David Ellison and Paramount’s unexpected $108 billion offer to buy Warner Bros. Discovery on Monday caused a major stir in the entertainment industry. Now that the initial shock has passed, experts are trying to understand how Paramount was able to finance such a large, all-cash deal.

The way money and investors have come together suggests a deliberate strategy. This isn’t just about the Ellison family challenging Netflix; it involves a carefully chosen group of investors worldwide, including those from the Middle East and even members of President Trump’s family, representing some of the biggest names in entertainment.

Family Funds

Earlier this year, Larry Ellison, co-founder of Oracle, and RedBird Capital Partners invested in Skydance’s $8 billion merger with Paramount. Larry’s son, David Ellison, became the Chairman and CEO of the combined company, and his desire to buy Warner Bros. Discovery sparked the recent competition among potential buyers.

RedBird Capital Partners is investing $40.7 billion in Warner Bros. Discovery, signaling their ambition to become the leading company in the entertainment industry, not just a major one.

But a move this big requires more than the Ellison family’s resources.

Middle-Eastern Money

A recent filing with the Securities and Exchange Commission shows that Paramount is backed by $24 billion from Saudi Arabia, Qatar, and Abu Dhabi in its bid. There’s been a lot of discussion about why these countries are interested in Warner Bros. Discovery, and now we know it represents one of their biggest investments in the entertainment industry to date.

I was really surprised to hear Saudi Arabia bought EA Games for almost $29 billion! It definitely shows they recognize how important Western entertainment companies are, and to me, it signals that we’re entering a truly global era for games and entertainment – it’s not going anywhere!

Although the deal involves funding from overseas, it includes protections to address regulatory concerns. The investors from the Middle East won’t get any positions on the company’s board, voting rights, or control over daily operations. This structure is expected to prevent the Committee on Foreign Investment in the United States from closely examining the deal.

Saudi Arabia wasn’t the sole investor in the EA Games purchase, and another investor is also involved in Paramount’s attempt to acquire Warner Bros. Discovery.

A Trump Family Connection

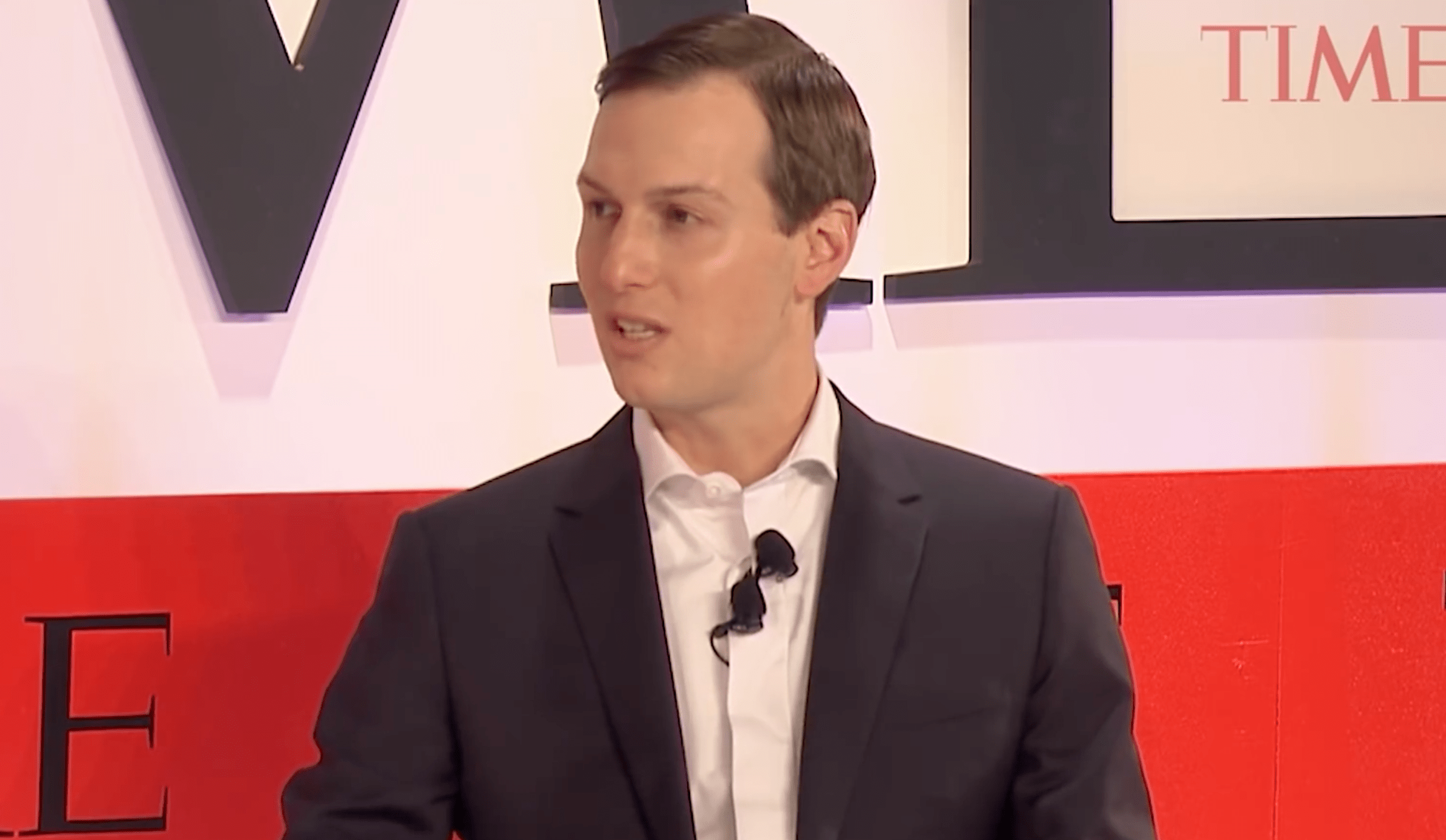

Affinity Partners, an investment firm led by Jared Kushner, recently made a minor investment in EA Games. Additionally, the firm seems to be collaborating with the Ellison family in their attempt to acquire Warner Bros. Discovery, even though the company doesn’t want to be bought.

Because of his close ties to the White House and his business relationships with investors in the Middle East, Kushner is in a good position to help finalize the deal.

In a letter to investors on Monday, Paramount highlighted that the proposed deal with Netflix faces a potentially lengthy and complex regulatory review with no guaranteed approval. The involvement of Kushner’s investment firm could give investors more confidence that the deal will ultimately be approved.

Wall Street

Okay, so here’s the kicker: Wall Street is clearly placing its bets on a deal happening. We’re talking serious financial backing – Bank of America, Citi, and Apollo are all promising a whopping $54 billion in loans to Paramount if their bid goes through. It’s more than just the money, though. These firms are signaling confidence – they believe Paramount can actually pull this off and, crucially, become profitable again. It’s a vote of confidence, and it suggests this isn’t a hopeless situation.

David Ellison probably hopes to reassure Warner Bros. Discovery investors with this positive outlook, and he’s likely trying to communicate it repeatedly.

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 7 Western Antiheroes (Almost) Better Than Doc Holliday in Tombstone

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Ben Stiller’s Daughter Ella Details Battle With Anxiety and Depression

- Adapting AI to See What Doctors See: Zero-Shot Segmentation Gets a Boost

2025-12-09 00:57