The competition between Netflix and Paramount over Warner Bros. Discovery has intensified. After Paramount Global made an unexpected attempt to take over the company, Netflix has publicly stated it remains confident and committed to completing its own deal for Warner Bros. This move has created significant disruption within the entertainment industry.

During the UBS Global Media and Communications Conference, Netflix leaders Ted Sarandos and Greg Peters directly responded to recent developments. They both expressed confidence in the existing deal with Warner Bros. Discovery and downplayed any concerns about Paramount’s unexpected move to change things. Sarandos made the strongest public comments to date regarding the growing competition between Netflix and Paramount.

We fully anticipated today’s announcement. We’ve reached an agreement that we’re very pleased with, and we believe it will benefit both our investors and customers. This deal will also help create and maintain jobs in the entertainment sector. We’re confident we can finalize everything successfully.

Netflix has positioned itself as the more reliable and customer-focused choice. While promising to continue releasing movies in theaters, it also hinted at changes to that model to make it more convenient for viewers—essentially meaning they’ll be available to stream on Netflix quickly. The company also suggests that the quality and creativity of brands like Warner Bros., HBO, and HBO Max will be maintained within Netflix.

The signals are clear: Netflix thinks Warner Bros. would be better off under their ownership. However, Paramount predictably disagrees.

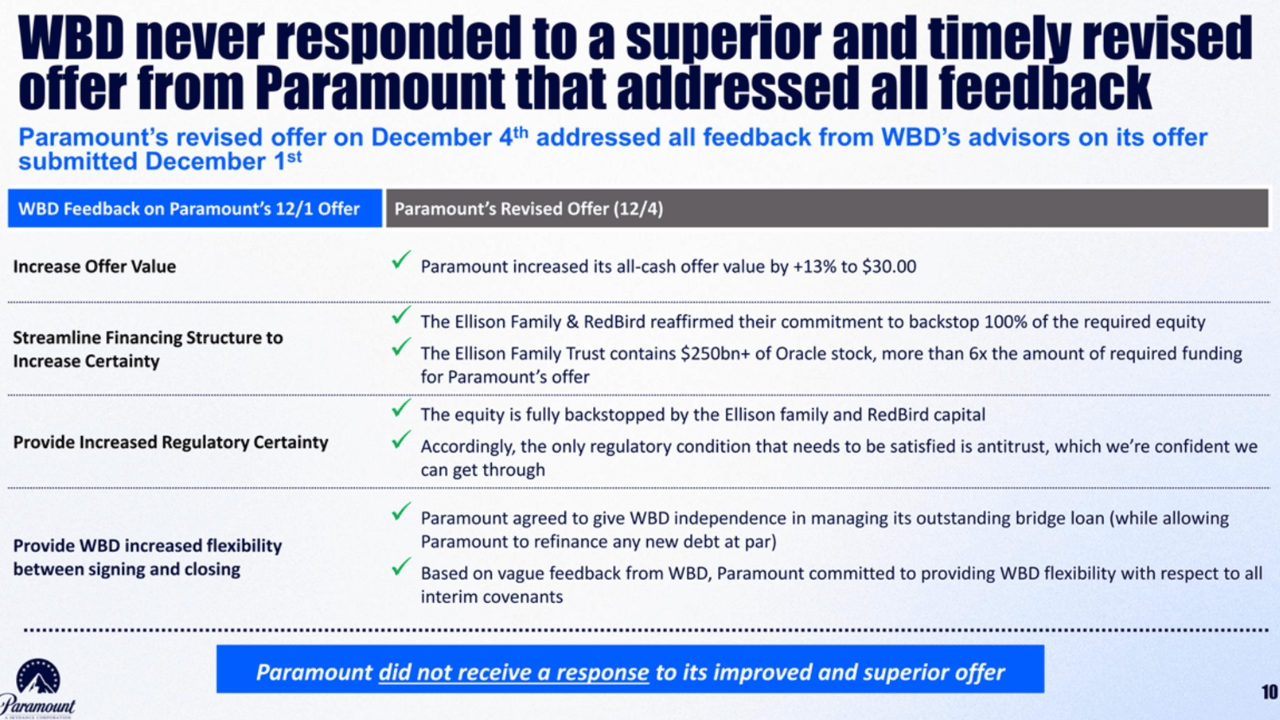

This week, Paramount Skydance made a formal offer to acquire Warner Bros. Discovery for a substantial $108.4 billion, a cash-only deal that exceeded Netflix’s $82.7 billion offer. Paramount insisted their bid was more solid and reliable, but Warner Bros. Discovery’s board chose to partner with Netflix anyway, dismissing the larger, cash-backed offer.

Paramount has made a strong financial offer to Warner Bros. Discovery shareholders that is better than the deal currently on the table with Netflix. The Netflix offer is less valuable, more risky, and would likely face a long and complicated regulatory review with no guarantee of success. It also involves a payment structure that’s a mix of stock and cash, which adds to the uncertainty.

The core of the disagreement between Netflix and Paramount centers on the proposed deal. Netflix believes it’s a solid agreement, already supported by leaders at Warner Bros. Discovery, and will move forward smoothly. Paramount, however, sees significant risks, potential regulatory issues, and financial downsides for its shareholders.

Warner Bros. Discovery’s board is now considering Paramount’s unexpected offer. They’ve confirmed they received the bid and will provide an official answer within the next 10 business days, by December 19th. Until then, expect a lot of rumors and guesses in Hollywood.

From an industry standpoint, the numbers alone illustrate what’s at stake:

- Paramount all-cash hostile bid: $108.4 billion

- Netflix enterprise value offer: $82.7 billion

- Netflix’s per-share mix: $27.75 split between $23.25 cash and $4.50 stock

Paramount’s main goal is to prevent Netflix from acquiring a historic Hollywood studio and becoming the dominant force in streaming. Netflix, on the other hand, sees this as an opportunity to combine its streaming success with Warner Bros.’ long-standing filmmaking reputation, potentially revolutionizing the entertainment industry.

The discussion isn’t limited to company executives; it’s become a heated debate among fans and industry experts online. People are arguing about which company – Netflix or Paramount – would be better for the future of HBO, DC, Warner Bros. Animation, and movies in theaters. Netflix fans point to its worldwide audience and modern streaming approach, while Paramount supporters worry about too much power being concentrated in one company, the potential for streaming monopolies, and possible issues with government regulators.

The battle between Netflix and Paramount is now the dominant story in Hollywood. A decision by Warner Bros. Discovery’s board will determine which company gains control of a valuable collection of films and shows. It will also decide if Netflix can fulfill its pledge to maintain employment, or if Paramount can persuade investors that a full cash buyout is the only way to prevent financial trouble.

The next ten days are critical for Warner Bros., HBO, Max, and could reshape the entire Hollywood landscape.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Thanos Comics (September 2025)

- Goat 2 Release Date Estimate, News & Updates

2025-12-10 16:01