In the shadowed corridors of modern finance, where the damned peasantry trade their digital illusions, something peculiar stirs. Ethereum-second only to some Titan among cryptocurrencies-embarks upon a strange and almost tragic dance. In mere hours, titanic institutions, cloaked in the veneer of civility, pull away a staggering 9,000 ETH from the cold, unfeeling exchanges, like thieves in the night. 😏

Major whales, those sprawling monsters of greed, open massive long positions-an act of quiet defiance or perhaps a desperate gamble. The supply, once plentiful, now dwindles to eerie lows, as if the market itself fears what lurks behind the curtain. Could this be the herald of a rally, or merely another distraction in the grand cosmic joke? 🎭

Institutions Snatch 9,000 ETH While Humanity Watches

According to Arkham Intelligence-a name you might find in the shadows-these mighty entities, Amber Group and Metalapha, have, with a calculated silence, extracted from Binance a staggering amount of ETH. Think of it: over 28 million dollars tucked away, as if the gods themselves are hoarding divine nectar for a rainy day. And why wouldn’t they? They’ve been quietly collecting close to 4 million ETH over the last five months-probably dreaming of a day when they can rub their hands and laugh at the fools still panicking. 🤡

INSTITUTIONS ARE STOCKPILING ETH… QUIETLY.

Recently:

• Amber Group took 6,000 ETH ($18.8M)

• Metalapha took 3,000 ETH ($9.4M)All in one morning. Coincidence? Or just the universe playing jokes on us? 🤔

– BMNR Bullz (@BMNRBullz) December 8, 2025

This withdrawal frenzy is no fleeting fancy; it’s the slow, deliberate prelude to what many hope is the inevitable-another cycle, another burst of madness, or perhaps chaos. The institutions are preparing, their bags bursting at the seams with long-term plans that probably involve some cryptic scrolls of ancient crypto prophecy.

Whale Watching: The Silent Art of Wealth Accumulation

Meanwhile, those larger-than-life wallets-some say the ghosts of investors past-are unfurling their banners and opening vast long positions on Ethereum. Wallets like 1011short and Anti-CZ are flooding into longs, adding close to half a billion dollars into what could be the next cosmic wave. 💸

Supply Shrinking Faster Than My Patience

Data from the blockchain reveals a nihilistic truth: ETH is slipping into the shadows. Only 8.7% remains on the exchanges-safe, perhaps, from the eyes of the beast. Over 28 million ETH are in confinement-staked, stored, or otherwise hidden from the rabble. Daily inflows of staking amount to over 40,000 ETH-an almost humorous testament to our collective hope that this digital ledger will be our salvation or our doom.

This steady withdrawal reduces the weight of sellers and erects a new, precarious altar for Ethereum’s next ascension-if, that is, it chooses to climb out of its existential despair, trading around $3,040 with the resilience of a man who refuses to surrender.

Predictions or Just Speculation? The Price of Hope

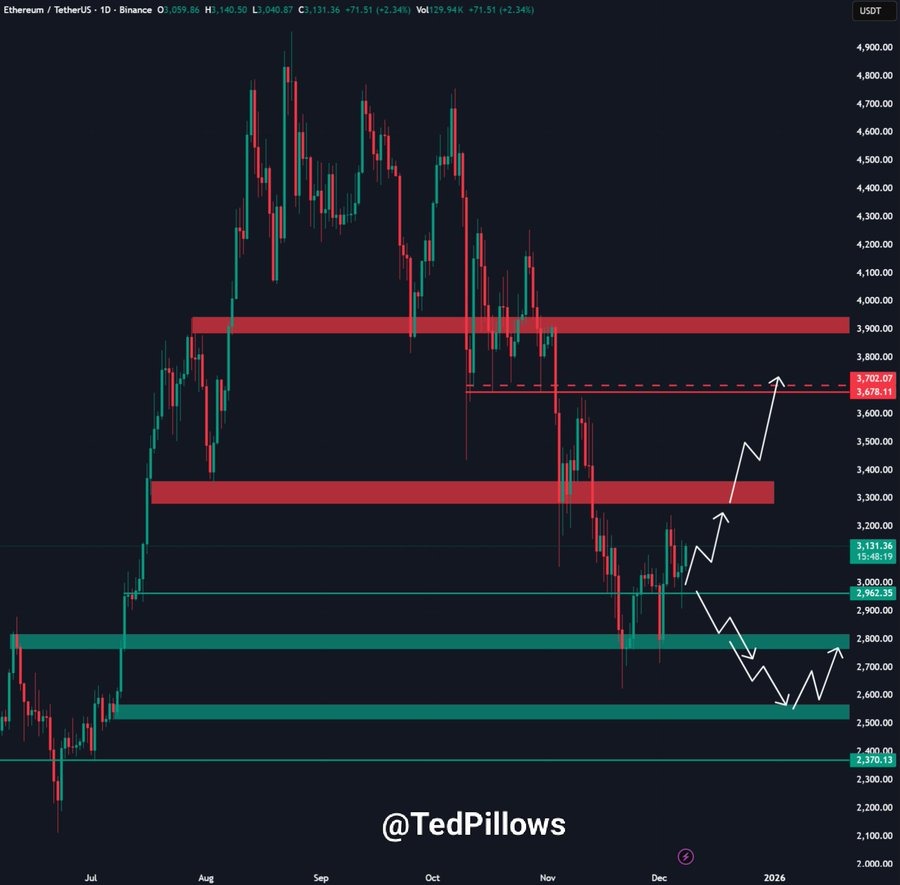

Thanks to these clandestine rituals of accumulation, ETH has gained 3% in a day and clings desperately to the $3,100 support like a drowning man to the last straw. According to the oracle Ted Pillows-who surely has seen things most mortals would rather forget-ETH is dancing within a narrow corridor between $3,050 and $3,200, awaiting a sign from the heavens or perhaps just a lucky break.

If the brave coin surmounts the formidable wall at $3,300-$3,400, it may soar toward $3,700 or $3,800-an almost laughable target, but therein lies the perverse beauty of it all. Just don’t be surprised if rejection in this realm sends ETH tumbling back toward $3,000-a familiar loop in the circus of markets. 🎪

And so, we wait. For a rise, for a fall, for a joke. The market, that cruel, glorious prankster, watches us squabble over shadows and whispers-an eternal chess game in the dim glow of our digital salvation and despair.

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Where Winds Meet has skills inspired by a forgotten 20-year-old movie, and it’s absolutely worth watching

- Ashes of Creation Rogue Guide for Beginners

- Stargate’s Reboot Is More Exciting Thanks to This Other Sci-Fi Series Revival (Which Was Cancelled Too Soon)

- James Gunn & Zack Snyder’s $102 Million Remake Arrives Soon on Netflix

2025-12-08 17:48