutional 🛡️ (@CoinbaseInsto) December 5, 2025

Federal Reserve’s Pumping & Bitcoin’s Underappreciated Glamour

Coinbase’s latest crystal ball gaze into the Federal Reserve’s dance reveals that they’re finetuning their bond market flirtations. The final act of quantitative tightening might just be peeking over the horizon, which – surprise! – tends to send liquidity on a mini holiday, often with Bitcoin as the reluctant guest of honor. 🥳

In November, Bitcoin played the bashful outsider, dropping over three standard deviations below its 90-day trend, while U.S. stocks maintained their cool-probably pretending not to notice. Meanwhile, long-term hodlers (a breed both noble and slightly crazy) were casually offloading coins, and digital assets traded below their net asset value-cryptic gossip for those who cherish the drama. All this hints-perhaps-December could be the breakout star in our financial soap opera.

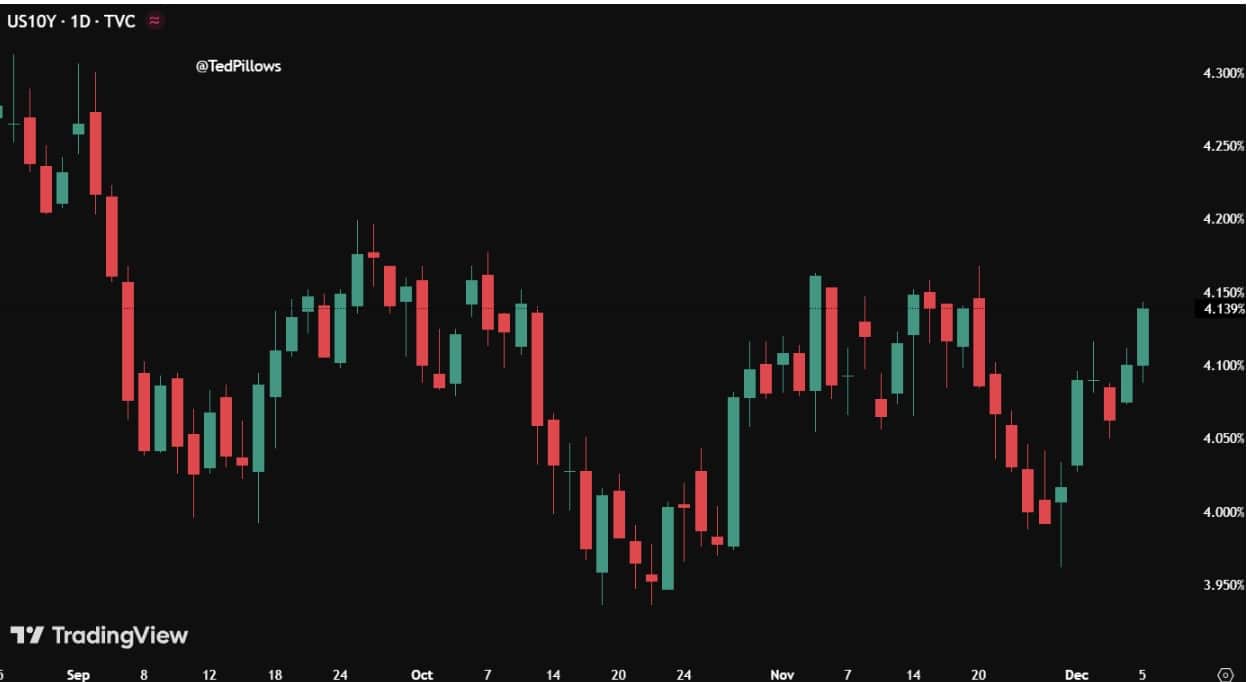

But hold on-analyst Ted Pillows (yes, really) warns that the 10-year bond yield is about to send a weekly high-five that would make June 2025 blush. Despite the Fed’s rate cuts, yields cling above 4%, which isn’t exactly a cozy blanket for risk lovers. 🍂

Source: Ted Pillows, or perhaps someone just fond of puffy cushions

Altcoins and Stablecoins: A Never-Ending Dance of Drama

According to the ever-saga-worthy Altcoin Vector, a tale of two signals unfolds: when USDT (Tether’s alias) dominates, risk seems to hide behind the curtains-classic risk-off move. But when altcoins take the spotlight and USDT wanes, chain reactions of liquidity happy dances commence. 🕺💃

This volatile waltz is our risk-on/risk-off metronome:

- Risk-off: USDT rises-safety first, please! 😉

- Risk-on: Altcoins shine bright, liquidity grins, and gamblers rejoice! 🎲

Recently, stablecoins have tired a bit, whilst altcoins stand firm-an encouraging sign that once Bitcoin takes a breather, the revving engine of crypto may gears into full speed again.

If this pattern persists, expect altcoins to accelerate faster than a caffeinated cheetah, as liquidity turns back in the direction of risk. Because, after all, everything old-like a good rally-is new again.

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- DC K.O.: Superman vs Captain Atom #1 Uses a Fight as Character Study (Review)

- “I’m Really Glad”: Demon Slayer Actor Reacts to Zenitsu’s Growing Popularity

2025-12-06 14:54